- What Is Insurance Pre-authorization and Why Is It Required?

- Common IVF Pre-authorization Requirements across Insurers

- Understand IVF Coverage Insurance Guidelines

- Why Pre-authorization Matters: Clinical and Administrative Benefits

- Common Pre-authorization Challenges Faced by Clinics

- Best Practices to Minimize IVF Claim Rejections Related to Pre-authorization

In-vitro fertilization (IVF) remains one of the most effective assisted reproductive technologies available today, but it is also associated with significant treatment costs and complex payer requirements. As insurance coverage for fertility services expands, IVF insurance pre-authorization has become a decisive factor in ensuring smooth claim processing and minimizing reimbursement delays.

For fertility clinics and reproductive specialists, the pre-authorization stage often determines whether an IVF claim proceeds seamlessly or encounters avoidable denials. A clear understanding of insurer expectations, documentation standards, and coverage criteria enables physicians to align treatment planning with payer requirements—supporting both clinical timelines and financial outcomes.

What Is Insurance Pre-authorization and Why Is It Required?

Insurance pre-authorization is a utilization review process through which payers assess whether a proposed IVF treatment meets defined coverage criteria, medical necessity standards, and policy-specific guidelines. From a payer perspective, pre-authorization helps control costs and ensures adherence to evidence-based fertility treatment pathways. From a clinical perspective, it serves as a safeguard—confirming that planned interventions are eligible for coverage before treatment initiation, thereby reducing downstream claim disputes.

Failure to obtain prior authorization may result in claim denial even when the treatment itself is covered under the policy.

Ensure documentation readiness before initiating IVF cycles to avoid reimbursement delays.

Common IVF Pre-authorization Requirements across Insurers

While requirements vary by payer and plan type, most insurers expect the following elements to be clearly documented:

- Confirmed infertility diagnosis: Clinical documentation establishing infertility based on accepted criteria (e.g. duration of unsuccessful conception attempts, age-related considerations).

- Prior treatment history: Evidence of less invasive fertility treatments (such as ovulation induction or IUI), when required by policy.

- Specialist recommendation: A referral or clinical justification from a board-certified reproductive endocrinologist supporting IVF as the appropriate next step.

- Diagnostic test results: Hormonal evaluations, imaging studies, genetic testing (where applicable), and semen analysis supporting medical necessity.

- Detailed IVF treatment plan: Clear outlines of medication protocols, laboratory procedures, anticipated cycles, and supporting clinical rationale.

Incomplete or inconsistent documentation remains one of the leading causes of authorization delays or denials.

Understand IVF Coverage Insurance Guidelines

IVF coverage insurance guidelines define:

- Eligibility thresholds

- Covered number of cycles

- Medication inclusions and exclusions

- Age limitations

- Criteria for donor services or advanced reproductive technologies

Physicians and clinic teams who proactively review these guidelines are better positioned to structure treatment plans that align with payer expectations, improving authorization success rates and minimizing rework

Why Pre-authorization Matters: Clinical and Administrative Benefits

Effective pre-authorization management offers several advantages for fertility practices:

- Greater financial clarity for clinics and patients regarding covered services

- Lower risk of post-treatment claim denials

- More efficient cycle scheduling, with coverage confirmation in place

- Improved coordination between clinic billing teams and insurers

Although pre-authorization does not guarantee final reimbursement, it significantly strengthens the likelihood of claim approval and supports smoother revenue-cycle workflows.

Common Pre-authorization Challenges Faced by Clinics

- Extended payer review timelines, delaying cycle initiation

- Complex and evolving documentation requirements

- Ambiguous policy language or clinical criteria

- Communication gaps between payers and fertility centers

- Limited access to insurance representatives for follow-up

Addressing these challenges proactively reduces administrative burden and prevents treatment delays.

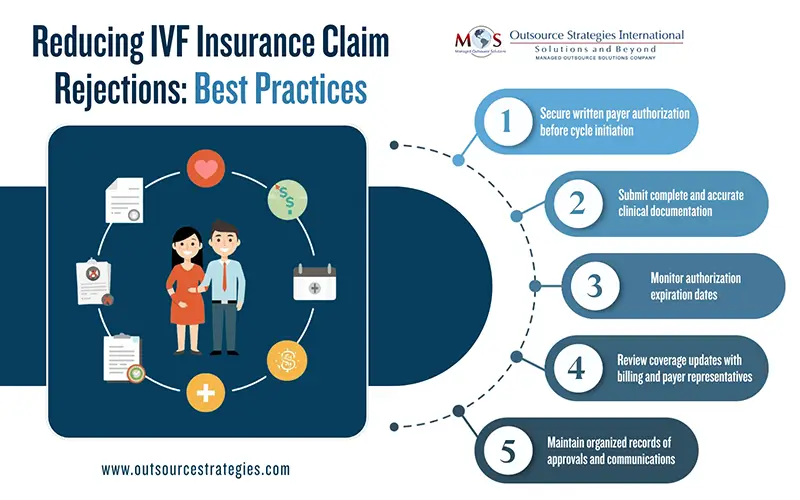

Best Practices to Minimize IVF Claim Rejections Related to Pre-authorization

Claim rejections often happen when pre-authorization steps are incomplete or misunderstood. Here are practical tips to avoid IVF insurance claim rejection due to pre-authorization issues:

- Obtain written authorization before initiating IVF cycles

- Verify that all required clinical documentation is complete and current

- Monitor authorization validity periods to avoid expirations

- Align treatment protocols with payer-specific coverage rules

- Maintain detailed records of submissions, approvals, and payer communications

- Review policy updates regularly to remain compliant

A structured, physician-led approach to pre-authorization significantly reduces avoidable denials and resubmissions.

IVF treatment planning extends beyond clinical decision-making—it requires careful alignment with payer requirements. A thorough understanding of IVF insurance pre-authorization processes and coverage guidelines enables fertility specialists to protect treatment timelines, reduce financial uncertainty, and support successful claim outcomes.

By maintaining comprehensive documentation, coordinating closely with billing teams, and proactively addressing payer criteria, physicians can ensure a smoother authorization and reimbursement process for IVF services.

Avoid Claim Delays

Check Your IVF Pre-Authorization Requirements Now.

Call: (800) 670-2809.