In the medical practices, revenue leakage can arise from numerous overlooked gaps in operational and financial processes. Factors such as coding mistakes, inefficient insurance verification, or late claim submissions can significantly impact your practice’s bottom line. One common way practices lose revenue is through write-offs in medical billing. These unpaid balances often accumulate over time due to claim denials, patient non-payment, or administrative oversights. If left unchecked, even small, routine write-offs can become a major source of lost revenue for healthcare providers. Practices seeking to minimize such losses can benefit from partnering with a reliable medical billing company. Experts can help you optimize revenue cycle management (RCM) processes and boost financial stability.

What is Write-Off in Medical Billing?

A write-off, also known as charge-off, is a common billing practice in which a portion of the bill is deducted by the healthcare provider, often due to insurance agreements or uncollectible amounts. This amount is either owed by the patient or the insurance company, but ultimately removed from the provider’s receivables as it is not expected to be collected. This happens typically due to reasons such as:

- Contractual obligations: Agreements with insurance companies that limit how much payment the provider receives for the service rendered.

- Uncollectible debts: When a patient is unable or unwilling to pay and collection efforts fail.

- Legal requirements: Regulatory standards that limit what amount providers can bill their patients.

- Internal billing policies: Decisions made by the provider’s organization to simplify the billing system or support patient care.

- Coding or documentation errors: Mistakes in medical coding or insufficient documentation can result in insurance claim denials that cannot be appealed.

While considered a financial loss, charge-offs play a crucial role in ensuring compliance, maintaining accurate financial reports, and preventing billing disputes. To accurately document and track charge-offs, providers rely on standardized alphanumeric codes known as Claim Adjustment Reason Codes (CARCs) and Claim Adjustment Group Codes (CAGCs). These codes are used to classify and understand the specific reasons for claim adjustments and clarify the financial responsibility associated with write-offs.

Key Types of Write-Offs in Medical Billing

Typically, there are two broad classifications of write-offs:

- Approved/ necessary: These are contractual adjustments in medical billing approved as part of insurance contracts or policy guidelines.

- Unnecessary/ other: These are voluntary or courtesy charge-offs resulting from issues such as financial hardships cases, bad debts, or billing errors.

Let’s go through the further classifications that fall under approved and unnecessary charge-offs:

Necessary Charge-Offs

- Contractual adjustments: These are the most common and expected deductions from billed amounts, as they are part of contractual agreements between healthcare providers and payers. When a provider enters into a contract with an insurance company, every procedure code is assigned an allowable fee. If the provider submits a claim using their standard charges, the insurer will reimburse only the contract-approved payment for the services. For example, a procedure billed at $500 may be reimbursed at $300, with the remaining $200 written off as a contractual adjustment.

- Small balance: As the term suggests, this type of adjustment occurs when the patient owes the provider a negligible amount, such as $10 or $15. These charges are often written off as they are not worth the administrative effort or resources required for collecting from the patient. In such cases, the provider may choose to waive the charges or collect during the next visit, depending on internal policies.

- Promotional: Practices can offer promotional billing concessions as part of discounts from new and uninsured patients. In this case, a fixed percentage, such as 5%, can be applied as discounts for patients that make full payment upfront. This not only reduces collection recovery efforts, but also promotes timely payments and better patient relationships.

- Charitable: Some providers may offer charitable reductions to patients facing financial hardships as a professional courtesy and commitment to the healthcare community. In this case, a partial or full amount may be written off after reviewing the patient’s eligibility through a formal financial assistance or charity care program.

Unnecessary Charge-Offs

- Timely filing: This occurs when a provider files a claim past the insurance company’s established deadline. Both government and commercial insurers have specific timeframes under which claims must be submitted. If a practice fails to submit the claim within the allowed window, the insurer will deny it, making the amount non-reimbursable.

- Bad debt: This refers to the amount owed by patients or payers that remain unpaid despite multiple billing attempts and collection efforts. Bad debts in healthcare billing often arise from issues such as incorrect coding, incomplete documentation, or lack of proper insurance coverage. Once all reasonable efforts to collect the outstanding balance have been exhausted, this amount is deemed uncollectable and write-off as bad debt.

- Administrative: Providers may write off balances due to administrative reasons such as billing errors, pre-authorization issues, or outdated accounts. Charges may also be eliminated in case patients face unexpected out-of-network charges or report a poor experience, as a courtesy to maintain the patient-provider relationship and avoid further disputes.

Understanding the differences between various types of charge-offs is essential to ensure fair billing practices, financial transparency, regulatory compliance, and adherence to ethical standards.

Ready to improve your revenue flow? Get expert help for your billing today!

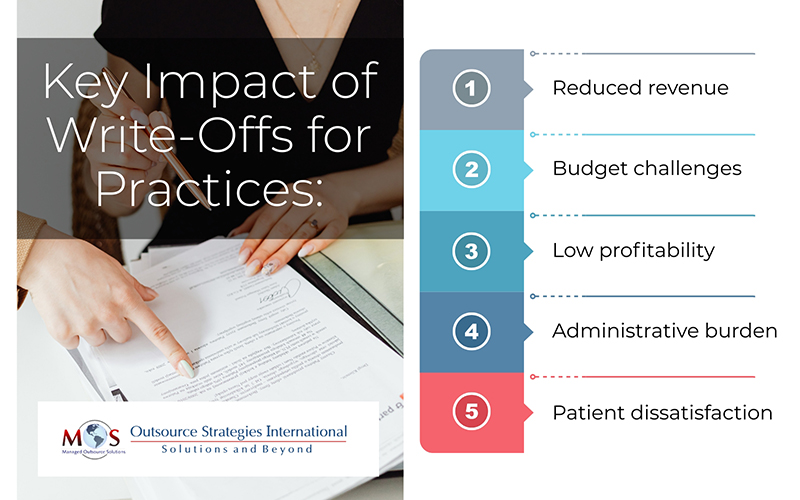

Key Consequences of Write-Offs for Practices

While write-offs are a standard billing practice, uncontrolled or high charge-off rates can significantly impact a practice’s financial health by affecting different aspects of RCM:

- Reduced revenue: Charge-offs directly reduce the amount of collected revenue, affecting the overall cash flow of the practice.

- Budget challenges: High volumes of charge-offs can make financial planning and forecasting difficult.

- Low profitability: Excessive or unnecessary charge-offs can result in revenue leakage and decrease profit margins, limiting resources for future practice growth or investment.

- Administrative burden: Managing and tracking charge-offs requires additional administrative effort and time from staff, leading to increased operational costs.

- Patient dissatisfaction: Charge-offs that stem from unclear policies or billing errors can affect patient satisfaction and retention, resulting in damaged reputation and long-term retention.

Understanding these consequences can help practices develop better strategies to effectively manage charge-offs and maintain financial stability.

Key Strategies to Prevent Medical Billing Write-Offs

While it’s not possible to completely reduce charge-offs, there are effective strategies that practices can implement to minimize their frequency and financial impact:

- Leverage RCM Analytics

Practices should integrate advanced billing software and RCM tools with built-in analytics to track key performance metrics (KPIs) such as bad debt to sales ratio and percentage of high-risk accounts. Monitoring key metrics can help to identify root cause, spot trends, and take corrective measures to strengthen your RCM processes. These insights can also support data-driven decision-making to optimize billing performance and resource allocation.

- Conduct Regular Audits

Rather than waiting for billing issues to pile up, practices should conduct regular internal audits to assess coding process, billing workflows, and RCM systems. Routine auditing will help to find out any recurring and costly issues early and prevent them from escalating further. By maintaining audit consistency, practices can foster long term compliance and financial stability.

- Establish Denial Management

As denials are one of the major contributors to high write-off rates, establishing proper denial management strategies is crucial. A systematic process includes analyzing denial trends, filing for timely appeals, and improving front-end processes to prevent denials before they occur. A strong denial management strategy not only reduces write-offs but also ensures faster reimbursements.

- Enhance Patient Communication and Collection

Medical billing is often a long and strenuous process, and can end up confusing patients without clear communication. Practices should implement clear internal policies on financial responsibilities and explain cost estimates upfront to avoid surprises or delays. Setting up various collection options for full payments, installments, and digital modes can significantly improve cash flow and reduce revenue losses. Sending timely reminders through text, phone, or email is known to improve collection rates. When patients are well-informed and guided throughout the billing process, chances of delayed payments and eventual write-offs can be significantly reduced.

Outsource Your Billing Needs to an Expert

Efficiently managing write-offs is the key to reducing revenue leakage in practices as they are an unavoidable aspect of medical billing. By outsourcing medical billing services to an expert, healthcare providers can closely monitor and reduce write-offs through targeted strategies. Experts leverage advanced analytics and industry best practices to optimize the entire RCM cycle, minimizing errors, improving approval rates, and accelerating practice reimbursement. Outsourcing allows healthcare providers to focus more on patient care while maximizing financial performance.