Years of Experience

Experienced Resources

Satisfied Clients

Get Faster Pharmacy Authorizations

Insurance companies often require pharmacy authorizations for medications that:

- Have serious side effects or pose risks when combined with other drugs

- Are prescribed to treat specific conditions (e.g., Medicare Part D) or are often misused

- Treat non-life-threatening medical conditions when lower-cost formulary medications are available

- Are subject to step therapy (i.e., when patients must try lower-cost alternatives first)

Speed Up Approvals for High-Value Claims

- Handles prior authorization requests for all healthcare specialties

- Works with both government and private insurance plans

- Confirms drug coverage, copays, deductibles, and other plan details upfront

- Prepares and submits documentation that meets payer criteria and medical necessity standards

- Secures faster approvals for high-value claims — improving care delivery and boosting your cash flow

Save Time and Focus on Your Patients

Our support streamlines your prior authorization process and minimizes delays. Our team keeps things on track, so you can focus your time and resources where they matter most — on patient care, not on paperwork or appeals.

Why Outsource Prior Authorizations to OSI?

Real-Time Verification

Clear Communication

Expert Knowledge

We serve all 50 states

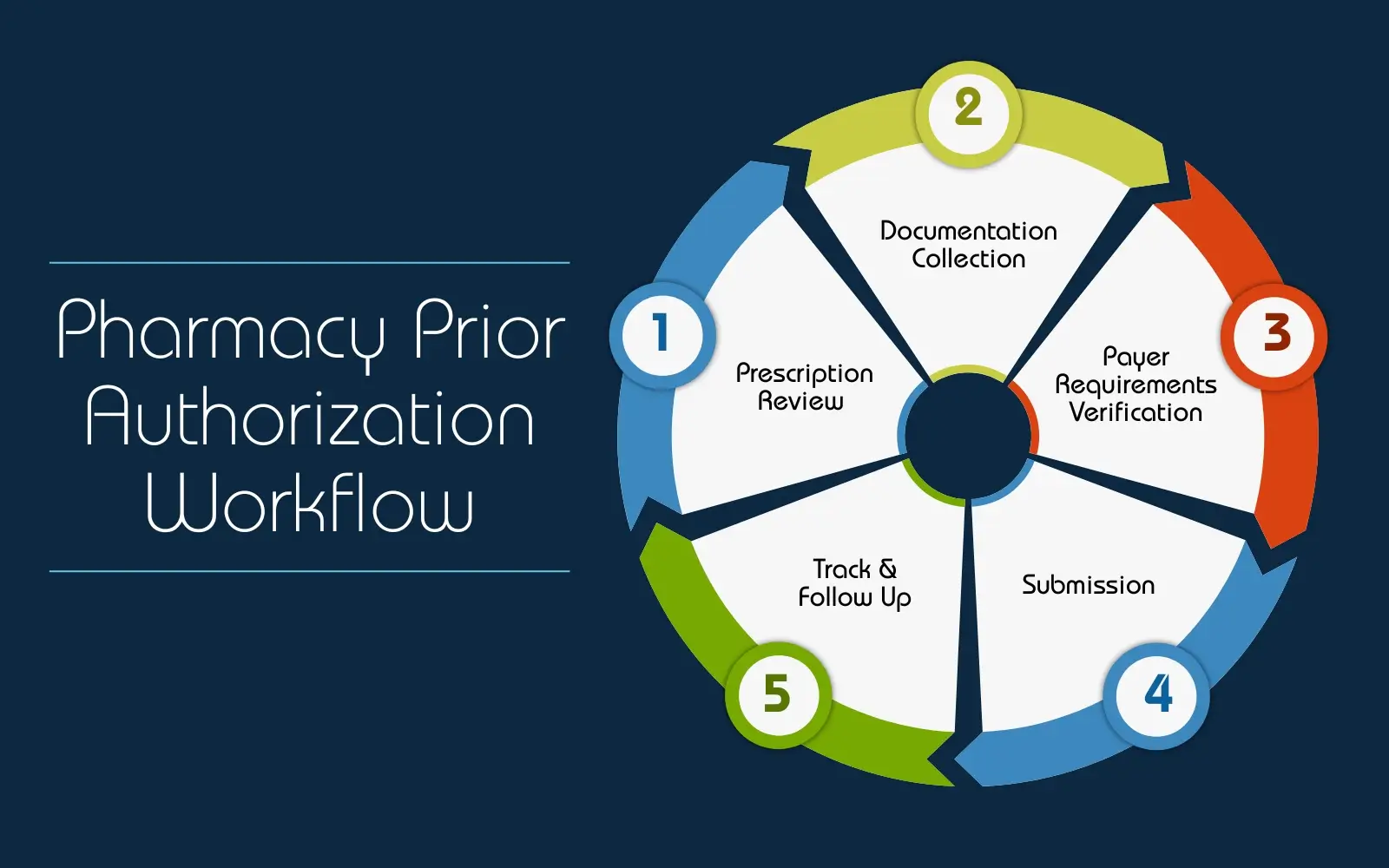

Our Pharmacy Prior Authorization Process

Identify Medication Needing Prior Approval

Gather Required Documentation

Evaluate Payer-Specific Requirements

Prepare the Authorization Request

Submit to the Payer

Track & Follow Up

Benefits of Partnering with OSI

Timely Reporting: Receive updates that fit your workflow

How Our Insurance Verification and Prior Authorization Services are Priced

Full-Time Equivalent

In this model, you will be charged a fixed monthly or annual fee based on the number of full-time equivalent staff required to manage your practice’s AR follow-up activities.

FAQs

What is pharmacy prior authorization?

What information is typically required for a pharmacy authorization request?

How long does the approval process generally take?

How do you handle pre-authorization denials?

When a request is denied, both you and your patient can appeal the decision. Our team can guide you through the appeals process and help you overturn the denial.

Why do health insurance companies require pharmacy prior approval?

Health insurance companies use a PA as a means to essentially put a restriction in place to reduce unnecessary prescription drug use and cost of the service. Prescribed medications are approved after verifying the medical necessity to ensure it is the most economical option viable for the health condition. If a less expensive but equally clinical effective alternate is available after review, then the cost-friendly option is recommended by payers. It is an evidence-based process that minimizes overall medical costs to improve affordable healthcare access for patients. For example, if the physician prescribes an expensive drug, the insurance company may authorize it only if the physician can show that it is a better option than a less expensive medication for the condition.

What types of drugs require PA?

- Brand name medicines that are available in a generic form

- Expensive medicines, such as those needed for psoriasis or rheumatoid arthritis

- Drugs used for cosmetic reasons such as medications used to treat facial wrinkling

- Drugs prescribed to treat a non-life-threatening medical condition

- Drugs not usually covered by the insurance company, but said to be medically necessary by the prescriber

- Drugs usually covered by the insurance company but are being used at doses higher than normal

Blue Cross Blue Shield requires prior authorization for those drugs that:

- have dangerous side effects

- are harmful when combined with other drugs

- should be used only for certain health conditions

- are often misused or abused

- are prescribed when less expensive drugs might work better