Continuous positive airway pressure (CPAP) is the gold standard therapy for the management of obstructive sleep apnea (OSA). Most insurance companies, including Medicare, cover at least part of the cost of some CPAP machines and supplies, although the benefits, authorization, and conditions of coverage differ among plans. In order for patients receive the financial assistance they need for their CPAP therapy, it’s crucial for sleep medicine specialists to understand payer documentation requirements and rules associated with insurance reimbursement. A common way for practices to effectively navigate the complexities of coding and billing is to outsource their billing to experienced experts.

Struggling with insurance verification?

Take the hassles out of the process

Verifying Insurance Coverage for a CPAP Machine

Health insurance companies cover CPAP machines as durable medical equipment (DME).

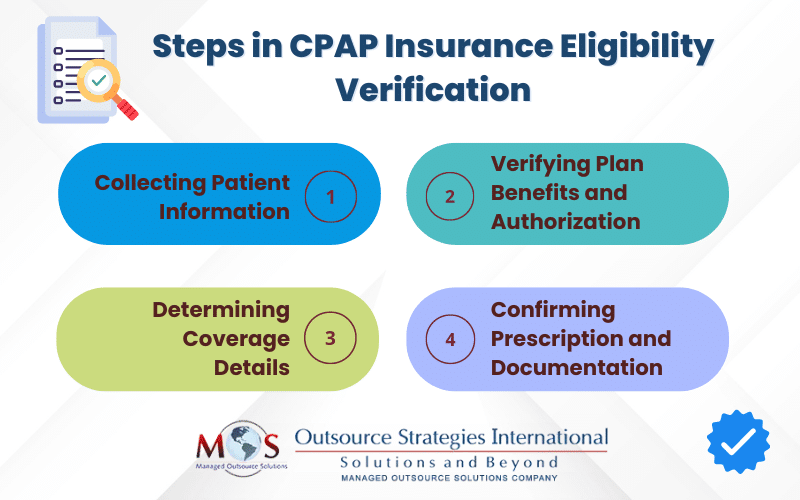

Verifying coverage for CPAP therapy involves several steps:

- Collecting patient information

Collect and verify all necessary patient information, including the patient’s full name, date of birth, insurance identification number, coverage dates, and any specific requirements or limitations. - Verifying plan benefits and authorization

The next step is verifying the patient’s insurance plan’s benefits and authorization requirements. This requires contacting the patient’s insurance plan directly with questions or to verify coverage. Medicare and private insurers’ coverage for CPAP therapy includes CPAP machines and supplies. However, the details and authorization process vary from plan to plan. - Determining coverage details

Your office needs to ask the patient specific questions to ensure they are covered for CPAP under their plan. Details about coverage for a CPAP machine can be verified by calling the insurance company, through the company’s online portal, or by submitting an electronic request. This will ensure that claims for CPAP are filed with the specific information and the particular form that the insurance company requires.

Verifying coverage for a CPAP machine requires obtaining the following information:

- Whether a CPAP machine is covered under the patient’s policy: Provided the patient meets certain conditions, Medicare offers 80% coverage under Part B. This includes CPAP supplies and accessories, like tubing, filters, humidification chambers, and CPAP mask.

- If there are specific requirements or criteria for coverage, such as a prior authorization or a prescription: Some insurance plans require prior authorization before a CPAP machine is covered.Medicare requires the patient to have a diagnosis of OSA from a sleep study by a Medicare-approved physician. To qualify for a three-month CPAP therapy trial, the patient must have an apnea-hypopnea index (AHI) or respiratory disturbance index (RDI) of at least 15 events per hour, or 5 to 14 events per hour combined with other documented symptoms (like heart disease, hypertension, or excessive daytime sleepiness). Patients must use the CPAP for four hours a night for at least 70% of the nights in any 30-day period within three months of getting the device.If a patient cannot provide evidence of nightly usage of CPAP after 3 months, Medicare will not cover the cost. If the patient wants Medicare to cover CPAP again, they must start with a new face-to-face evaluation with a physician as a new patient.If a claim submitted for a CPAP device does not meet these criteria, it will be denied as not medically necessary.

- Whether there any restrictions on where the equipment can be obtained, such as in-network providers or preferred suppliers: Medicare requires the CPAP equipment supplier to be enrolled in Medicare.

- The coverage percentage or cost-sharing arrangement (e.g., deductible, copayment, coinsurance) for the CPAP machine: The out-of-pocket costs the patient is responsible for paying will vary based on their insurance provider, their plan, and whether they choose an enrolled doctor and supplier. The patient may have to pay 20% of the Medicare-approved amount for the CPAP machine and supplies and a deductible before qualifying a three-month trial of CPAP therapy.

- If there are any limitations on the frequency of equipment replacement or supply replenishment: Most insurance companies also cover replacement of CPAP masks and seals, tubing, filters and other replaceable parts.

- Prescription and Documentation

If coverage is confirmed, ensure that the patient has a valid prescription for the CPAP machine from a qualified healthcare provider. Some insurance providers may also require additional documentation, such as a sleep study report or a letter of medical necessity, to support the need for the equipment. The documentation should include the patient’s CPAP therapy adherence and confirm its effectiveness to qualify for a 13-month period, CPAP equipment rental (and ultimate purchase).The physician should document the adherence and effectiveness of the therapy. The KX modifier should be used on a claim to signal that though the patient services have met the threshold of the amount allowed, the provider deems continued care medically necessary.

It’s important that insurance coverage is verified and confirmed prior to providing services. This helps avoid claim denials due to issues like inactive policies, lack of coverage for a particular service, or failure to obtain prior authorization. With the correct insurance details on file, clean claims can be sent out right away, so that they are processed correctly and in a timely manner.

The process of verifying insurance coverage can vary depending on the specific insurance provider and policy. Having expert support can be a definite advantage. Outsourced insurance authorization services provided by experts in the field can ensure thorough verification of patient coverage. Claims with accurate and up-to-date information are more likely to be processed quickly and paid in a timely manner, helping to improve cash flow and reducing the risk of denials or rejections.

Ensure your patients receive the DME they need promptly!