We Simplify Insurance Authorizations for You

Insurance authorization is the act of obtaining an insurer’s approval for providing certain services. It plays a pivotal role in alleviating common challenges faced by healthcare practices. Also referred to as prior authorization, insurance authorization services are designed to address issues like time-consuming paperwork, delayed reimbursements, and administrative burdens.

Let our team help simplify your pre-authorization process.

We are also experienced in authorizing up to 300 DME cases per day. We communicate with the concerned agencies/companies for appeals, missing information, and other matters.

Stay 3-5 Days Ahead Of Your Patient Visits!

Boost Practice Efficiency with Our Expert Authorization Services!

Benefits of Insurance Authorization Services

- Expedite the approval process

- Reduce delays in patient care

- Reduce claim denials

- Improve financial health

- Improve patient experience

- Reduce administrative costs

- Enhance productivity

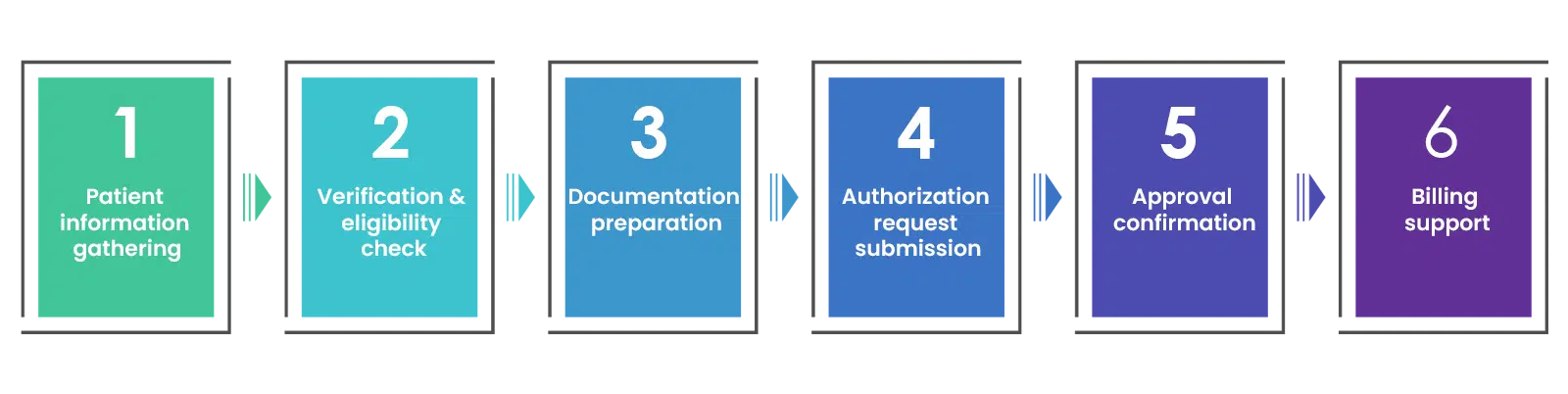

Our Prior Authorization Process Steps

Our prior authorization process is a meticulous, multi-step procedure that ensures efficient and timely approval of medical services. We begin by gathering patient and insurance information, followed by rigorous verification to confirm eligibility.

Why Choose Us?

Proven track record of success

HIPAA-compliant services

Team skilled in navigating complex processes

End-to-end solutions, from verification to approval

Up-to-date with industry regulations and guidelines

Timely approvals, reducing patient waiting times

Exceptional customer care from a dedicated support team

No setup fees or training costs

No long-term yearly contracts

Affordable & Flexible Pricing Plans

Fixed Cost Pricing

Like an FTE model, a person is dedicated to your practice. Perfect for a practice that is busy. They work as an extension to your business.

- A dedicated employee or team member

- Team handling multiple responsibilities

- Preset pricing and production guidelines

- No Start-up fees

Per Verification Pricing

Perfect for a practice that is unsure about their work requirements. This can have per request pricing for eligibility verifications and other functions.

- Dedicated team or employee

- Team handling multiple responsibilities

- A per transaction or hybrid model

- No Start-up fees

FAQs

What types of medical services require authorization?

How can insurance authorization services benefit my healthcare practice?

What is the typical timeframe for authorization approval?

Will using prior authorization services increase my practice's compliance with insurance regulations?

Are there any specific patient responsibilities during the authorization process?

Can you handle both commercial and government insurance authorization requests?

What happens if an authorization request is denied?

How do your services ensure patient confidentiality and data security?

Testimonials

Recent Posts

Why Outsourcing Preauths and Insurance Verification Is a Game Changer

Medical practices face several challenges that can hinder efficiency and impact revenue cycles. One aspect that the front office often has problems handling is checking patients’ insurance coverage. While a patient's insurance coverage may seem straightforward, not...

Advantages of Collecting Out-of-Pocket Payments in Real Time

Verifying a patient’s insurance coverage before their appointment is a key step in the medical billing process. Insurance eligibility verification helps healthcare providers determine what services are covered under a patient’s insurance plan and what costs the...

Best Practices for Ensuring Accurate Health Insurance Verifications

Healthcare professionals play a key role in the patient eligibility verification process. Accurate verification of insurance coverage is crucial to a medical practice’s financial stability. Ensuring that every detail is meticulously verified can be a challenging task....