Is insurance eligibility verification that important for your practice? Yes, it is.

Most practices realize that a large proportion of their administrative costs are related to not performing proper insurance eligibility verification and/or errors in verifying, leading to claims denial and costly resubmission processes. Verification of patient benefits include authenticating the patient’s name, date of birth, social security number, address, insurance carrier’s name, type of plan, coverage details, policy status, effective date, plan exclusions, payable benefits, co-insurance, co-pays & deductibles, pre-authorizations & referrals, health insurance caps, type of Medicare coverage, DME coverage, and out-of-network benefits.

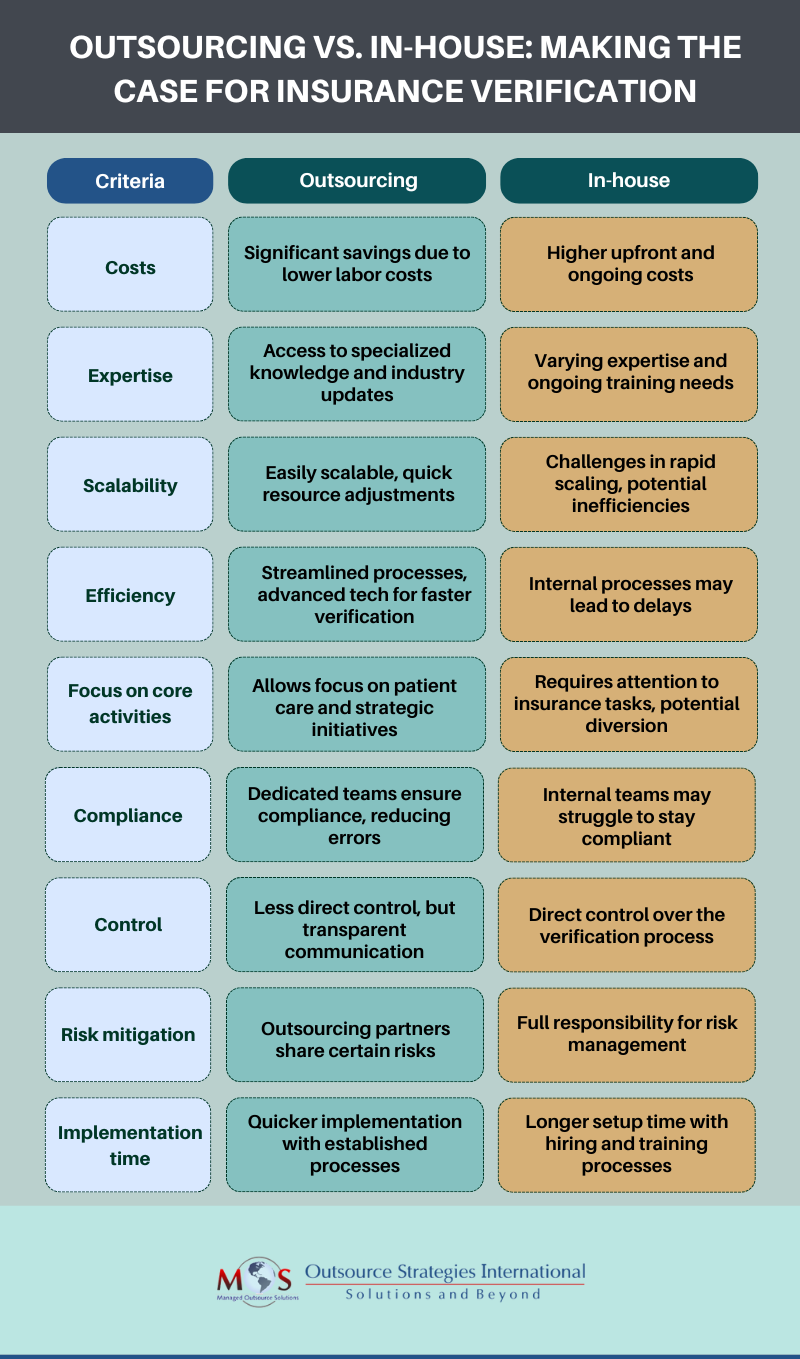

Providers face many challenges such as inaccurate patient details, complex insurance policies and procedures, time-consuming administrative tasks, changes in insurance coverage, claim denials and rejections, compliance with privacy and security regulations, meeting prior authorization needs and dealing with uninsured or underinsured patients. Front office staff must have an in-depth understanding of the insurance industry and be familiar with the specific requirements of various insurance companies. Moreover, they need access to the right technology and tools to efficiently handle the process. This is where professional medical billing companies and their expertise becomes essential for completing verification and billing processes.

Consider a dental practice where the practice administrator has multiple responsibilities to fulfill. Among their key duties is making sure that the patient appointment and billing process runs without any hassles. For this, insurance eligibility verification must be managed flawlessly. Though they may strive to balance all their duties, the eligibility verification is bound to consume an outsized chunk of time. This is mainly because they may have to contact the insurance companies directly to verify the details. The main concern here is the lengthy hold time. Another issue is regarding inactive insurance plans; often this is discovered only weeks after the patient’s visit. These and other related concerns can be successfully addressed by outsourcing patient eligibility verification to a professional company.

Here’s a video podcast from OSI’s President Rajeev Rajagopal, discussing why outsourcing insurance eligibility verification and authorization is an important part of healthcare revenue cycle management.

Benefits of Outsourcing Insurance Verification and Authorization

- Cost-effectiveness: Recruiting, training, and retaining staff with these specialized skills, as well with purchasing the necessary technology and software, is expensive. Outsourcing eliminates these large overhead expenses by providing access to flexible pricing models, so that you only pay for services as they’re needed. This ensures that your resources are utilized efficiently.

- Access to expertise: Outsourcing brings you the expertise of professionals who specialize in this field. They have knowledge and experience in the complexities of insurance plans, policies, and procedures. You gain access to their industry-specific knowledge and benefit from accurate and timely processing of claims.

- Enhanced efficiency: The right partner frees up valuable time and resources within your practice. Instead of your staff juggling multiple responsibilities, they can focus on core tasks such as patient care. You can ease up operational load, reduce administrative burdens, and improve overall efficiency. This results in a faster and smoother revenue cycle, improved cash flow and reduced claim denials.

- Scalability and flexibility: As your practice grows, the volume of insurance verifications and authorizations required will increase. Professional billing companies are built to be scalable. They can easily handle fluctuating workloads, and ensure prompt processing without compromising quality. Whether you need assistance during peak periods or regular ongoing support, they will adapt to your changing needs.

- Compliance and accuracy: Insurance regulations and requirements are in a constant state of change. It’s challenging for in-house teams to stay current and compliant with these changes. Professional providers specialize possess a keen understanding of industry regulations. They are equipped with the latest knowledge and technology to ensure accurate verification, authorization, and claims processing, reducing the risk of errors, rejections, and compliance issues.

Key Performance Indicators (KPIs) for Outsourcing Insurance Verification

KPIs to effectively measure the success of outsourcing for your practice could include:

- Accuracy rate: Measure the percentage of accuracy rate by the provider compared to the total number of verifications requested. Obviously, the higher the accuracy rate the better the service.

- Turnaround time: Assess the time taken by the provider to complete verifications from the time of request submission. A shorter turnaround time ensures timely access to patient insurance information, facilitating a smoother billing process.

- Error rate: Track the frequency of errors or discrepancies. A low error rate demonstrates the provider’s attention to detail and proficiency in verifying insurance information accurately.

- Denial rate reduction: Monitor the rate of insurance claim denials. A decrease in denial rates suggests that accurate verification results in fewer claim rejections, ultimately improving revenue cycle management.

- Cost savings: Evaluate the cost-effectiveness of outsourcing compared to in-house processes. Calculate the savings achieved through reduced staffing costs, overhead expenses, and potential revenue losses due to billing errors.

- Customer satisfaction: Gather feedback from patients, staff, and providers regarding their satisfaction. Good feedback indicates that the provider meets expectations and is having a positive impact on your practice.

Need the right verification partner? Consider the services provided by an experienced medical billing company. Such a firm can provide quality solutions that will exactly suit your requirements and bring you cost savings of at least 30 to 40%. A reliable company also offers additional benefits such as free trial option, round- the-clock customer services and much more.

Don’t let errors slow your revenue inflow!

Get professional patient eligibility verification.