Most insurance companies have different regulations, making properly handling prior authorizations challenging. Adding to the problem, payers may add new services to their prior auth list every year. Using specialized insurance authorization services can help you deal with the complexities associated with the process in order to obtain approval quickly.

AMA Survey highlights Burden of Prior Authorization

Insurers use prior authorization (PA) to determine if the prescribed services are medically necessary before the patient receives them. However, in a 2022 AMA survey, physicians reported that authorization protocols lead to unnecessary waste and avoidable patient harm. Up to 88% of the physician respondents reported that the burdens associated with PA were high or extremely high. To handle the administrative burden, 35% of physicians reported delegating staff members to work exclusively on tasks associated with prior authorization. More than 80% of physicians said PA led to delays in accessing necessary care with negative impact on patient clinical outcomes and even patients abandoning treatment.

These issues reveal the need for thoughtful strategies to handle preauthorization.

11 Best Practices for Obtaining Prior Authorizations

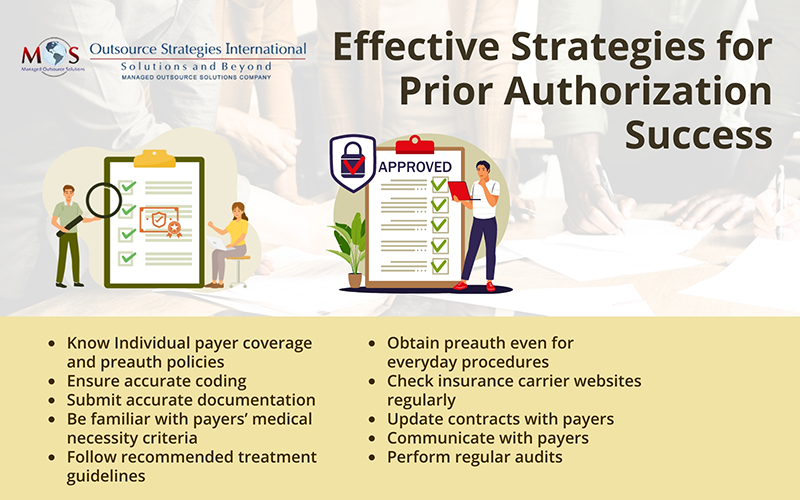

Here are some steps you can take to ensure your practice receives preauthorization.

- Understand each payer’s coverage and preauthorization policies: Each insurance carrier has their own prior authorization form that you must fill out when you prescribe a specialty medication or treatment that is restricted or not covered under an insurance carrier’s formulary. Your practice may have to deal with dozens of forms of varying lengths and complexities. Spend time to understand and complete these forms correctly.

- Ensure accurate coding: Make sure to report the appropriate diagnosis codes that support the medical necessity of the procedure and tell the payer “why” the service is required. Such information would also help during reimbursement negotiations. The proper CPT code(s) must also be reported for all the treatment options being considered. For example, suppose an orthopedist treating a patient’s shoulder pain is considering viscosupplementation injections or corticosteroid injections. The orthopedist is not sure which option he will use. In this situation, it is important to submit the CPT codes for both injections to ensure the provider receives payment.

- Submit accurate information: One of the primary reasons that prior authorizations take so long to resolve is that incomplete or incorrect information is submitted to the health plan. During patient scheduling, verify eligibility and benefits, and if a prior authorization is required. Information required includes the patient’s ID number from the insurance card and /or SS number, name and date of birth, type of procedure(s)/modality, tax ID number and/or NPI number of facility where it’s being scheduled and ordering MD’s tax ID number and/or NPI. Even seemingly minor mistakes such as an incorrect number, transpositions, or incomplete address can trigger a denial and require manual rework by your office. Professional insurance verification services can help you establish a fool-proof verification process for all patients.

- Know payers’ criteria for medical necessity: Payers will only reimburse for services that meet their own specific criteria for medical necessity. Understand each payer’s definition of medical necessity. For example, Medicare Advantage Contractors use the following criteria to determine if an item or service is medically necessary:

- It is safe and effective

- It is not experimental or investigational

- It is appropriate when:

- Furnished in accordance with accepted standards of medical practice

- Furnished in a setting appropriate to the medical needs and condition

- Ordered and furnished by qualified personnel

- Meets the patient’s medical need

In addition to the patient’s diagnosis and the procedure to be performed, make sure the preauth request is submitted with information on the severity of the diagnosis, the risk of not performing the procedure, and any diagnostic studies or interventions tried previously. Take steps to close any gaps that can lead to increased medical record reviews, denials, and overpayment requests.

- Inform the insurer why the patient is a good candidate for the procedure: If a patient needs surgery, the surgeon and/or referring physician can write to the insurance company justifying the patient’s candidacy for the procedure. They can pull evidence-based literature to support their arguments.

- Follow recommended treatment guidelines: Make sure you follow the recommended treatment guidelines for high-cost procedures. Insurers generally perform retrospective review after treatment is complete. The goal is to determine if the treatment was appropriate, effective, and timely, as well as to assess the setting in which they were delivered. If proven treatments are not used, and a claim is denied, the financial burden falls on the healthcare provider.

- Obtain preauthorization even for mundane procedures: While preauth previously focused on the most expensive types of care, such as cancer treatment, insurance companies now commonly require prior authorization for many mundane medical encounters, including basic imaging procedures such as computerized tomography (CT) scans, magnetic resonance imaging (MRI), and brand-name pharmaceuticals.

- Visit insurance carrier websites regularly: A practice can familiarize itself with insurer policies by checking their website or calling the payer directly. This information is also available in payer contracts. Patients should be informed about any condition in the policy that would affect them so that they can take it up with their insurance carrier and advocate for themselves and their provider.

- Update contracts with insurance companies: Insurance companies may update their coverage policy from time to time. Make sure to track these changes and update your contracts to maintain coverage.

- Maintain open lines of communication with insurers: Obtaining insurers’ approval for services demands open communication between all parties involved. If a patient is referred by a primary care physician, they are usually “pre-authorized” for their initial sessions. The provider will need to perform re-evaluations and submit updated information in order to obtain authorization for more sessions.

- Perform regular audits: Regular preventative audits can detect issues and help identify denial trends for certain procedures. This will allow providers to correct issues that may be responsible for a large proportion of the denials.

Getting pre-approvals from payers often results in long delays in treatment, restricting a patient’s access to necessary care. While most insurance companies typically reply to a preapproval request within 30 business days, others may respond sooner. The American Academy of Dermatology reports that when dermatologists tracked how long it took patients at their practice to get a reply for prior authorization for a biologic medication, they found that about half of their patients had a reply in under 8 business days. The response time varied based on the type of medication prescribed.

Some private payers follow CMS policies, while others have more or less restrictive benefits than those mandated by federal carriers. As prior authorization process can be overly complicated, mistakes can easily occur, causing a denial that is often difficult to reverse.

Outsource Prior Authorization: Overcome Administrative Hassles

Insurance verification and authorization services can simplify the prior authorization process for your practice and your patients. Companies providing these services have a streamlined, centralized process in place which minimizes errors.

Insurance verification specialists will work with you to ensure that PA requests are submitted promptly and meet all of the payer’s criteria. These experts have extensive experience working with all government and private insurers and will work to shorten the time between approval and therapy. Partnering with an expert can save time and resources and reduce your risks of denials.