Efficient revenue cycle management is the backbone of any healthcare organization, and it is constantly shaped by emerging trends, technological advancements, and ongoing challenges. Like previous years, medical RCM for 2025 brings significant changes that will impact various facets of the revenue cycle. From breakthroughs in AI to ongoing workforce shortage, understanding these upcoming trends is the key to identifying growth opportunities, overcoming obstacles, and maintaining a competitive edge in an evolving industry.

While navigating the latest developments in medical RCM may seem daunting, with the support of a trusted medical billing company, practices can streamline their revenue cycle processes and focus on what matters the most: delivering quality patient care.

Hire our professional medical billing services to optimize your revenue cycle and maximize profits in 2025!

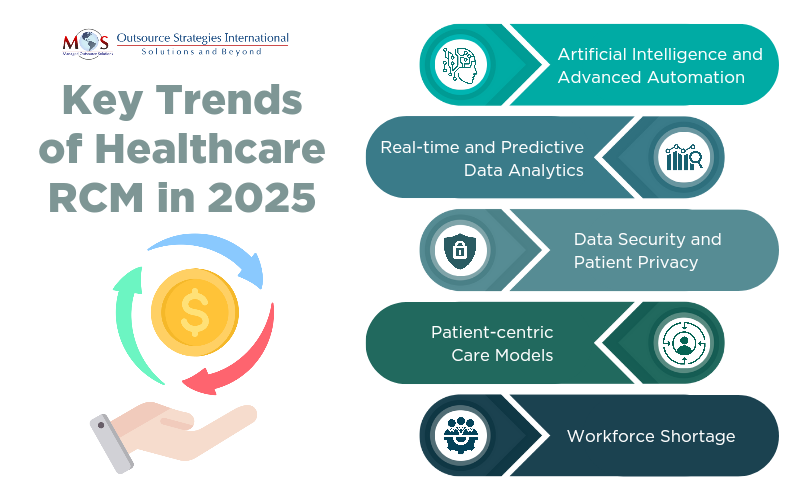

Key Trends in Medical RCM for 2025

Let’s take a look at the top trends in RCM impacting the healthcare industry.

- Artificial Intelligence and Advanced Automation

Advanced automation technologies, such as artificial intelligence (AI) and machine learning (ML), continue to grow at an accelerated pace in the healthcare industry. Over 71% of private firms report prioritizing AI investments for healthcare revenue cycle management in 2025. AI-driven processes are transforming clinical workflows by automating numerous repetitive tasks, effectively reducing manual errors and enhancing operational efficiency. By integrating AI for steps such as data entry, insurance verification, and claims processing, healthcare providers can reduce claim denials and expedite cash flow.

- Real-time and Predictive Data Analytics

AI analytics tools and machine learning (ML) algorithms have sophisticated capabilities to analyze vast amounts of healthcare data, identifying revenue trends, payment patterns, and claim performance. These analytics platforms enable real-time and predictive analysis of historical claims data, allowing healthcare providers to recognize common reasons for denials, optimize strategies, and facilitate data-driven decision-making. This proactive approach ensures accurate revenue forecasting, minimizes financial losses, and streamlines the RCM system for practices.

- Data Security and Patient Privacy

With the rise of digitization, healthcare data breaches and ransomware attacks have become an escalating concern for healthcare facilities. Cybersecurity and healthcare data protection remain major challenges in 2025, as cyber threats continue to increase in frequency, diversity, and effectiveness. Health organizations must invest in robust security protocols such as access control, encryption, and real-time threat detection systems, to proactively protect patient information and mitigate cyberattack. Collaborating with reliable medical billing partners who offer advanced cybersecurity systems can provide top-notch security solutions tailored to a provider’s specific needs. This not only demonstrates a commitment to safeguarding sensitive patient information but also ensures compliance with healthcare data security regulations, preventing financial and legal repercussions related to breaches.

- Patient-centric Care Model

As the healthcare industry faces high costs, uninsured patients, and increased claim denials, many medical professionals are motivated to adopt value-based care (VBC) and capitation models. Traditional fee-for-service models can incentivize unnecessary tests, procedures, and hospital visits, driving up healthcare costs. With VBC, providers are paid based on the health outcomes they deliver, which encourages efficiency, cost-saving measures, and quality care. This shift toward VBC is backed by a McKinsey report, which predicts VBC will become the dominant model within the next five years.

- Workforce Shortage

Workforce shortages continue to pose a significant challenge in 2025. The AMA reports that the medical field may face a critical shortage of nearly 3.2 million healthcare workers by 2026. This issue is compounded by rising labor expenses and other overhead costs, making it difficult to hire and retain specialized RCM experts. To address workforce shortages in healthcare RCM 2025, organizations can partner with an experienced RCM outsourcing provider. This will allow practices to work with external experts while retaining current staff and controlling administrative expenses. Other solutions include automating manual tasks, offering remote work options, and delivering telehealth capabilities. These strategies help healthcare providers boost productivity and maintain seamless operations without incurring additional expenses.

Best Strategies for RCM Success in 2025

Let’s explore the best strategies healthcare providers can implement for RCM success in 2025.

- Understand Current RCM State

To optimize your Revenue Cycle Management (RCM) for maximum profits, practices must first understand the current state of their RCM process. Effectively assessing the efficiency of RCM requires monitoring key performance metrics such as Days in Accounts Receivable (AR), Net Collection Rate, and Denial Rate. Focusing on these metrics allows healthcare providers to identify areas for improvement, address common bottlenecks, and develop effective strategies to optimize the revenue cycle.

- Streamline RCM Process

Streamlining key RCM processes such as eligibility verification, insurance prior authorization, and claim submission can significantly improve the efficiency of the billing system. Errors or discrepancies in any of these areas can lead to delayed patient payments, denied claims, and lost revenue. Implementing RCM automation for complex workflows isn’t just a trend; it’s a strategic decision that continues to gain momentum in 2025. The key benefit of intelligent platforms is their ability to perform across various tasks and domains by combining multiple technologies. These multifunctional platforms enable practices to improve interoperability, optimize resource allocation, and enhance overall efficiency.

- Improve Denial Management

Denial management remains a critical pain point for healthcare organizations. In 2025, reducing denials and optimizing the appeals process should be a primary focus. Analyzing common causes for denials, such as coding errors, eligibility issues, and authorization problems, will help providers address the root causes and reduce the occurrence of future denials. Establishing a robust denial management strategy that includes accurate claim tracking, timely follow-up, and clear documentation will improve overall cash flow and reduce write-offs.

- Monitor Industry Trends and Regulations

RCM is heavily impacted by changes in healthcare policies, payer regulations, and reimbursement models. Staying informed about emerging industry trends and regulatory updates is critical for success in 2025. Healthcare providers must remain flexible and adjust their RCM strategies to comply with evolving rules around payment models, insurance reimbursement, and patient financial responsibility.

- Invest in Staff Training and Development

A well-trained RCM team is key to ensure the success of your revenue cycle management efforts. Regular training on new coding regulations, payer policies, and emerging billing technologies will help your staff stay ahead of the curve. By fostering an environment of continuous learning, healthcare providers can ensure their teams are equipped to handle challenges and adapt to changing regulations in 2025.

Looking Ahead

RCM success in 2025 will require healthcare providers to be agile, data-driven, and patient-centered, all of which can be achieved through outsourced medical billing support. Understanding the key developments of the current year is essential to remain competitive and stay alert regarding major challenges and growth opportunities for practices. By understanding the current state of your revenue cycle, embracing technology, and streamlining RCM processes, healthcare providers can position themselves for long-term profitability and success. Through continuous optimization, training, and a commitment to innovation, RCM can be transformed into a competitive advantage in the evolving healthcare industry.