Insurance verification is undergoing a transformative leap through automation and AI. Automated insurance eligibility verification refers to the use of advanced AI and technology to simplify and expedite the process of verification of patient benefits in the healthcare industry. It involves the integration of automated systems with electronic health record (EHR) platforms and insurance databases to access real-time insurance information. Integrating insurance eligibility verification with automation and AI accelerates the process, ensuring quick and accurate assessments. This integration minimizes manual efforts, expedites eligibility checks, and enhances overall efficiency. By using technology, insurers can reorganize operations, reduce errors, and deliver a more responsive and reliable verification experience.

By automating verification tasks, even complex systems can now swiftly pull information from disparate databases, cutting response times and eliminating human error. Technology integration is streamlining the insurance landscape, fostering accuracy, efficiency, and a smoother experience for all stakeholders.

Discover efficiency in patient eligibility verification!

Our advanced insurance verification services ensure precision and timeliness!

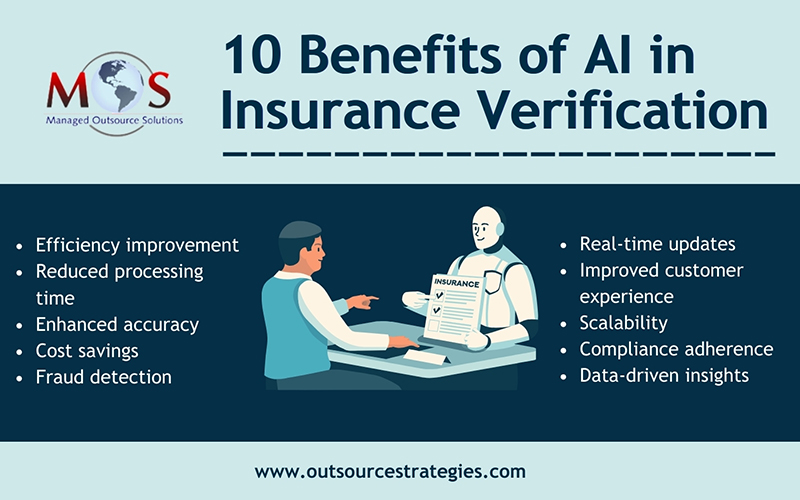

Benefits of Automation and AI Integration in Health Insurance Verification

Automating time-consuming patient eligibility verification tasks provides diverse benefits for healthcare organizations such as:

- Faster verification process: Automation and AI technologies enable the rapid extraction of relevant information from various documents, such as insurance cards and patient records. This expedites the verification process, reducing the time needed to confirm insurance coverage.

- Enhanced accuracy: AI algorithms can analyze data with a high degree of accuracy, minimizing errors in patient eligibility verification. This is crucial for ensuring that the information obtained is correct, leading to more reliable eligibility checks and reduced chances of claim denials.

- Real-time updates: Automation allows for real-time verification of insurance details. AI systems can instantly cross-check patient information with insurance databases, providing up-to-the-minute data on coverage status, copay amounts, and deductible information.

- Improved cost efficiency: By automating verification, healthcare providers can significantly reduce manual labor costs and the risk of human error. This leads to cost savings and allows staff to focus on more complex tasks that require a human touch.

- Fraud detection: AI technologies excel in identifying patterns and anomalies. In health insurance verification, AI can detect potential instances of fraud or inaccurate information, helping to prevent fraudulent claims and ensuring the integrity of the verification process.

- Seamless integration with Electronic Health Records (EHR): Automation and AI solutions can seamlessly integrate with existing EHR systems, creating a unified platform for managing patient information. This integration enhances workflow efficiency and provides a holistic view of patient data for healthcare providers.

- Personalized patient experience: Automation enables the customization of patient interactions. AI-driven chatbots or virtual assistants can provide patients with personalized information about their insurance coverage, copays, and deductible status, improving overall patient experience.

- Compliance adherence: AI systems can be programmed to ensure compliance with healthcare regulations and insurance industry standards. This reduces the risk of non-compliance issues and potential legal repercussions.

The integration of automation and AI in insurance eligibility verification accelerates the process and ensures a higher level of accuracy, cost efficiency, and compliance. As the healthcare industry continues to embrace digital transformation, these technologies are poised to play a central role in improving the overall efficiency and effectiveness of insurance-related processes.

Implementing AI for predictive analysis in insurance verification also brings forth numerous advantages. AI algorithms can analyze historical data, identify patterns, and predict potential issues or trends in the insurance eligibility verification process. This predictive capability enhances decision-making, allowing insurers to anticipate challenges and proactively address them.

Is Manual Verification Still Relevant?

Even with the advancements in AI technologies, manual processes remain relevant in verification for several reasons such as – complex cases and exceptions, data accuracy verification, adaptability to health insurance policies and regulations, patient interaction and communication, handling ambiguous cases, flexibility in verification procedures, and integration with legacy systems. Professional medical billing outsourcing companies provide the services of verification specialists who can deal with even complex insurance claims.