It is vital to integrate technology into the dynamic landscape of health care insurance to ensure efficiency, productivity and overall customer satisfaction. Remarkable transformations are occurring in the ever-evolving field with the advent of new technological tools that reduced human error in a remarkable way. Technology is making a significant impact on insurance verification, a process which is essential for healthcare providers as well as insurance companies. This process ensures that accurate information is obtained to facilitate seamless billing and claims processing.

Patient eligibility verification software and tools have emerged as pivotal components in optimizing administrative tasks, reducing errors, and enhancing the overall efficiency of healthcare operations. Insurance eligibility verification companies utilize the latest software solutions for insurance eligibility checks so that their client healthcare providers receive accurate reimbursement for the services they provide to patients.

Simplify your insurance verification services and receive optimized reimbursement!

Contact us today:

We are available at (800) 670-2809

Innovations in Technology for Insurance Verification in Healthcare

The healthcare sector is experiencing unprecedented levels of efficiency, convenience and accessibility with increasing use of the latest technological innovations. The right use of technology ensures streamlined processes, reduced costs, and enhanced customer experience. With increasing use of cloud platforms and related services, Big Data, Ai and Machine Learning are also bound to witness increasing significance. So, what are the most recent technologies that are proving to be highly beneficial for healthcare providers, insurance companies, and insurance eligibility verification agencies?

AI tools help automate insurance verification services and this helps to avoid the long waiting time required during the manual verification process. This in turn helps process more files in less time and enhance patient satisfaction. The documentation process is error-free, and systematic, automated verification processes also help reduce additional costs. Let us look at the possibilities offered by innovative technology for health insurance eligibility verification.

Software Solutions for Insurance Eligibility Checks

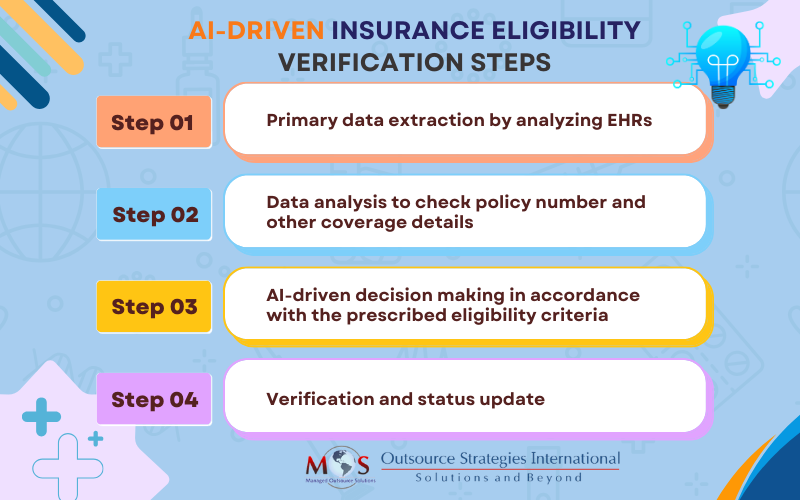

AI software tools can analyze patient records to determine whether they are eligible for insurance coverage at the point of time they make the claim. AI tools will scrutinize the intricacies of policy guidelines and conduct a thorough evaluation of the medial records.

Real-time Eligibility Verification

AI tools facilitate real-time eligibility verification of details provided in the EHR. Diagnosis, previous conditions, medical history, medical prescriptions, and so on can be accessed and verified easily. AI tools can identify whether any prescribed medical procedures require pre-authorization. This can reduce delays in the fund delivery and streamline the overall process. Providers can instantly verify a patient’s insurance coverage, deductible status, and co-payment details. This not only accelerates the billing process but also minimizes claim denials.

Want to learn more?

Click the link to explore Electronic Health Records and Insurance Verification Systems.

Integration with the Electronic Health Record

Seamless integration between verification systems and Electronic Health Records (EHRs) has become essential for comprehensive patient care. By combining insurance information with medical records, healthcare providers can ensure that services rendered are accurately reflected in the billing process.

Ensures Enhanced Accuracy

Advancements in technology for medical billing and patient eligibility verification services have resulted in the production of more accurate data. AI tools can classify and categorize documents and identify crucial billing information. Having this information in the required format improves data accountability.

Patient-friendly Options

The technological advancements implemented in the health care insurance sector have made it easy for patients to review their insurance plans. With the help of user-friendly technology, patients can easily access, review, update and monitor the status of their healthcare policies. Vital information can be communicated easily and this results in a drastic reduction of manual administrative work. Enrolling to schemes can be done virtually cutting the paper work, and required documents can be submitted online.

Blockchain

Blockchain, by eliminating the role of an authority, secures and manages valid data. Block chain facilitates secure and accessible storage for patient’s personal health information and payment details.

Blockchain eliminates the role of a “middle-man” provides a transparent and secure atmosphere for the patient. By the elimination of data transfer and analysis through multiple stakeholders, blockchain ensures timely services.

Smart Predictions

Advancements in technology for medical billing and verification has paved the way for calculated risk predictions and assessment. AI tools can analyze the provided information and observe patterns by scrutinizing similar information in its database. This analytical output is used to make risk predictions and to anticipate the trend in the industry. High-value claims are identified easily and prioritized. Advanced AI tools analyze patient files and predict patient outcomes to design premiums accordingly.

Device Compatibility

Technological integration has moved beyond the limitations of using a single device; mobile applications that can ensure a smooth delivery of insurance services are available. Services can be availed without any spatial or temporal constraints. These applications use a simple user interface to guarantee hassle-free service to the user.

Personalized Healthcare Programs

Utilizing the insights provided by AI tools after analyzing EHRs, insurers, with the help of advanced AI software can design and offer personalized healthcare programs. Customized preventive care plans can be offered to improve the overall healthcare.

Electronic Fund Transfer

EFT facilitates a smooth and fast transfer of funds into the account of health insurance providers. Fast delivery of services is ensured and delays associated with paperwork are eliminated.

Use the Right Technology for Insurance Eligibility Verification

Choosing the right technology for patient eligibility verification is vital as there are arrays of technological advancements which are occurring swiftly and often. The right technology can offer reliable solutions; some of the solutions offered through technological interactions are illustrated below.

Automated Verification Process

Advanced AI chat bots facilitate a smooth navigation through various steps of the insurance verification process. AI-driven bots swiftly scan and verify the relevant documents and channelize the process in the right pace. Intelligent document processing that uses OCR, deep learning and Machine Learning can save a remarkable amount of time and improve accuracy of the documents verified. Natural Language Processing aids in extracting important information from the documents verified, and helps to convert the extracted text into the required format. Application of NLP can create structured data from unstructured data sources. This process, by analyzing the discrepancies in medical documents, prevents fraudulent activities and false claims.

Real-time Verification during Hospital Visits

Advanced software is used to incorporate real-time verification in the verification process. Validity and eligibility of the insurance coverage can be analyzed during the time of hospital visit itself. This can prevent unauthorized claims and will ensure that only eligible patients are availing the service. Application Programming Interfaces are used by the insurers to conduct real time verification and ensure a smooth flow of data between the stakeholders.

Instant Communication and Feedback

As the bots are equipped to analyze and rectify documents efficiently, communication regarding the processes will be clear, concise and instant. The chat bots can provide instant replies to the queries and offer impeccable support throughout the process. This advanced information exchange can assure timely processing of the claim.

Along with providing instant communication and feedback, automated notifications are sent to the policyholders. Information regarding coverage changes, premium plans and policy renewals are sent to the policy holders regularly.

Data Security

By utilizing cloud storage and other means of secure storage facilities, technological integration can ensure the safety and security of data. An advanced storage facility ensures smooth access and facilitates a safe environment to share it securely with stakeholders involved.

Encryption algorithms are used while sharing sensitive information like patient case files, health records, billing details, etc. This will ensure the safety of data while transferring. To strengthen the encryption measures and ensure safe data transfer, SSL and TLS protocols can be utilized.

By utilizing advanced authentication measures, policy holders and insurers can ensure safety and security of sensitive information. AI tools use electronic signature system to authenticate information related to policies.

To ensure that an individual is getting access only to the necessary files, Role-Based Access Control (RBAS) can be implemented. RBAS will ensure that individuals are getting access to the files that are necessary for their purposes and access to other files is denied. Privacy and data security for verifying insurance details is ensured through proper implementation of RBAS.

Timely Reimbursements

AI-assisted verification avoids erratic reimbursement requests for medical services that are not covered in the insurance policy. AI tools identify the trends and patterns in claims and devise an appropriate reimbursement scheme. The insurer can allocate the resources efficiently and save more time by reducing delays.

AI-powered online tracking systems are utilized to assess the progress of claim. This can reduce the number of queries and make the insurer more accountable and transparent.

Denials of claims are scrutinized by AI tools and the automated denial management system paves the way for smooth resubmission measures. Steps required to ensure re-approval will be initiated by the AI tools.

Healthcare Regulations Compliance

With the new changes in technology, new ethical guidelines and regulations are updated frequently. Automated adherence to these guidelines ensures that the policy mandates are regularly updated. To ensure that the policy mandates are in accordance with the regulations implemented, databases containing updated guidelines are integrated with the insurance systems and regular automated analysis is conducted to check compliance. This integration is also utilized to conduct automated audits. Automated audits will verify the databases and ensure compliance with the current framework.

Along with ensuring compliance with regulatory frameworks, AI tools can generate automated compliance reports and reviews for regulatory bodies. This will reduce the amount of administrative work from the insurer’s side and ensure that only relevant data without any errors are being transferred.

Fraud Detection

AI tools equipped with deep learning and Machine Learning technology can enable the software to update itself by learning new patterns and can devise new security measures against evolving fraudulent activities. AI tools can verify databases that record previous fraudulent activities and insurers will be provided details regarding repetitive offenders and common suspicious activities. Protective measures can be taken in advance and this will ensure overall data security.

By integrating biometrics in data collection, fraudulent activities by means of identity fraud can be prevented. By integrating geospatial analysis, claims made from locations where the patient is not present can be identified and fraudulent activities prevented.

Fraudulent or unfair activities conducted by the hospitals can also be detected with the help of advanced software. AI tools are equipped to read financial documents and can categorize the contents efficiently. Patterns that reflect possibilities of unbundling, upcoding and excessive billing will be traced by the AI tools and this will prevent unfair billing practices.

Want to learn more about our insurance

verification services?

Call (800)670-2809 to speak to one of our Solutions Managers.

Integrating Technology for Insurance Verification with the Best Benefits

Patient eligibility verification services now make use of artificial intelligence to enhance the service experience. Integration with artificial intelligence tools has resulted in a remarkable reduction of human errors, reduced paperwork, accentuated overall claim services, and optimized the overall functioning of health care services.

With optimized flow of information, catalyzed by technological integration, there is smooth and transparent connectivity between healthcare providers and insurance companies. Accuracy of data, timely services, and eligibility assessment have gained new dimensions in insurance verification services.

The scope of technological integration is not limited to the realm of service delivery; it has also revolutionized the grievance redressal mechanisms that are vital to health care insurance services. Concerns related to claim denials, unbundling, upcoding and excessive billing are properly handled by AI-powered chat bots.