Running a successful medical practice involves not only providing quality patient care but also managing the financial aspects that keep your practice thriving. One crucial element of financial management is maintaining a healthy cash flow – the lifeblood of any healthcare organization. This can be challenging, considering that your medical practice’s cash flow is affected by various factors, from increasing regulatory changes and evolving payment models to growing patient expectations. Fortunately, there are proven strategies that you can utilize to optimize your revenue cycle and ensure a steady influx of funds. Enhancing medical practice cash flow requires additional effort and strategic planning, which is the reason why many providers opt to partner with a medical billing and coding outsourcing company to implement these steps and collect insurance and patient payments in a timely manner.

Significance of Medical Practice Cash Flow

In a medical practice, cash flow refers to the movement of funds into and out of the practice from diverse sources. These sources include patient payments, insurance reimbursements, and other revenue streams. Simultaneously, cash flow accounts for the outflow of funds to cover essential expenses. These expenses may include salaries, rent, utilities, medical supplies, and other operational costs necessary for the smooth functioning of the practice. Effectively managing this cash flow is vital to ensure financial stability and sustainability in the medical practice.

Optimize your medical practice’s cash flow with our dedicated medical billing services!

Best Practices to Enhance Medical Practice Cash Flow

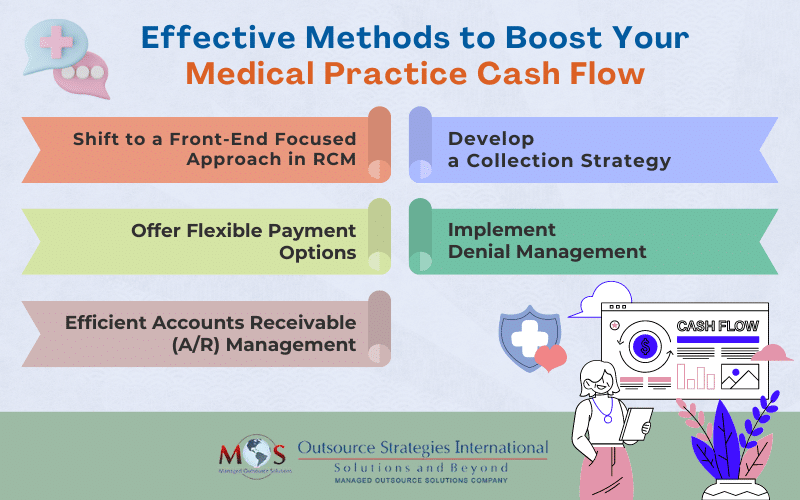

Improving your practice’s cash flow depends on identifying areas within your revenue cycle management (RCM) that could be optimized. It’s crucial to assess the barriers impeding your cash flow’s optimal performance and implement the right strategies to reverse this.

Here are five effective methods to boost your medical practice cash flow:

Shift to a Front-End Focused Approach in RCM

By focusing on the front-end in your healthcare revenue cycle, you can enhance both your practice’s experience and that of your patients. This proactive approach significantly reduces the risk of accumulating bad debts while allowing you to promptly identify and address potential issues or discrepancies, which will minimize revenue leakage and maximize revenue generation. By performing essential tasks like eligibility verification and pre-authorization upfront, your practice can address any coverage issues or preauth requirements before the patient’s visit.

For services that are approved, you can bill patients in advance, ensuring timely payment reimbursement from the insurance company. Additionally, for services that are not covered by insurance, billing patients in advance allows you to collect payment directly from them, preventing any potential payment disputes or delays. This will streamline the process, reduce delays, minimize the chances of claim denials or rejections, and enhances collections.

Develop a Collection Strategy

Any delay in receiving payment for services rendered can increase the overall expense for your practice. By billing patients in advance, you reduce the likelihood of delayed payments and improve cash flow. Establishing a comprehensive collection strategy is crucial for maintaining consistent cash flow. For this, it’s important to openly share pricing information with patients. This will prepare them for their expenses and allow them to make choices that align with their medical as well as financial needs. It will also prompt them to make timely payments towards their medical bills. This proactive approach will enable you to receive payment promptly and efficiently, minimizing the financial impact on your practice.

Offer Flexible Payment Options

Implementing a modern and efficient payment system is crucial in facilitating timely bill payments from patients. Accept payments via credit card, check, bank draft, or through the patient portal for overdue bills. Streamline payment processes, send timely notifications, and provide various payment platforms to optimize collections. Facilitate multiple payment methods to accommodate patient preferences. Not only will this contribute to an improved cash flow for your healthcare practice, but it will also enhances patient engagement and satisfaction.

Implement Denial Management

While preventing claim denials is crucial for improving cash flow, addressing claim denials is essential as they often lead to lost revenue. The success of your revenue cycle process greatly depends on implementing an effective denial management program. Reasons for denials fall into two categories: technicalities and medical. Technicalities refer to missing codes or authorizations or claim filing mistakes, while medical reasons include treatment not considered a medical necessity or is considered experimental/investigational. Identify the root causes for insurance companies rejecting your reimbursement requests. By rectifying issues such as incorrect paperwork and hiring experienced billing staff you can minimize future payment denials.

Efficient Accounts Receivable (A/R) Management

Accounts receivable represents the outstanding payments due from patients or insurance companies for services rendered. A large volume of accounts receivable is a key obstacle to maintaining a healthy cash flow in a healthcare practice.

Minimizing accounts receivable is crucial for maximizing cash flow and financial stability. An AHIMA article reported on a Medical Group Management Association (MGMA) Stat poll which stated that on the practice side, survey respondents reported an average increase in denials of 17 percent in 2021 alone. It is also reported that nearly 20 percent of all claims are denied, and as many as 60 percent of returned claims are never resubmitted. The cost to rework or appeal denials, which averages $25 per claim for practices and a whopping $181 per claim for hospitals, adds to the burden, notes AHIMA.

Track outstanding claims diligently, regardless of their age or amount. Follow up on uncollected balances and copays diligently until they are fully paid. Efficient management of accounts receivable

ensures that no revenue is left on the table.

How a Medical Billing Company can Help

Maintaining financial stability within a complex regulatory environment can be quite challenging. It demands a comprehensive understanding of the strategies to ensure proper reimbursement for services rendered. This includes effectively managing claim denials, improving denial management and underpayment processes, as well as diligently following up on outstanding payments.

To optimize financial health, it is crucial for your practice to keep payer fee schedules up to date, file secondary insurance claims when necessary, and accurately code services to prevent undercharging. Recognizing the importance of profitability, many practices choose to collaborate with medical billing experts who specialize in maximizing revenue and streamlining financial operations.

As a medical billing company, OSI offers end-to-end RCM solutions. “Utilizing our AR follow up services can help catch repeated issues and trends , such as sending claims to wrong payor address/ missing payer specific requirements on claims) and identify reasons for repeated denials”, says Natalie Tornese CPA, OSI’s Director of Revenue Cycle Management – Healthcare Division.

With a team of skilled billing professionals, OSI can provide invaluable assistance in accomplishing your financial goals. By relying on our expertise, you can increase your cash flow and focus on providing quality care to your patients.