The world of healthcare is complex, involving multiple systems, technologies, and interactions. While navigating these challenges to deliver quality patient care is paramount, ensuring the financial health of a medical practice is equally crucial. This is where healthcare or medical revenue cycle management (RCM) becomes relevant. RCM comprises the financial processes that healthcare providers use to track patient care episodes from appointment scheduling and insurance verification to medical billing and collection of payments.

Understanding and optimizing each step of the healthcare revenue cycle management process is crucial for improved cash flow, reduced claim denials, and enhanced patient satisfaction. This post covers the various stages of RCM in healthcare and explores strategies to enhance each phase.

What Is Medical Revenue Cycle Management?

To maintain profitability and financial sustainability, healthcare facilities must effectively collect and manage revenue. Equally critical is having complete visibility into the entire revenue cycle – the administrative and clinical functions associated with claims processing, payment, and revenue generation.

Medical or healthcare RCM is a comprehensive financial process that healthcare faculties implement to manage all revenue-generation functions. It involves a series of steps that begin with patient registration and end with the collection of payment. When successfully implemented, the proc ensures that healthcare providers are reimbursed for their services in a timely and efficient manner, maintaining the financial health of the practice.

Front-End vs. Back-End Revenue Cycle

The revenue cycle can be divided into two main components:

Front-End RCM: Involves processes before the patient encounter, such as registration, appointment scheduling, insurance verification, and pre-authorization.

Back-End RCM: Consists of processes after the patient encounter, including coding, billing, payment posting, and collections.

Coordination between front-end and back-end processes is essential for a seamless revenue cycle.

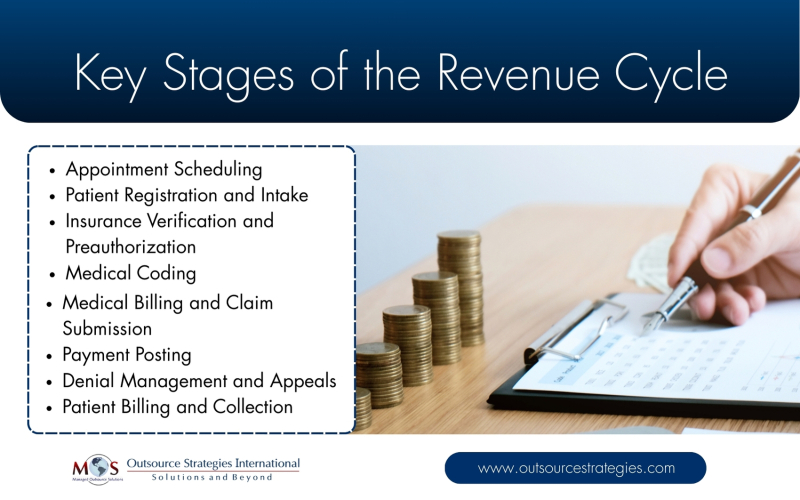

Key Stages of the Revenue Cycle

- Appointment Scheduling

The RCM process begins when a patient schedules an appointment. Key steps include selecting a date and time for the appointment, aligning the patient with the appropriate provider or service, verifying provider availability, and recording basic patient details (name, reason for visit). In addition to booking visits, appointment scheduling includes sending reminders and managing cancellations.

A disorganized clinical appointment process has severe consequences, including increased no-shows, financial strain, and reputational damages for practice. Optimizing appointment scheduling ensures efficient time management for providers, improves patient satisfaction, and enhances front-end revenue cycle flow.

- Patient Registration and Intake

During patient registration, essential information such as personal details, medical history, contact information, and insurance details is collected. Accurate patient information is essential for ensuring proper care, billing, and legal compliance. Errors or omissions can lead to claim denials or delays in payment.

Best Practices:

- Utilize electronic health records (EHR) systems to streamline data collection.

- Ensure the patient registration form is easy to read, clear, and concise.

- Verify insurance eligibility in real-time.

- Train front-desk staff to answer patient questions and ensure accuracy in data entry.

- Insurance Verification and Preauthorization

Before services are rendered, it’s essential to verify the patient’s insurance coverage and obtain any necessary pre-authorizations. This step prevents unexpected out-of-pocket expenses for patients and reduces the risk of claim denials.

While implementing automated tools streamlines the process, outsourcing insurance eligibility verification and authorization to experts can ensure accuracy. Practices need to clearly communicate with patients about their coverage and financial responsibilities. This helps prevent surprises, ensuring a smoother experience and enhancing patient satisfaction.

- Medical Coding

After services are provided, medical coders translate the care delivered into appropriate ICD-10, CPT and HCPCS codes. Medical coding includes appending modifiers to provide additional information to the insurance company about the procedure or service provided. Accurate coding is essential for proper billing and reimbursement.

Best practices include employing certified medical coders familiar with current coding standards, using coding software to minimize errors, and regularly audit coding practices to ensure compliance.

- Medical Billing and Claim Submission

Once coding is completed, the coded services are entered into the billing system along with the associated charges. Timely and accurate claim submission is critical to avoid payment delays, ensure appropriate reimbursement from insurers, and properly bill patients. Submitting claims electronically speeds up processing and reduces administrative burden.

To further enhance accuracy, healthcare practices can implement claim scrubbing tools, which automatically review claims for completeness, coding accuracy, and compliance with payer-specific rules and regulatory standards (such as Medicare and HIPAA). These tools detect and flag potential errors—such as mismatched codes, missing information, or invalid modifiers—before submission. By identifying and correcting issues early, the software helps reduce denials, rejections, and delays in payment, ultimately improving revenue cycle efficiency. Monitoring claim status regularly is necessary to address issues promptly.

- Payment Posting

After the payer processes the claim, payments are posted to the patient’s account. This step involves reconciling the amount paid with the expected reimbursement and identifying any discrepancies.

Automating payment posting reduces manual errors. Regularly reconcile accounts is crucial to ensure accuracy. Underpayments or overpayments should be addressed promptly.

- Denial Management and Appeals

Not all claims are approved upon first submission. Denial management is the process of identifying, analyzing, and resolving insurance claim denials to recover correct reimbursement. It involves reviewing denial reasons, correcting errors, resubmitting claims, and following up with payers through appeals when necessary. Effective healthcare receivable management recoups outstanding accounts receivable (A/R)–the money owed to a provider by payers and patients after services have been rendered and claims submitted. It minimizes revenue loss, shortens the payment cycle, and improves overall cash flow.

Best practices include analyzing denial trends to identify systemic issues, developing standardized appeal processes, and educating staff on common denial reasons and prevention strategies.

- Patient Billing and Collection

After insurance payments are applied, any remaining balance is billed to the patient. Efficient patient billing processes enhance cash flow and patient satisfaction.

Best practices include offering multiple payment options, including online portals, providing clear, itemized statements, and implementing reminder systems for outstanding balances.

Common Challenges in Medical RCM

Healthcare providers often face several challenges in managing the revenue cycle:

- Coding Errors: Inaccurate or outdated codes can lead to claim denials.

- Claim Denials: Claims may be denied due to missing information, lack of authorization, or eligibility issues.

- Patient Payment Collection: Collecting payments from patients can be time-consuming and may impact cash flow.

- Regulatory Compliance: Staying updated with changing healthcare regulations is critical.

How to Optimize your Medical Revenue Cycle

Enhancing RCM involves implementing best practices and leveraging technology:

- Use of RCM software and automation: Automated systems can streamline processes, reduce errors, and provide real-time analytics.

- Staff training and workflow improvements: Regular training ensures that staff are knowledgeable about current coding standards and billing procedures.

- Regular audits and performance monitoring: Conducting periodic audits helps identify inefficiencies and areas for improvement.

- Patient engagement: Educating patients about their financial responsibilities and providing flexible payment options can improve collections.

Effective revenue cycle management is vital for the financial sustainability of healthcare practices. By understanding each stage of the process and implementing strategies to optimize them, providers can enhance cash flow, reduce claim denials, and improve patient satisfaction. Outsourcing RCM management to experts is a proactive approach to ensure efficiency. Data-driven healthcare revenue cycle management services can streamline the financial process—from patient registration to claim submission and denial resolution—ensuring revenue integrity and higher profitability.

Struggling with denied claims or delayed payments?

Optimize your revenue cycle for faster, more reliable reimbursements