Claim denials can prove to be a major challenge to healthcare providers, revenue cycle professionals, and billing teams. Every denied claim represents delayed payment, increased administrative burden, and potential revenue loss. With rising denial rates and tightening margins, organizations are increasingly turning to advanced tools to improve performance. Data analytics in claim denial management has emerged as a good strategy to minimize denials, improve financial outcomes, and strengthen revenue cycle performance. By integrating powerful analytical models into their workflows, healthcare organizations can respond to denials more effectively and even proactively prevent them in the first place. With a strategic application of analytics, predictive modelling, and denial intelligence, healthcare providers can make meaningful improvements in efficiency, accuracy, and revenue capture.

Understanding Claim Denials and Their Impact

A claim denial occurs when a payer refuses to pay for a submitted healthcare claim. The reasons for denials are many—incorrect patient data, coding mistakes, missing attachments, insurance eligibility issues, authorization lapses, or lack of compliance with payer-specific rules. Over time, these denials can lead to significant revenue leakage, increased work for clinical and administrative staff, and delayed payments. According to industry data, claim denial rates have risen significantly in recent years, and many denials stem from inaccurate or incomplete data in the claim.

While some denials are unavoidable, many are preventable. This is where healthcare data analytics plays a pivotal role. By analyzing historical claims, denial patterns, payer responses, and operational workflows, data analytics unveils insights that help organizations identify vulnerabilities before claims are submitted.

Reduce Claim Denials Faster with Data-driven Analytics.

Defining Data Analytics in Claim Denial Management

At its core, data analytics in claim denial management involves the use of statistical analysis, machine learning algorithms, and pattern recognition to evaluate claim performance and pinpoint denial indicators. Rather than simply reacting to denials, analytics enables organizations to understand the why behind denials and address root causes at scale. Rather than relying on manual reviews, data analytics empowers healthcare teams to examine massive volumes of data and identify trends that may contribute to denial risk.

How Data Analytics Helps Reduce Claim Denials

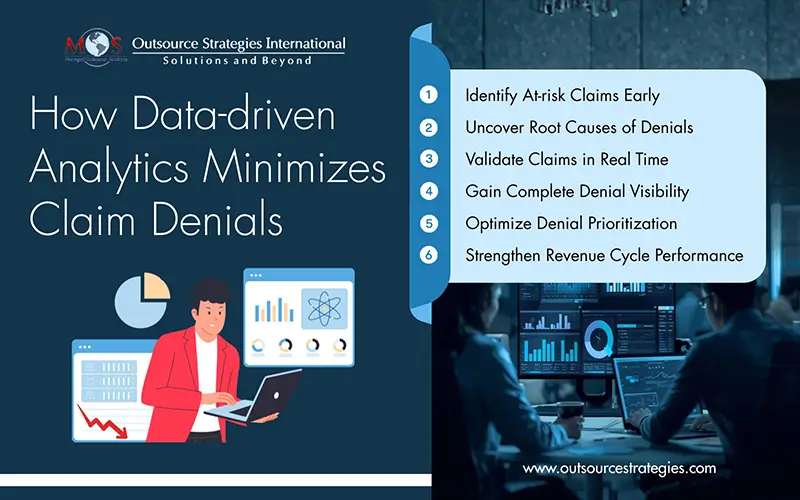

How does data analytics help reduce claim denials? The answer for this question lies in the depth of insight and actionability that analytics provides. Below are key ways analytics drives measurable results:

- Predictive Analytics Identifies At-risk Claims: One of the most strategic applications of data analytics is predictive modeling. Strategic use of predictive analytics in revenue cycle processes allows healthcare organizations to forecast which claims are most likely to be denied. Predictive models analyze historical patterns—including payer behavior, coding trends, and claim attributes—to assign risk scores to claims. Visualization and alerts generated from these models enable denial management teams to intervene early, correct errors, and improve the likelihood of first-pass claim acceptance. This proactive approach reduces rework and cuts down on the administrative cost of appeals.

- Root Cause Analysis Improves Process Quality: Healthcare data analytics goes beyond raw numbers by highlighting systemic issues that contribute to denials. For instance, analytics can uncover that a disproportionate share of denials occur due to incorrect insurance eligibility checks or inconsistent coding practices. With this insight, organizations can redesign workflows to address the root cause of recurring denial patterns.

- Real-time Data Validates Accuracy: Advanced analytics tools can validate claim data in real time. This involves checking eligibility, coverage requirements, diagnostic coding consistency, and payer rules before the claims are submitted. By performing real-time data analysis, organizations increase their clean claim rates and reduce the likelihood of rejection.

- Comprehensive Denial Visibility: Data analytics provides visibility into denial categories, payer trends, and operational weak points through reporting. This enables revenue cycle teams to monitor denial trends over time, compare payer performance, and make informed decisions based on insights. Analytics-driven visibility transforms denial management from a reactive task into a strategic discipline.

Strategic Use of Predictive Analytics in Revenue Cycle

Beyond denial prevention, strategic use of predictive analytics in revenue cycle operations extends to broader financial performance:

- Pre-visit and Eligibility Verification: Predictive analytics can flag potential coverage issues before a patient arrives, so that front-end staff can obtain authorizations and confirm eligibility in advance.

- Point of Service and Charge Capture: Analytics helps identify gaps in charge capture and coding that could lead to downstream denials. This ensures that services rendered are captured and correctly coded.

- Denial Categorization and Prioritization: Rather than treating all denials equally, predictive models help prioritize those with the highest recovery potential. Analytics can even suggest tailored appeal strategies based on historical outcomes.

- Revenue Forecasting: Predictive insights help anticipate cash flow trends, plan staffing, and allocate resources more effectively to optimize financial performance across the revenue cycle.

In an era where revenue margins are under pressure, mastering claim denial management is no longer optional—it is essential. Data analytics in claim denial management empowers healthcare organizations to transition from reactive denial handling to proactive prevention and strategic intervention.

By leveraging healthcare data analytics, predictive models, and analytics-enabled denial workflows, healthcare providers can streamline operations, strengthen clinical and administrative processes, and significantly reduce denied claims. When paired with quality denial management services, analytics becomes a strategic asset that drives financial resilience and operational excellence.

Get Expert Support and See How Analytics Can Transform Your Claim Management.