Effective denial management in medical billing is crucial for ensuring timely reimbursements and minimizing financial disruption for both healthcare providers and patients. A denial occurs when a healthcare insurance company reviews a claim and refuses to provide payment for the requested services. Unlike rejections that occur as a result of errors or discrepancies in the claims data, denials occur due to reasons like lack of medical necessity, incorrect coding, or insufficient documentation. Denials in medical billing pose significant challenges to healthcare providers, leading to increased administrative hassles, delayed payments and eventually, potential financial losses. Leveraging comprehensive denial management services can overcome insurance reimbursement challenges, improve reimbursement, and enhance revenue cycle performance. This post explains the difference between claim denials and rejections, explores the common types and causes of denials, and offers tips to prevent them.

Claim Denial vs. Claim Rejection

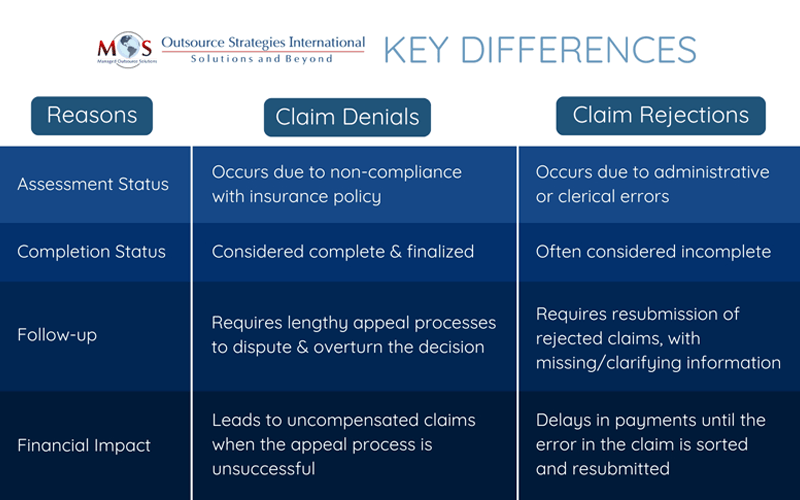

Denial and rejection are two ways an insurer responds when they decide not to pay a claim. As a healthcare provider, it is important to understand the nuances between a claim denial and rejection to accurately address them and get paid promptly. Let’s examine the reasons for claim denials and rejections and the steps you can take to mitigate these risks.

Claim Denials: Denials usually happen after the claim goes through adjudication and processing. It occurs as a result of non-compliance with regard to the payer’s policies. Common reasons for denial include incomplete documentation and coverage constraints. For instance, a claim can be denied if the procedure is considered elective and not medically necessary. Claim denials are challenging as the insurer has processed the claim and identified that it does not qualify for payment. This means the claim must go through an appeals process to overturn the decision, which can be difficult and time-consuming.

Claim Rejections: Rejections occur at the primary stage (initial review), when the insurer identifies errors or discrepancies in the documentation. These errors can range from invalid procedure/diagnosis codes, incorrect patient demographics to incorrect payer information.

Unlike denials, rejections can be often corrected and resubmitted without going through the lengthy appeal process. Healthcare revenue cycle management experts specialize in managing claim denials and rejections to ensure healthcare providers maintain a healthy revenue cycle. They help providers identify the root causes of denials and rejections, streamline the claims process, appeal denied claims, and implement proactive measures to prevent future errors.

Common Reasons for Claim Denials in Medical Billing

There are several reasons why claim denials occur and understanding them can help providers identify and fix issues expeditiously.

- Incomplete Documentation: Missing information or incomplete clinical records can lead to denials.

- Coverage Exclusions: Insurer will not be covering procedures that are outside the patient’s insurance plan.

- Care Decline: The care was deemed not medically necessary for the treatment or diagnosis provided.

- Preauthorization Issues: Treatments that require prior authorization weren’t submitted or were denied.

- Coding Errors: Errors that occur in diagnosis/medical coding (CPT, ICD, or HCPCS) can trigger denials.

- Medical Billing Errors: Incorrect patient information, missing documentation, duplicate claims, and failure to verify insurance eligibility can lead to delays in reimbursement or outright claim rejections.

- Late Submissions: Claims that were submitted beyond the insurer’s deadline will be denied.

The Financial Impact of Claim Denials

Industry reports suggest that nearly 20 percent of all claims are denied. Up to 65 percent of denied claims are never resubmitted, according to the Healthcare Financial Management Association (HFMA). This leads to heavy financial losses with for reaching consequences for the revenue cycle of a healthcare practice. Frequent change in payer policies and regulations add to the problem.

Implementing effective denial management strategies can prevent or minimize denials and boost overall cash flow.

What are the Best Practices to Prevent Claim Denials?

Defensive Eligibility Checks: Make sure to verify insurance coverage, benefits, and policy details in advance, at the time of the appointment scheduling.

Accurate Documentation: Ensure all necessary clinical records, including lab results and physician notes are correct.

Error-free Medical Coding: Bring in expert medical coders to ensure correct procedure and diagnosis coding that meets payer guidelines. They will be updated on changes to coding standards like ICD and CPT.

Prior Authorizations: Check pre-approval for procedures, especially for costly or specialized procedures.

Prompt Filing: Processes should be established to ensure claims are submitted well before the insurance company’s deadlines.

Incorporate Technology: Invest in billing software to identify errors before submission and properly track claim status.

How to Prevent Medical Billing Denials

Addressing denials is not a straightforward process, but if you follow a systematic approach, you might be able to turn the decision in your favor.

Analyze the Reason for Denial: Identify the reason by evaluating the insurer’s explanation of benefits (EOB) to get around the issue.

Fix Errors: Once the issue has been identified, work towards fixing the errors, if they are coding errors or missing documentation.

Appeal the Denial: If the issue is beyond any administrative errors (policy disputes), then consider filing an appeal with proper documentation and justification.

Trend Monitoring: Using billing software, track denial patterns to identify issues and use it to improve processes for upcoming claims.

Partnering with a medical billing expert is the best way to manage claim denials.

OSI is a full-service medical billing company with EHR integration. Our experienced team is up to date on coding changes and insurance rules and policies, which helps ensure accurate claim submission. With timely review of denial and audit data through advanced medical billing software and ongoing communication with payers, we can help you minimize errors that lead to denials.

Losing Revenue to Claim Denials?

Take control of your revenue cycle with our state-of-the-art medical billing services.

Partner with us for minimized denials and maximized reimbursements!