Obesity is a common and chronic medical condition that increases risk of diabetes, high blood pressure, heart disease, stroke, certain cancers, and musculoskeletal disorders. According to the CDC, during August 2021–August 2023, the prevalence of obesity in adults was 40.3%, with no significant differences between men and women. Bariatric surgery is generally recommended when other weight-loss methods have proven ineffective and obesity is contributing to serious health complications. Many insurance companies cover weight-loss surgery for patients who meet certain criteria, though coverage details vary depending on the state and insurance provider. Specific services and procedures often require referrals or prior authorization. To ensure that patient benefits are confirmed before appointments, bariatric practices need efficient insurance verification and authorization processes.

Let our expert team handle your bariatric insurance verification needs!

Verifying coverage for bariatric surgery is a complex process involving unique challenges that can impact a patient’s journey toward weight-loss surgery. Since it directly impacts both patient care and practice revenue, having the verification handled by specialists in the field is crucial to ensure accuracy and efficiency.

Before looking into the steps in bariatric insurance verification, let’s take a look at the main challenges involved in the process.

Challenges in Bariatric Insurance Verification

Bariatric surgery, or weight-loss surgery, comprises a range of procedures designed to help individuals with obesity achieve significant weight loss. These operations can help in treating and preventing various obesity-related metabolic conditions. Patient eligibility verification is a crucial front-end step in revenue cycle management, following patient scheduling and registration. However, eligibility issues are a leading cause of claim rejections. For bariatric surgery, Insure.com reported that nearly 25% of patients are denied coverage up to three times before eventual approval. The American Society for Metabolic and Bariatric Surgery (ASMBS) identifies these denials as a major barrier preventing patients from accessing necessary bariatric surgery.

Verifying coverage for bariatric surgery can be challenging due to various reasons:

- Complex coverage requirements: Insurance policies for bariatric procedures can be complex and vary significantly across providers. Many insurers require specific pre-approval steps, such as documented weight-loss attempts, dietitian consultations, or psychological evaluations, which add layers to the verification process. Payment may be denied because there may be a specific exclusion in a patient’s policy for obesity surgery or treatment of obesity.

- Varying coverage and criteria: Criteria for bariatric surgery eligibility often depends on factors like BMI, comorbid conditions, and sometimes even age. What procedures are covered can vary among carriers:

-

- Aetna covers Gastric Bypass, Sleeve Gastrectomy and Adjustable Gastric Banding (lap band)

- UnitedHealthcare covers Biliopancreatic diversion/biliopancreatic diversion with duodenal switch, Gastric bypass (includes robotic-assisted gastric bypass), Adjustable gastric banding (using open or laparoscopic approaches) for individuals >18 years of age. And Sleeve Gastrectomy (Vertical Sleeve Gastrectomy).

- Medicare covers bariatric surgical procedures like gastric bypass surgery and laparoscopic banding surgery, when patients meet certain conditions related to morbid obesity.

This variability means that each patient’s coverage details need to be carefully reviewed and cross-referenced with insurer requirements.

- Frequent policy changes: There are frequent updates to insurance policies, especially those covering elective or specialized procedures. These changes can impact what is covered, how much is covered, or even eligibility criteria, requiring continuous monitoring to ensure accurate verification.

- Pre-authorization and documentation requirements: Bariatric surgeries typically need pre-authorization, and the process involves gathering specific documentation, such as medical necessity forms and physician referrals. Any missing or inaccurate documentation can lead to delays or denials.

Coordinating with insurers to obtain pre-approvals, clarify coverage details, and handle follow-up questions can be time-consuming and challenging, especially if response times are slow. Miscommunication at this stage can lead to coverage gaps or misunderstandings about patient eligibility. Partnering with an insurance authorization and verification company is a practical approach to overcome these challenges and ensure accurate verification of patient eligibility for bariatric surgery.

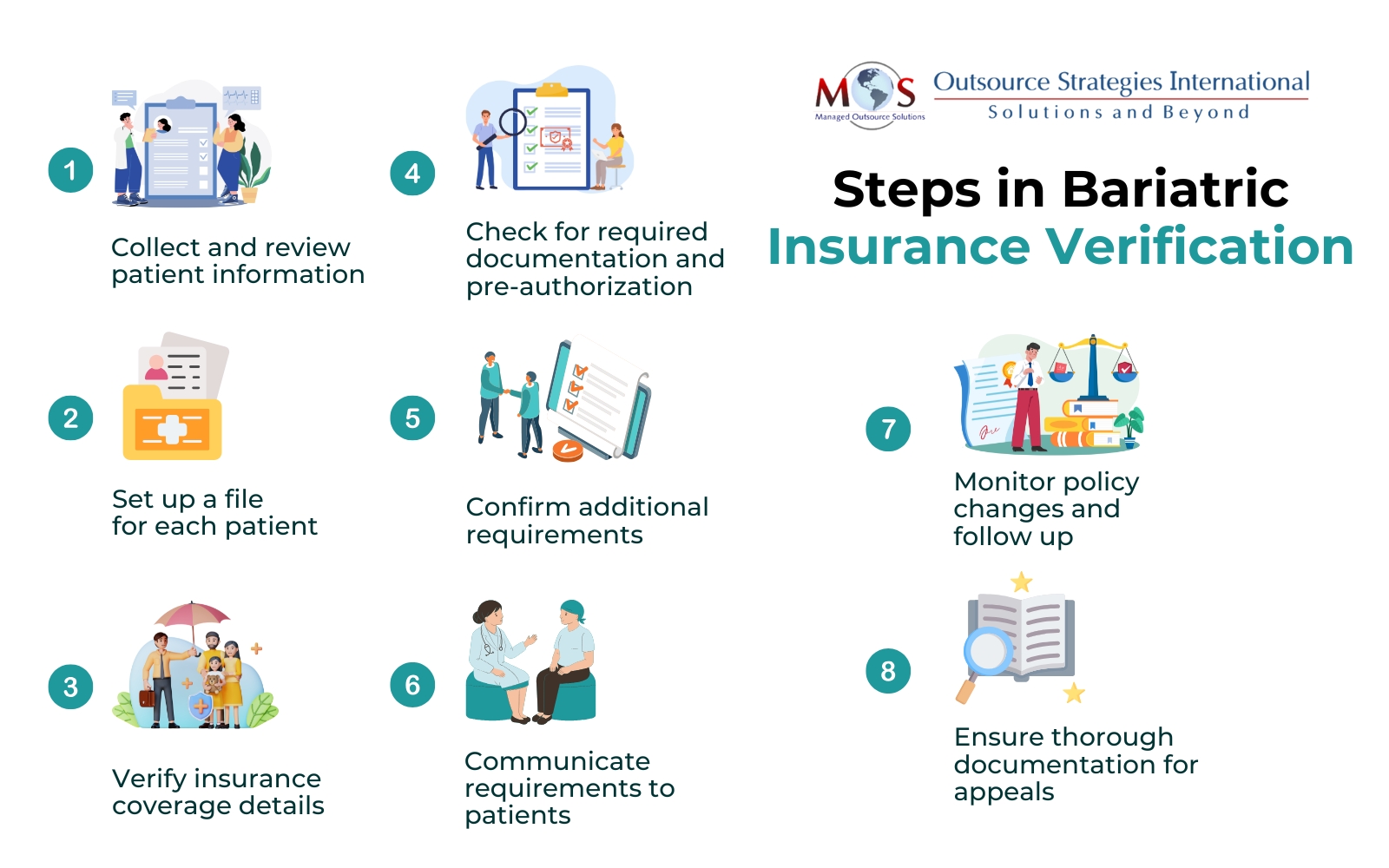

Essential Steps in Bariatric Insurance Verification

Here are the key steps in the process of verifying patient eligibility for bariatric surgery:

- Collect and review patient information: Start by gathering comprehensive patient information, including demographics, medical history, BMI, and any existing comorbidities. This information forms the foundation for the verification process.

- Set up a file for each patient: A dedicated file should be set up for each patient. This will facilitate easy access to patient insurance information and making updates to it as and when required.

- Verify insurance coverage details: Contact the insurance provider to verify the specific coverage details for bariatric surgery. This includes confirming that the patient’s plan covers bariatric procedures, checking for any coverage restrictions, and understanding co-payment, deductible, or out-of-pocket costs associated with the surgery.

- Check for required documentation and pre-authorization: Determine if pre-authorization is needed for the procedure and compile all necessary documentation, including any medical records or referrals required. Insurance providers often require detailed documentation to establish the medical necessity of the procedure.

For instance, UnitedHealthcare requires a number of documents and evaluations for bariatric surgery coverage, including:

-

- BMI: A BMI of 35 or higher, or a BMI of 30–35 with obesity-related conditions

- Weight history: A written letter describing weight history for the last five years, including diets, exercise programs, and weight loss programs

- Psychological evaluation

- Nutritional evaluation

- Documentation on medical necessity from the medical provider

- Preoperative evaluation

- Failed weight loss attempts

- Confirm additional requirements: Many insurers require patients to complete a supervised weight-loss program or a certain period of lifestyle counseling before approving bariatric surgery. Identify and verify these additional requirements early to ensure patients complete them within the insurer’s specified timeline.

- Communicate requirements to patients: Patients should be informed about any specific requirements for coverage, such as weight-loss attempts or psychological evaluations, and assist them in understanding their coverage benefits and out-of-pocket expenses. Educating patients about their coverage and treatment costs will empower them to make informed decisions regarding their treatment options and understand their financial responsibilities.

- Monitor policy changes and follow up: Since policy requirements can change, ensure regular follow-ups with insurance companies to verify that there have been no recent updates to coverage terms that might impact the surgery’s approval. Keeping track of this helps avoid last-minute surprises or coverage lapses.

- Ensure thorough documentation for appeals: If the insurer denies coverage, ensure thorough documentation of every step, the correspondence and submitted information. This documentation will support the appeals process, which may be necessary to get the surgery approved.

By following these steps and addressing the unique challenges, bariatric practices can improve their insurance verification processes.

Benefits of Outsourcing Bariatric Insurance Verification and Authorization

Bariatric surgery insurance verifications and authorization services are a crucial part of the services provided by medical billing companies. Outsourcing the process to specialized billing companies ensures patient insurance checks are completed efficiently, enabling healthcare providers to focus on care. Their insurance verification specialists are knowledgeable about the requirements of leading insurers. They will directly call insurers to confirm eligibility, enabling physicians to submit clean claims quickly and providing patients with accurate pricing information before the office visit. This helps minimizes demographic or eligibility-related rejections, enhances patient satisfaction, and helps accelerate the revenue cycle, leading to improved cash flow for the practice.

Learn how our insurance verification services can benefit your practice!