Successful revenue cycle management in medical billing ensures that healthcare providers can focus on delivering optimal patient outcomes without compromising financial viability. Effective revenue cycle management in healthcare involves 3 stages: front-end, mid cycle and back-end processes to ensure financial stability and operational efficiency. The front-end of the revenue cycle involves patient interactions, from appointment scheduling and registration to insurance verification, the mid-cycle involves clinical documentation, coding, and charge capture, and the back-end focuses on claims processing, payment posting, and denial management.

According to a report from Markets and Markets, key factors that are boosting the adoption of RCM solutions are: growing regulatory requirements and government initiatives, increasing patient volumes, and the growing need to manage unstructured healthcare data.

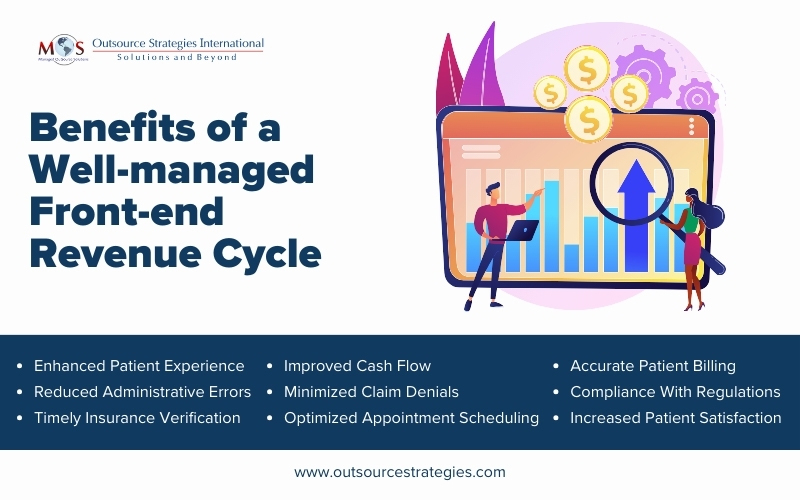

Front-end revenue cycle optimization is paramount for medical practices, as it directly impacts financial health and operational efficiency. Efficient front-end processes can also improve patient satisfaction by reducing administrative hurdles; they play a crucial role in accurate billing and claims submission.

A seamless integration of all these operations is essential for a healthcare practice to maintain financial health, provide quality patient care, and navigate the complexities of reimbursement in today’s dynamic healthcare landscape.

Understanding the Different Stages of the Front-end Revenue Cycle

Improving front-end billing processes include optimizing patient scheduling, insurance verification, financial counseling, and upfront patient collections. These functions are critical to accurate and timely claims generation and revenue collection.

Patient scheduling

Patient scheduling is a critical component of the front-end revenue cycle in healthcare, playing a crucial role in shaping the overall patient experience and the financial health of a practice. The front office staff needs to schedule patient appointments constructively. Too many unfilled slots will reduce provider productivity and revenue, while overbooking can lead to provider burnout and increase the potential for patient dissatisfaction. Efficient patient scheduling involves the strategic coordination of appointments, aligning patient needs with the availability of healthcare providers and resources.

Well-managed scheduling helps with

- minimizing idle time

- maximizing patient care efficiency

- optimizing practice workflow

- reducing patient wait times

- minimizing no-show rates

- increasing revenue capture

- collecting accurate patient data

Automated appointment scheduling is much easier for patients and providers. The software’ s easy interface allows patients to view availability and set a date and time for their visit online. Physicians and staff can access schedules at the same time and from anywhere. The software can help them identify vacant time slots and sends out reminders to minimize no-shows for scheduled appointments. An experienced provider of medical billing services will follow certain best practices to optimize the patient appointment scheduling process.

Insurance verification

Insurance verification stands as a cornerstone in the front-end revenue cycle of healthcare, ensuring financial clarity and operational efficiency. At this critical stage, healthcare providers or automated systems meticulously confirm and validate a patient’s insurance coverage details. This includes assessing policy status, coverage limitations, co-pays, deductibles, and any prerequisites for pre-authorization. Proper verification fosters transparent communication with patients regarding their financial responsibilities.

Accurate patient eligibility verification serves as a proactive measure to:

- prevent claim denials

- enhance patient satisfaction

- ensure services are appropriately covered

- streamline the billing process

- promote financial stability

Prior authorization

For certain medical procedures, treatments, or services, pre-authorization from the insurance provider is required. The process involves obtaining approval from insurance providers, submitting requests to insurers, and ensuring that approvals are obtained before the scheduled services are rendered. This service aids in financial transparency for both healthcare providers and patients, and contributes to streamlined billing, reduced claim rejections, and overall operational efficiency within the healthcare practice. Successful prior authorization at the front end ensures that healthcare providers can deliver timely and approved services, while maintaining financial stability and compliance with insurance regulations.

Upfront patient collections

Upfront patient collections involve the proactive collection of patient payments before or at the time of service. With high-deductible health plans, patients are responsible for a significant portion of healthcare costs. Patients should be informed of their financial estimates prior to service so they can plan payment accordingly. This process is designed to enhance financial transparency and efficiency by clarifying patient financial responsibilities and facilitating prompt payment. By accurately estimating and communicating costs, healthcare providers minimize billing surprises for patients and improve the predictability of revenue streams.

Best Practices for Front-end Billing Optimization

Optimizing front-end billing processes is crucial for the financial success and operational efficiency of healthcare organizations. Outsourcing front-end services like verifications and authorizations to an experienced medical billing company allows providers to spend more face to face time with their patients. Here are some best practices to enhance front-end revenue cycle:

- Educate patients on their financial responsibilities, insurance coverage, and co-pays upfront to minimize billing confusion and enhance upfront collections.

- Ensure accurate patient registration to capture vital demographic and insurance information, reducing errors that may lead to claim denials.

- Implement robust insurance verification processes to confirm coverage details, policy status, and pre-authorization requirements, reducing the risk of claim rejections.

- Provide transparent cost estimates for services, empowering patients to understand and plan for financial obligations before receiving care.

- Optimize point-of-service collections with efficient payment processing systems and staff training on respectful financial discussions.

- Utilizing AR follow-up services can help catch repeated issues and trends (such as sending claims to the wrong payer address missing payer-specific requirements on claims), identify repeated denials, and more.

- Leverage technology for seamless integration of front-end billing processes, reducing manual errors and ensuring timely data exchange between systems.

- Stay updated with healthcare regulations and insurance requirements to ensure compliance and avoid legal issues and financial penalties.

- Provide ongoing training for front-end staff on billing processes, coding requirements, and effective patient communication to enhance efficiency and accuracy.

- Implement automation for routine tasks, such as appointment reminders and insurance verification, freeing up staff for more complex responsibilities.

- Conduct regular audits of front-end billing processes to identify and rectify inconsistencies, ensuring accuracy and effectiveness in the billing workflow.

By implementing these best practices, healthcare organizations can optimize their front-end billing operations, streamline revenue cycles, and enhance the overall financial health of the practice.

Maximize revenue, minimize hassle!

Schedule your medical billing consultation now!

Call (800) 670-2809