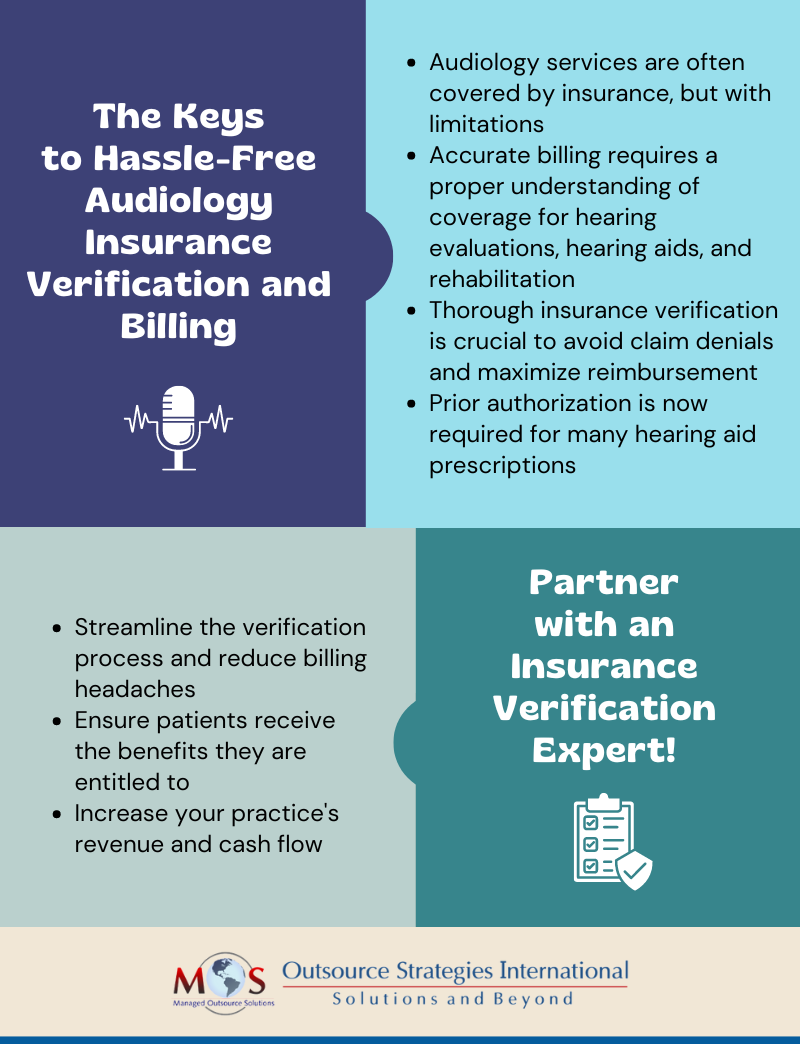

Outpatient audiology services are usually covered by health plans, but with limitations, making audiology insurance verification crucial for efficient claim submission and proper reimbursement. Audiologists provide a range of services to manage issues that affect hearing and balance. This includes evaluating and treating hearing and balance disorders, support for the selection and fitting of hearing aids and implants, performing hearing screening and testing, and more.

Minimize billing headaches with our audiology insurance verification services!

Audiology Services – What Insurance Covers

Navigating insurance coverage for audiology services can be complex. Understanding coverage, limitations and exclusions is crucial to ensure a smooth medical billing process and helping patients receive all the benefits to which they are entitled. Here’s what you should know about coverage for hearing care:

- Evaluations to detect hearing loss and services related to degenerative hearing loss are covered by some plans.

- Medicare Parts A and B and Medigap do not cover the cost of hearing aids.

- Medicare does not pay audiologists for therapy services such as auditory rehabilitation.

- Many insurers do not cover hearing aids, but some private insurance and Medicare Advantage plans include coverage for hearing exams and hearing aids, if ordered by a doctor as part of medical treatment, covering the cost of annual hearing exams as well. Coverage can vary by state and provider.

- If ordered by the doctor for potential medical treatment, Medicare Part B covers:

- Hearing and balance exams

- An annual audiology test

- Nonacute hearing conditions, such as hearing loss that occurs over many years.

- Diagnostic services related to hearing loss that’s treated with surgically implanted hearing devices.

- In 20 states, it is mandatory for insurance companies to pay for hearing aids for children. Only five states require health insurance coverage for adults who need hearing aids: Arkansas, Connecticut, Illinois, New Hampshire, and Rhode Island.

- Medicaid offers coverage for hearing aids, but specific coverage details differ and also vary by state. Based on broad federal guidelines, each state administers its own program, and establishes its own income eligibility standards, type, amount, duration and scope of services covered.

- Medicaid covers new, non-refurbished, monaural or binaural hearing aid(s), which includes the ear molds, for eligible clients age twenty and younger. For the provider to receive payment, the hearing aid must meet the client’s specific hearing needs and carry a manufacturer’s warranty for a minimum of one year.

Prior Authorization Requirements for Hearing Aids

Hearing aids now require prior approval. Understanding prior authorization requirements is essential to obtain coverage for hearing aids.

At the start of 2024, a prior authorization requirement was added to the Federal Employee Program (FEP) Blue Cross Blue Shield (BCBS) coverage requirements for prescription hearing aids for the Basic Option and Standard Plans. Over-the-counter (OTC) class hearing aids are not covered under these plan benefits. The prior authorization process can vary depending on the local BCBS company.

At the start of January 2024, the requisite degree of hearing loss was 40 dB or greater. This was amended and as per the most recent BCBS guidance document effective April 1, 2024, the requisite degree of hearing loss is 26 dB or greater loss.

Medical necessity is defined as hearing loss confirmed by audiometry or other age-appropriate testing (completed in the six months prior to hearing aid purchase) to be greater than 26 dB hearing loss for conductive, sensorineural, or mixed.

New prescription hearing aids must meet the following medical necessity criteria:

- Hearing aids must be approved, listed, and/or registered with the FDA as a prescription device.

- Hearing aids must be dispensed by prescription or signed written order from a licensed health-care provider practicing within the scope of their license.

- Prescription should include the make/model of the recommended hearing aid.

- Audiometric testing should have been completed no longer than six months prior to hearing aid purchase.

- Degree of hearing loss greater than 26 dB hearing loss for conductive, sensorineural, or mixed hearing loss.

Providers should submit documentation to substantiate medical necessity along with the prior approval request. The documentation should establish that the prescribed hearing aid will serve a purpose in treating the patient’s medical issue.

What Audiology Insurance Benefits Verification Involves

Insurance verification is a time consuming process that involves checking each patient’s hearing aid benefits eligibility, responsibility, and plan requirements before the patient comes in. The roadmap to obtain pertinent plan information involves querying third-party payers regarding patient hearing aid plan requirements, coverage, and patient responsibilities. The key information that an insurance verification specialist will check with the insurer includes:

- Patient name and date of birth

- Insurance company and policy number

- Coverage: Primary, Secondary, & Tertiary participating provider

- Whether in-network provider, and if not an in-network provider, what is the out of network benefit?

- Allowable benefit and how much of it has been used to date

- Whether the patient is allowed to share in the cost of the device(s) if they chose technology beyond their benefit

- Will a specific type of hearing aid realize their maximum benefit, and if yes, what type?

- Is the hearing aid benefit: Monaural/Binaural and Annual Every: 2 years, 3 years, or 5 years

- Patient responsibility: Deductible and when was it met, Co-Pay, and Co-Insurance

- Plan requirements (check if required)

- Provider discount if any and amount

- Plan requirements (prior authorization, Medicare denial, referral, prescription, etc.)

- If codes to be billed are covered, and if not, how are uncovered codes handled?

It’s important that patient coverage and benefits are verified every time services are provided.

Having an audiology insurance verification company handle patient eligibility checks can facilitate a smooth claims submission and billing process. Insurance verification specialists have extensive experience in working with government insurance as well as commercial insurance companies. They will communicate with carriers regarding clinical information requested and strive to resolve coverage and payment related issues. Partnering with an experienced service provider can optimize insurance verification and prior authorization, reducing denials and maximizing reimbursement.

Simplify insurance verification for your audiology patients