Every medical practice needs to have effective processes and policies to maintain its financial well-being. That’s where success with claim submission plays a crucial role. However, denials are on the rise. According to a kff.org report, while on average, HealthCare.gov insurers denied nearly 17% of in-network claims in 2021, some insurers report denying nearly half of in-network claims submitted. This calls for proactive action to submit accurate claims on a consistent basis. Let’s take a look at what a “clean” claim means and the best practices that a medical billing company can help you implement to ensure successful claim submission.

Optimize your claims process and boost revenue with our medical billing and coding services!

What is a “Clean” Claim?

A clean claim is one that contains all of the required information in the appropriate format and is submitted to the payer within the designated timeframe. Clean claims conform to the expectations and policies of the payer.

The Department of Insurance and Financial Services (www.michigan.gov) lists the criteria that a clean claim must fulfill as follows:

- Identifies the health professional, health facility, home health care provider, or durable medical equipment provider that provided service sufficiently to verify, if necessary, affiliation status and includes any identifying numbers.

- Sufficiently identifies the patient and health plan subscriber.

- Lists the date and place of service.

- Is a claim for covered services for an eligible individual.

- If necessary, substantiates the medical necessity and appropriateness of the service provided.

- If prior authorization is required for certain patient services, contains information sufficient to establish that prior authorization was obtained.

- Identifies the service rendered using a generally accepted system of procedure or service coding.

- Includes additional documentation based upon services rendered as reasonably required by the health plan

Claims are reimbursed only if they meet these requirements and are submitted in a timely manner. However, conforming to the expectations and policies of the payer is not easy since each payer may have different policies. Furthermore, payer requirements are becoming exceedingly complex. This is leading to delays, rejections, reimbursement issues, and lost revenue.

Here are some tips for achieving success with claim submission.

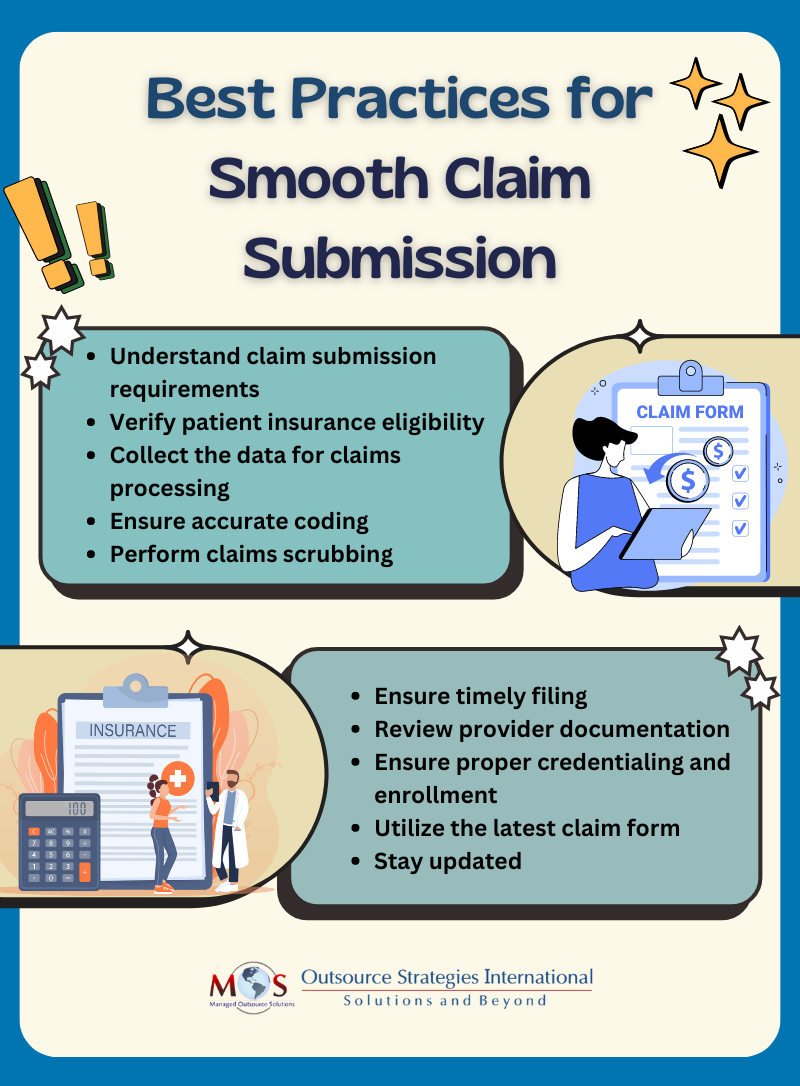

Best Practices for Successful Claim Submission

Typically, when a practice generates a claim, it is sent to its RCM system, a clearinghouse, or a charge master system to ensure it is properly formatted for the plan, delivered to the correct recipient, and optimized for maximum reimbursement. Medical billing specialists can help you implement these essential steps to ensure clean claim submission:

- Understand the requirements: The first step is to thoroughly review the claim submission guidelines and documentation requirements for the specific type of claim you are filing. Clean claim submission depends on having all the necessary information and supporting documentation.

- Check patient demographics and verify insurance eligibility: Erroneous or incomplete patient demographic and insurance information is a common reason for claim rejection. Insurance eligibility verification should be done before the appointment and during the initial visit and each subsequent visit to ensure that the patient’s insurance is active and that the patient will be covered for the treatment. Best practice involves verifying eligibility at multiple stages such as creating a patient record, adding insurance details, and scheduling appointments.

- Collect all required information: Clean claims have correct dates of service, diagnostic codes, procedure codes, and any other information required. Collect all this information and double-check that it is accurate and complete.

- Ensure accurate coding: Use up-to-date ICD-10 codes and CPT/HCPCS Level II codes to appropriately report services rendered. It is essential to understand and use National Correct Coding Initiative (NCCI) edits which identify HCPCS/CPT codes that should not be reported together when services are performed by the same provider on the same date of service. NCCI edits allow for the use of specific modifiers to indicate that the two codes represent distinct and separately identifiable services. Understanding and properly applying medically unlikely edits (MUEs) is also important to ensure accurate billing and avoid claim denials or overpayment recoveries. Partnering with an experienced medical coding company is a practical way to ensure that claims are submitted with the correct codes.

- Perform claims scrubbing: The claims scrubbing process involves using specialized software to review medical claims before they are submitted to insurance payers. Claims scrubbing software can identify and correct errors or potential issues that could cause claim rejections, denials or delays, such as:

-

- CPT codes inconsistent with the patient’s age or gender

- Add-on codes that require a primary CPT code

- Invalid or deleted CPT and ICD-10 codes

- Invalid modifiers

- Improper unbundling

- Check for deficiencies in provider documentation: Shortcomings in provider documentation can lead to a variety of issues, such as claim downcoding or denials, payment retractions, and prepayment reviews. Common documentation problems include missing patient or provider signatures, incomplete records, improper or missing codes and modifiers, lack of medical necessity, and cloned notes. Ensuring thorough and accurate documentation is crucial to prevent these billing and compliance problems.

- Ensure timely claim submission: It is important to file claims as soon as possible after providing a service to a patient. Timely filing limits can vary depending on the specific insurance company and the provider’s network status (in-network vs. out-of-network). Knowing these guidelines for each payer is crucial to avoid claim denials due to late submissions.

- Streamline the payer enrollment process: Improper credentialing and enrollment can significantly impact revenue through claim rejections. Ensure providers are properly credentialed and enrolled with payers to prevent claims from missing filing deadlines. Review paperwork and verify practice, provider, and payer information is accurately set up in software and clearinghouse enrollments are completed correctly.

- Submit claims on the relevant, latest version of claim forms: Institutional Claim Form (includes 837I, UB-04 Form); Professional Claim Form (includes CMS-1500, 837P); Dental Claim Form (includes ADA Dental Claim Form J400, 837D).

- Stay updated: Keep track of industry trends, state and federal legislation, and payer policies. Sign up for email newsletters and updates from leading insurance carriers. Monitor the Centers for Medicare & Medicaid Services (CMS) website at www.cms.gov for regulatory changes and news.

Medical billing and coding outsourcing is a practical way to ensure that all of the above-mentioned steps are in place for accurate claim submission. Partnering with healthcare revenue cycle management (RCM) specialists can provide practices the resources needed to submit clean claims. RCM experts will implement quality assurance measures to verify the accuracy of submitted claims, optimizing reimbursement and protecting your practice from potential insurance disputes and refund requests.