In dental billing, accounts receivable (AR) represents the outstanding payments owed to a dental practice for services rendered, from patients or insurance. Dental practices often grapple with aging AR, which can tie up critical cash flow, limit resources for daily operations, and affect overall financial stability. According to Dental Intelligence, the industry average for AR days—the average time taken to collect payments—is 45 days. Going beyond this threshold “can put cash flow in jeopardy.

At OSI, we understand the challenges of dental revenue cycle management (RCM). Our dental billing services include effective accounts receivable revenue recovery strategies to minimize payment delays, reduce denials, and stabilize cash flow. We track and minimize dental AR days – the average time your dental practice takes to collect payments owed for services rendered, from the moment a claim is submitted to receiving the final payment from patients or insurance.

Improve your cash flow with expert AR management

Common Causes of Lost Revenue in Dental Accounts Receivable

LinkedIn-derived data highlights that delays in daily claim submission and remittance corrections can lead to staggering losses. about 34% loss in revenue, translating into $34,400 in delayed or uncollected payments per month, for a practice that should be collecting $3,000/day but ends up with only $1,975/day (LinkedIn, 2017).

The common reasons for suboptimal AR recovery are:

- Poor Insurance Verification – Providing treatment without confirming eligibility and benefits often leads to non-payment.

- Coding and Billing Errors – Inaccurate CDT coding or documentation gaps reduce reimbursement.

- Delayed Claim Submission – Late submission increases the risk of non-payment or reduced reimbursement.

- Patient Payment Delays – Outstanding co-pays, deductibles, or balances not collected at the time of service.

- Inefficient Follow-Up – Failure to track unpaid claims and patient balances results in aging AR and lost revenue.

- Improper Posting of Payments – Misapplied or missed payments create discrepancies in accounts and increase AR.

- Lack of Clear Financial Policies – Practices without transparent patient communication on payment responsibility face higher collection challenges.

- Non-compliance with payer rules – Failure to follow payer-specific guidelines, such as pre-authorization requirements, documentation standards, or timely filing limits, often results in denials and revenue loss.

- Underpayments by Payers – Not identifying and appealing underpaid claims leaves money uncollected.

- High AR Days – The longer receivables remain outstanding, the greater the risk of turning into bad debt.

Increased aging receivables lead to significant revenue loss for dental practices.

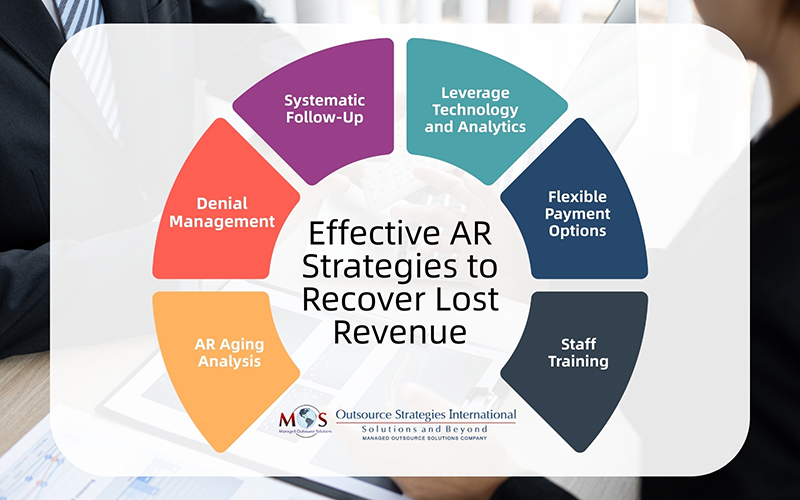

Effective AR Strategies to Recover Lost Revenue

Dental practices require strong accounts receivable revenue recovery processes to ensure timely collections, reduce aging AR, and protect the practice from significant revenue loss. Here are 6 proven strategies to reduce AR days and boost revenue cycle performance:

- AR Aging Analysis: An accounts receivable (AR) aging report shows how long a claim or bill has been due for payment. By assessing an AR aging report, your practice can quickly assess the health of your receivables, detect overdue accounts, and prioritize outstanding claims based on age and value for immediate follow-up. It also helps identify payments deemed uncollectable, which need to be written off.

- Denial Management: Effective denial management in dental billing is a strategic approach that safeguards a practice’s financial health while ensuring a positive patient experience. Review, correct, and resubmit denied claims promptly. Implementing effective claim resubmission strategies helps dental practices reduce denials, recover lost revenue, and improve overall reimbursement rates. Set up a step-by-step process for negotiation with payers to resolve issues and recover revenue. This includes:

- Regularly tracking claims to quickly identify denials and understand the specific reason for the rejection based on the payer’s explanation of benefits (EOB)

- Examining why the denial occurred, correcting the identified error and promptly resubmitting the claim in a timely manner with the necessary information.

- If a claim is denied based on medical necessity or a coverage dispute, the practice can file a formal appeal. This involves gathering additional supporting documentation, such as clinical notes, X-rays, and a persuasive appeal letter.

- Finally, track the status of all resubmitted and appealed claims to ensure a timely resolution. Follow up with the insurance company regularly.

With this systematic process of identifying, analyzing, and resolving rejected or denied claims, your practice can ensure the maximum possible reimbursement.

- Systematic Follow-Up: Ensure focused and consistent insurance and patient follow-ups using phone, email, and statements. Best practice, according to LinkedIn, is to batch and submit claims at the end of each day, review electronic remittance advice daily, correct errors immediately, and run an ‘unsubmitted claims report’ weekly to ensure no claims are overlooked. Automation can streamline reminders and reduce manual errors.

- Leverage Technology and Analytics: Investing in AR management software is a strategic approach that automates, streamlines, and optimizes the billing, collections, and tracking processes. AR software automates repetitive, time-consuming tasks within the accounts receivable lifecycle. It can automatically generate and send accurate electronic invoices promptly based on predefined rules. Patients can access secure portals and make payments. The software automatically matches incoming payments with corresponding invoices, which significantly reduces manual reconciliation efforts and human error. Dashboards provide real-time visibility into key AR metrics, payment trends, and the status of each claim. Using analytics can uncover problem areas and monitor recovery progress.

- Offer Flexible Payment Options: Provide multiple payment methods for patients like online payments, credit cards, and installments to facilitate timely payments. Dental financing gives patients a flexible and affordable way to manage the cost of their treatments. By spreading payments over time, it allows them to access the care they need without the burden of paying the full amount upfront. Dental credit cards enhance this flexibility by offering a dedicated line of credit that can be used for both current and future dental procedures.

-

- Staff Training: For successful AR revenue recovery, your staff should be thoroughly trained in effective communication, negotiation, and customer service. Strong communication skills help staff clearly explain patient balances, insurance denials, and payment options in a way that builds trust rather than frustration.

Collecting from insurance companies requires specialized skills beyond basic dental billing experience. It requires knowledge about payer rules, claim submission processes, and denial management. This is also crucial to ensure that all AR processes and documentation comply with current regulations. Attention to detail is critical for verifying patient eligibility, coding accurately, and ensuring claims meet documentation requirements. Strong follow-up and persistence are essential for tracking unpaid claims, appealing denials, and negotiating with payers. In addition, analytical skills are critical to identify patterns in denials or underpayments, address root causes and prevent future revenue loss.

Fortunately, leveraging expert support for managing accounts receivable can reduce revenue loss.

Accounts Receivable Revenue Recovery—Outsource Dental RCM

AR revenue recovery is one of the most critical aspects of a practice’s financial health, and outsourcing dental revenue cycle management (RCM) can significantly improve this process. External RCM experts bring in-depth knowledge of payer requirements, denial management, and AR follow-up strategies that many in-house teams may not have the time or resources to master. They use advanced tools and analytics to track unpaid claims, identify bottlenecks, and speed up collections from both patients and insurance companies. By outsourcing, dental practices gain access to trained AR management specialists who focus exclusively on recovering outstanding revenue, reducing AR days, and minimizing write-offs.

Benefits of efficient AR strategies include:

- Improves first-pass claim resolution rates

- Reduces AR days (average time outstanding)

- Increases cash flow and collections (providers have reported a 20–30% increase)

- Enhances revenue cycle visibility

Stronger AR management allows your practice to focus on patient care while improving reimbursement rates and strengthening your overall revenue cycle.