For any healthcare specialty, including Chiropractic, accurate medical billing plays a key role in getting paid on time. Following standard chiropractic billing practices is crucial for practices to maintain financial stability and sustain the quality of care offered to patients. The billing process for chiropractors includes verifying patient insurance coverage, submitting claims, resolving billing discrepancies, and ensuring compliance with healthcare regulations. Even a minor error in any step of the process can lead to rejected claims and delayed payment, impacting your practice’s cash flow.

Chiropractic billing comes with a unique set of challenges including the specialized nature of chiropractic care and the complexities of healthcare reimbursement. Other key challenges practices face include accurately documenting and coding a wide range of chiropractic procedures, and navigating insurance complexities. Most chiropractic practices rely on medical billing outsourcing services to assist in this time-consuming and crucial process. According to a report from Mordor Intelligence, the global billing outsourcing market size is estimated at $15.41 billion in 2024, and is expected to reach $26.4 billion by 2029, growing at a CAGR of 11.36% during the forecast period (2024-2029). According to this report, the market is driven by key factors such as the growing emphasis on compliance and risk management by regulators, the increasing need to make the billing process efficient, and efforts to reduce in-house processing costs.

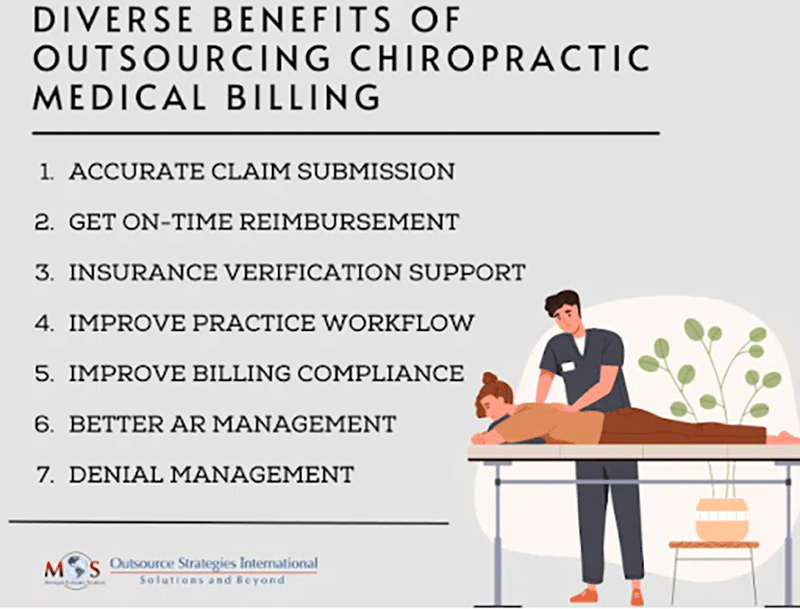

Advantages of Outsourcing Chiropractic Medical Billing

Outsourcing billing and coding tasks to an experienced company provides numerous benefits such as:

- Access to skilled billing staff: By outsourcing billing, chiropractic practices can benefit from the expertise and experience of specialized billing professionals who understand the intricacies of chiropractic billing codes, regulations, and compliance requirements. Their expertise helps minimize errors and maximize reimbursement.

- Clean claim submission: Submitting error-free claims benefits both chiropractic practices and their patients. Billing specialists and coders stay up to date with the current codes, billing guidelines and the industry protocols. They can avoid claim submission errors, which will help optimize collections and increase cash flow.

- Get on-time reimbursement: By filing accurate claims on time, practices can avoid payment delays and get reimbursed correctly. Billing specialists have in-depth knowledge regarding how claim submission and reimbursement systems function as well as the billing requirements of insurance companies, which is crucial for error-free, timely claim submission.

- Cost savings: By outsourcing, chiropractic practices can reduce overhead costs associated with maintaining an in-house billing department. Outsourcing eliminates the need to hire and train billing staff, invest in billing software, and manage ongoing administrative tasks, resulting in significant cost savings.

- Professional insurance verification support: Verifying patients’ chiropractic insurance eligibility and benefits is a key step to ensure that the patient is covered for the specific chiropractic treatment they need. Getting the patient’s insurance eligibility verification done by your front office staff can be extremely time consuming. A professional billing company will verify all key details including co-pays, co-insurances, payable benefits etc.

- Focus on care and improve practice workflow: By outsourcing complex tasks, providers can focus on patient care instead of spending time following up with the claims and payments. With an experienced team available to handle such administrative tasks, you don’t have to train your staff on changes in healthcare reforms or billing processes and software.

- Improved billing compliance: By outsourcing billing and coding, practitioners can enjoy peace of mind. Experts are well aware and up to date with the latest amendments to regulations and can identify non-compliant activities and prevent them from affecting filings.

- Better AR management: With timely follow-up and appeals, experienced companies will help accelerate practice cash flow and minimize accounts receivable (AR) days. AR management services mainly cover coding/charge capture, payer/insurance follow-up, self-pay follow-up, collections management, receivables analysis, and denial management, ongoing monitoring and reporting of receivables risk exposure, etc. Regular follow-ups with payers will speed up claim processing as well.

- Denial management: Just like submitting new claims, it is also important to re-submit and manage denied claims. Claim denials happen mainly due to administrative errors, poor insurance verification, wrong codes assigned on claims, or even due to delay in medical bills. Billing companies will regularly check claim status to ensure that all submitted claims are getting paid and denied claims are sorted out for further processing. When a claim is denied, they will identify the real reason for the denial, and initiate the claims appeal process which provides an opportunity for providers to get back lost revenue.

Partner with a Reliable Chiropractic Billing Company

Being experts in the chiropractic billing sector, OSI recognizes the importance of finding a billing partner that aligns with the unique requirements of chiropractic practices. With reliable chiropractic billing services, chiropractic physicians can take full advantage of the latest ICD-10 codes and enhancements and smoothly transition to the value-based payment environment and increase reimbursement. These billing specialists are also experts in Medicare documentation requirements and will evaluate chiropractic documentation to minimize compliance risks and avoid audits and costly paybacks. The right chiropractic billing company can streamline the billing process, ensuring accurate claims submission and timely reimbursements.

Take the stress out of billing.

Choose our reliable chiropractic medical billing outsourcing services!