As healthcare organizations grapple with financial challenges due to rising costs, declining reimbursement rates, and staffing shortages, proper revenue cycle management (RCM) has become more important than ever. RCM comprises various steps from patient intake to payment. Healthcare revenue cycle management is one area where analytics is making a significant impact.

Powered by advanced technology and intelligent machine learning, data-driven decision-making has emerged as a vital asset for enhancing performance across multiple aspects of healthcare delivery. Leveraging healthcare analytics for improved cash flow enables providers to identify payment bottlenecks and optimize revenue cycle processes more effectively. They must closely track critical revenue cycle metrics in order to improve financial performance and ensure sustainable operations. This post explores how practice can leverage data analytics to improve reimbursement and the key performance indicators (KPIs) commonly used in healthcare RCM analytics.

Partner with our expert RCM team to streamline billing, reduce denials, and boost collections.

What is RCM Analytics?

RCM analytics involves the strategic use of data to monitor, measure, and optimize the financial processes associated with patient care—from appointment scheduling and insurance verification to billing and final payment collection. By analyzing KPIs such as denial rates, days in accounts receivable, and cost-to-collect, healthcare organizations can identify revenue leakage and inefficiencies, predict financial outcomes, and make informed decisions that enhance revenue flow.

It’s more important than ever to ensure reimbursement from payers is accurate. The Medical Group Management Association (MGMA) estimates that healthcare practices lose up to 5% of annual revenue because of billing errors.

Identifying and resolving errors and oversights through advanced analytics can drive a significant and immediate boost to your financial performance. RCM analytics not only supports operational transparency but also empowers providers to adapt quickly to regulatory changes, payer requirements, and evolving patient payment behaviors.

How to Use Healthcare RCM Analytics for Better Financial Performance

By turning raw data into actionable insights, RCM analytics enables practices to identify inefficiencies, streamline processes, and make informed decisions that directly impact their bottom line.

- Identifies Revenue Leakage

RCM analytics helps uncover hidden revenue loss caused by billing errors, underpayments, and claim denials. By routinely analyzing trends in accounts receivable, denial patterns, and payer performance, hospitals can quickly pinpoint and correct problems that might otherwise go unnoticed.

- Optimizes Denial Management

Hospitals can use analytics to track denial rates by payer, reason codes, and department, allowing them to develop targeted strategies for reducing denials. This leads to faster reimbursements, fewer write-offs, and improved cash flow.

- Improve Charge Capture and Coding Accuracy

Using RCM analytics, hospitals can evaluate discrepancies between services rendered and charges submitted. Insights gained from this data help ensure that services are coded accurately and completely, reducing compliance risks and increasing reimbursement.

- Enhance Patient Collections

With the rise in high-deductible health plans, patient responsibility has become a major revenue source. Analytics can help forecast patient payment behavior, identify collection bottlenecks, and improve upfront collections by tailoring communication and payment options.

- Monitor Key Performance Indicators (KPIs)

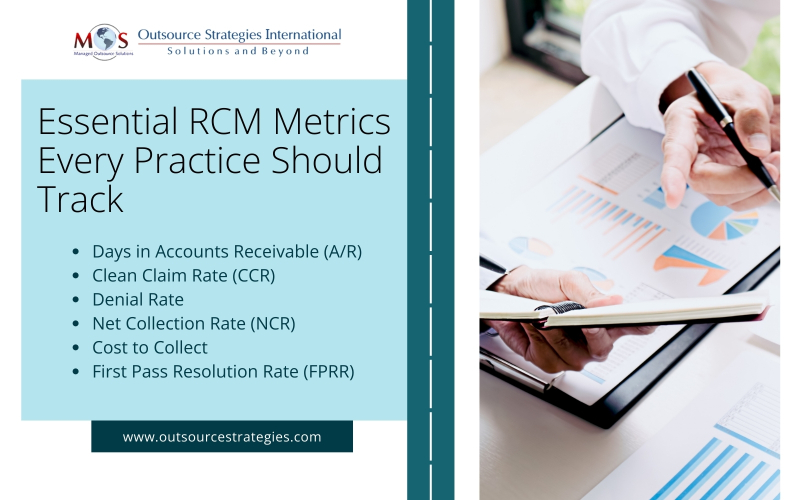

Hospitals can track essential KPIs such as Days in A/R, clean claim rate, denial rate, cost-to-collect ratio, net collection rate, and first pass resolution rate. Consistently monitoring these metrics allows finance teams to assess performance, benchmark against industry standards, and implement corrective actions when necessary.

- Predict Future Trends

Advanced RCM analytics with machine learning capabilities can forecast cash flow, predict denial trends, and support strategic financial planning. This forward-looking approach enables hospitals to prepare for payer changes, regulatory updates, and shifts in patient payment behavior.

Key Developments in Medical RCM for 2025

Key RCM Performance Metrics to Track

To improve financial performance and ensure sustainable operations, healthcare organizations must closely monitor critical revenue cycle metrics. Here are five essential KPIs that provide valuable insight into the efficiency and effectiveness of your RCM processes:

- Days in Accounts Receivable (A/R)

This metric tracks the average number of days it takes to collect payments after a service has been rendered. It’s a key indicator of a practice’s financial health, showing how efficiently they’re collecting revenue. A lower number indicates faster reimbursement and healthier cash flow. Prolonged A/R days may signal issues in claims processing or payment collection.

The Healthcare Financial Management Association (HFMA) highlights that a shorter days in A/R, ideally between 30-40 days, indicates a healthier revenue cycle, leading to better cash flow and reduced administrative costs

- Clean Claim Rate (CCR)

The clean claim rate reflects the percentage of claims that are submitted and processed without errors on the first attempt. A high CCR means fewer denials, less rework, and quicker payments. A benchmark of 90% or higher is typically considered strong.

A clean claim rate of 90% or higher indicates effective revenue cycle management practices. HFMA suggests that providers should aim for a clean claim rate of 90% or higher, with some sources citing 95% as an industry standard.

- Denial Rate

This measures the proportion of claims that are denied by payers. A high denial rate often points to problems with coding, eligibility verification, or documentation. According to market reports, denials costs healthcare organizations up to roughly 3 percent of their net revenue stream. Tracking and reducing denials can have a direct impact on revenue and staff efficiency.

- Net Collection Rate (NCR)

The net collection rate shows how much of the allowed reimbursement a practice actually collects from the services. It excludes adjustments for payer contracts and write-offs, and provides a clear view of collection effectiveness. A high NCR, typically 95% or higher, indicates effective RCM.

- Cost to Collect

Cost to Collect measures the total expense of managing the revenue cycle divided by the revenue successfully collected. This includes staffing costs, administrative overhead, billing software, and other operational resources. A lower cost to collect is indicative of a more efficient and optimized revenue cycle, potentially leading to increased profitability. Tracking the cost-to-collect ratio is essential for healthcare providers aiming to improve revenue cycle performance, reduce administrative costs, and maximize overall financial efficiency.

- First Pass Resolution Rate (FPRR)

FPRR indicates the percentage of claims that are paid upon first submission, without needing resubmission or appeal. A high FPRR means your billing processes are accurate and efficient, minimizing delays and administrative costs. A high first-pass clean claim rate enhances financial stability, boosts operational efficiency, and improves patient satisfaction—key factors that contribute to the overall success of a healthcare practice.

Driving Financial Success through Data-Driven RCM and Strategic Outsourcing

In a competitive environment, harnessing the power of RCM analytics is essential for medical practices to thrive financially. By integrating data-driven decision-making into their revenue cycle operations, practices can improve financial performance, reduce costs, and enhance the patient experience. Improving billing efficiency requires prioritizing accurate documentation, investing in staff training, leveraging advanced technology, conducting regular audits, maintaining clear communication with payers, and verifying patient information accuracy. Outsourcing medical billing offers a strategic and cost-effective way for healthcare providers to improve cash flow, reduce administrative burden, and enhance overall revenue cycle performance.

Discover how our tailored medical billing services can improve your financial performance!