In the highly regulated, highly scrutinized healthcare industry, implementing medical billing audits is essential. Whether a healthcare organization is a solo or group physician practice, a hospice, a nursing home, or a large medical center, it can benefit from an investigation to detect areas of noncompliance and missed revenue. As a physician, you are entitled to receive payment for the services you provide when they are coded and documented correctly. Conducting medical billing internal audits can catch and reduce errors that could lead to claim denials, lost revenue, payer scrutiny and, lost or unsatisfied patients. Audits of documentation and financial performance can be performed by a designated practice staff member or a medical billing and coding company that specializes in the field.

Experience the benefits of a third party audit of your practice’s billing processes.

What is an Internal Medical Billing Audit?

The goal of internal audits is to analyze the efficiency and accuracy of the provider’s billing practices. Simply put, it is like having another set of eyes review your practice’s billing and coding processes and practices. A medical billing internal audit can protect your practice against fraudulent billing and claims submission which can lead to heavy Medicare penalties. It also identifies and addresses areas of risk that may attract scrutiny by a Recovery Audit Contractor (RAC).

A healthcare billing audit, also known as a revenue cycle management (RCM) audit, takes a comprehensive approach that goes beyond just a medical coding review. A coding compliance review focuses on the accuracy of diagnostic and procedural codes. On the other hand, RCM audits include an assessment of the front-end workflows, such as patient registration, insurance eligibility verification, and collection of patient copays and deductibles.

During the process, the audit team closely reviews the health records maintained by your medical practice. They go through the clinical documentation thoroughly to ensure it supports the services billed to insurance companies and other payers. This includes verifying that the codes, modifiers, and billed amounts are correct and meet payer guidelines. Issues that billing accuracy verification audits can reveal include:

- Errors in provider documentation

- Errors in ICD-10, CPT and HCPCS coding and modifier use and frequency of such errors

- Undercoding, upcoding, and modifier use concerns

- Duplicate claim submission

- Inappropriate unbundling of services and other fraudulent billing practices, whether intended or unintended

- Medical necessity not established

- Patient insurance eligibility issues

- Payer reimbursement issues

- Areas of non-compliance to payer rules

How Internal Audits Help Reduce Billing Errors in Healthcare

A strong internal chart auditing program will allow the practice to enhance documentation processes, address billing and coding errors, take steps to ensure that these errors don’t recur, and optimize overall billing workflow.

Let’s look more closely at coding and billing risk areas that internal audits can help practices with.

Take upcoding, the practice of submitting a claim with a higher or more extensive medical code that is not supported by the documentation and/or circumstances. For example, if the E/M documentation warrants level three codes but it is coded with level five codes, it would lead to inappropriate claims by falsely inflating the level of E/M services performed.

Audits can also reveal downcoded or denied services. These are services the payer determines should be paid at a lower level of service. When payers deny or downcode services, the audit will examine the cause by comparing billed services.

Audits can identify underdocumented services. Underdocumented services are those that support a higher E/M level or additional ancillary service, but the documentation lacks sufficient detail to report the full extent of care rendered. This leads to revenue loss.

Underbilled services are another common issue causing revenue loss that audits can reveal. By comparing the chart documentation to the billed codes, audits can identify underbilled (and overbilled) services.

The use of modifiers is another high-risk area. For example, take modifier 25, which is added to an E/M code to denote a significant and separate E/M service was provided on the same day as a procedure. If modifier 25 is appended on the claim to obtain higher reimbursement, but the circumstances and/or the documentation do not support the separate nature of the E/M, it poses a major compliance risk.

The list goes on. Target areas that are frequently audited internally by provider organizations to ensure compliance throughout the revenue cycle include: evaluation and management levels, high-cost procedures, new patients vs existing patients, telehealth, and overall emergency department utilization, Recovery Audit Contractor–approved list, cardiac procedures, and total knee replacement and spinal surgeries (www.fortherecord.com). Other recommended target areas include most common payer denials and new medical services. Data that should be closely analyzed and tracked include misapplied codes, improper code sequencing, and missed codes that might lead to undercoding, according to a For the Record report

How a Medical Billing Audit Works

Knowing how the medical billing audit process works is important so that your office can be prepared for it. Keep in mind that there is no “one size fits all” when it comes to reviewing a practice’s medical billing and coding.

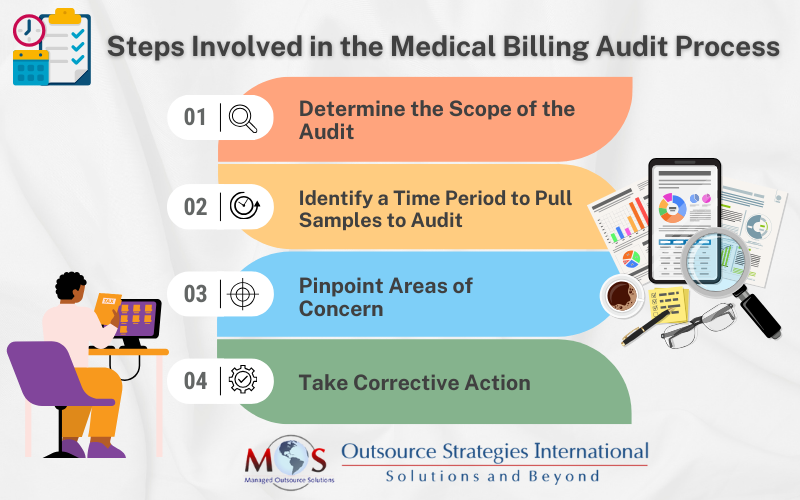

However, there are four basic steps involved in the billing audit process:

- Determine the Scope of the Audit: There are various options such as a random audit, a comprehensive audit and a hybrid audit. In a random audit, both large and small claims are selected at random based on their dollar amounts. A comprehensive audit covers a close inspection of audited claims with a focus on claiming refunds. The hybrid audit blends both the random and comprehensive audit approaches by evaluating samples of all types of claims to detect any gaps. When you determine the scope of the audit and the number of claims to review, you also need ensure that you have the resources and support (internal/ external) to implement the process successfully.

- Identify a Time Period to Pull Samples to Audit: The number of claims in a sample should be based on the number physicians in your practice. You also need to set the appropriate time to pull the samples to audit – such as a week, a month, a quarter, or an entire financial year.

- Pinpoint Areas of Concern: The next step is examining billing reports to identify any areas of risk or concerning trends. Reports are checked against past performances month-to-month or year-to-year. CPT code usage by providers and billing staff are analyzed to see if they are appropriately coding client encounters and if their coding patterns differ among themselves and from a general industry average. The medical billing audit uses a benchmarking process to accomplish these tasks. Examining billing reports will determine if patient encounters are coded correctly and billing practices are in order, and how CPT codes are being reimbursed. Use spreadsheet software to track data and organize the findings in a report.

- Take Corrective Action: Once the audit identifies irregularities, the practice can take corrective action. This includes developing strategies to improve billing processes and procedures, provide additional staff training, and better processes for revenue cycle management while implementing quality assurance protocols.

Reach Out to an Expert

Internal audits play a vital role in preventing healthcare fraud by identifying billing inconsistencies, uncovering improper coding practices, and ensuring adherence to compliance standards before external audits occur. The OIG recommends that practice audits be conducted at least once a year to identify risk areas such as billing and coding, reasonable and necessary services, and documentation requirements. The best approach is to partner with an expert in the field. A company that provides medical billing services will have skilled coders and billing staff on board and can ensure comprehensive audits to:

- Identify existing and potential problems

- Scrutinize detected problems and take corrective steps

- Revise policies and procedures to prevent issues identified from recurring

- Constant improvement of the practice’s claims submission and auditing processes

To select the right medical billing outsourcing company, it’s important to consider their experience and expertise as well as pricing policies.

Schedule a comprehensive billing and coding audit – identify opportunities to maximize revenue!