21+

Years of Experience

Experienced Resources

Satisfied Clients

Verify Insurance Authorization for Bariatric Surgery and Optimize Billing

Navigating insurance coverage for bariatric surgery or weight loss surgery, a common treatment for obesity, can be complex. Despite its high cost, many health plans cover bariatric surgery when it is found to be medically necessary. We provide comprehensive bariatric surgery authorization services, keeping in mind the specific requirements of both Medicare and private insurance companies.

Our bariatric surgery prior authorization support includes:

- Detailed insurance verification and benefit checks

- Prior authorization request submission and follow-up

- Coordination of medical necessity documentation

- Appeals support for denied authorizations

- Patient communication regarding benefit coverage

- Ongoing updates to providers regarding authorization status

Optimize Your Revenue Cycle with Efficient Verifications and Authorizations

Insurance Verifications

We analyze patients’ insurance policies to determine coverage for their weight loss surgery. By clarifying pre-authorization requirements, deductibles, co-pays, and limitations, we help you price procedures and enable patients to understand their financial responsibilities.

Read More

Pre-Authorizations

Obtaining the necessary pre-authorizations is a critical step in the insurance verification process for bariatric surgery. Our experts will work closely with insurance providers to secure timely pre-approvals, ensuring your claims are not denied due to lack of authorization.

Read More

Insurers require detailed clinical documentation from healthcare providers before approving bariatric procedures. Our team ensures all supporting materials are collected, verified, and submitted properly, including:

- Comprehensive medical history

- Nutritional and psychological evaluations

- Evidence of supervised weight loss programs (usually 3–6 months)

- Letters of medical necessity from treating physicians

- BMI reports and obesity-related co-morbidities

- Operative plans and CPT code justifications

With our support, you can focus on delivering exceptional care, while patients can begin their weight loss journeys without the burden of insurance-related concerns.

Common Challenges in Bariatric Prior Authorization

Several obstacles frequently prevent healthcare providers from obtaining timely insurance authorization for bariatric procedures, including:

- Variations in payer guidelines for covered procedures

- Incomplete documentation or failure to meet pre-surgical criteria

- Delays caused by non-compliant or missing referrals

- Denials based on medical necessity or unsupported ICD-10 codes

- Complex requirements for Medicaid plans that vary by state

Our team understands these concerns and works proactively with insurers to avoid unnecessary denials or delays.

Highlights of Our Insurance Verification Services

- Dedicated team of insurance verification experts

- Multi-level QA checks

- Cost savings of 30-40%

- Timely reporting based on your needs

- HIPAA compliance

Why Choose Us?

Expertise

Our team has extensive experience in medical billing and insurance verification for bariatric surgery. They are knowledgeable about the coverage policies across various insurance providers.

Live calls

Open communication

We serve all 50 states

How Our Insurance Verification Process Works

1

Setting up an insurance file for each patient

Verification of Patient Benefits

This process involves through checks to ensure that the patient’s insurance plan is active and covers bariatric surgery, potentially preventing claim processing issues.

Documenting all coverage details

Educating patients on costs of care

We educate patients about their coverage and treatment costs, empowering them to make informed decisions regarding their treatment options and understand their financial responsibilities. We also explain the claims submission and processing procedures, so that they are aware about the process works, with the aim to increase claim submission accuracy.

Pricing for Bariatric Surgery Insurance Verification

Full-Time Equivalent

AR is only FTE

In this model, you will be charged a fixed monthly or annual fee based on the number of full-time equivalent staff required to manage your practice’s AR follow-up activities. We are also considering a blended model for AR.

FAQs

Why is insurance verification necessary for bariatric surgery?

How long does the insurance verification process take?

Can insurance verification be done retroactively?

How can outsourcing verification and authorization benefit my healthcare practice?

Partnering with a specialized verification and authorization company like ours can save you practice time and resources. It allows you to focus on providing quality care while ensuring that verification and authorization processes are handled efficiently and accurately.

Related Posts

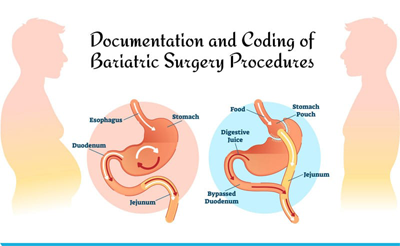

Documentation and Coding of Bariatric Surgery Procedures

by Natalie Tornese | Posted: Feb 28, 2019

Coding and Documenting Bariatric Surgical Procedures

by Natalie Tornese | Posted: Nov 20, 2018