When patients walk into a dental office expecting timely care, it can be disheartening for them to learn that their insurance doesn’t cover the treatment they need. Coverage gaps are a common cause of treatment delays in dental practices.

According to the American Dental Association, about one-third of adults age 19 to 64 do not have dental benefits, in sharp contrast to the 8.4 percent of Americans without health insurance. These figures underscore a persistent and troubling disparity in access to dental coverage. The ADA actively advocates for addressing these gaps, recognizing that millions of Americans still lack access to essential oral healthcare. The ADA highlights that coverage gaps disproportionately impact low-income individuals, seniors, and those living in rural areas.

From unmet waiting periods to misunderstandings about plan exclusions, dental insurance limitations not only frustrate patients but also create scheduling challenges, denied dental claims, and revenue loss for practices. This makes thorough dental insurance verification a crucial step before providing treatment.

In this post, we’ll discuss the most frequent coverage gaps that lead to delays in treatment—and how proactive dental insurance checks and communication can help practices manage them.

How Coverage Gaps in Insurance delay Dental Care

Government programs like Medicare and Medicaid often have limited or no dental coverage. Private insurance plans may also have gaps in coverage, particularly for certain procedures or for individuals with pre-existing conditions. Here are some common insurance issues that delay dental treatment:

- Caps on Coverage

The limited scope of dental insurance in the U.S. is a significant concern. As highlighted in an article on docseducation.com, annual coverage caps—typically ranging from $1,000 to $2,000—pose a major limitation. Despite the rising cost of dental care, these caps have remained largely unchanged since the 1970s. Consequently, patients needing extensive treatment often exceed their coverage limits quickly and are left to pay substantial out-of-pocket costs. Integrating dental care into standard healthcare plans coverage would help ensure that oral health is treated with the same priority as medical care. This could lead to more comprehensive benefits, reduce out-of-pocket expenses for patients, and promote better long-term health outcomes.

- Waiting Periods for Major Services

Dental insurance is often seen as supplemental coverage, so some people only sign up when they need major dental work. To prevent people from enrolling just to get expensive procedures covered and then canceling their plan, insurance companies set a waiting period. This also encourages patients to get regular preventive care before needing major treatments.

For many dental insurance plans, the waiting period typically ranging from 6 to 12 months, before covering major procedures like crowns, bridges, or root canals. Patients often assume they’re fully covered once their insurance kicks in, only to be surprised when they arrive for care. This misunderstanding results in postponed treatment while patients consider out-of-pocket options or wait for eligibility.

- Frequency Limitations

Insurance plans may limit how often certain procedures—like cleanings, X-rays, or fluoride treatments—can be performed. For instance, a plan may only cover two periodic oral evaluations and two cleanings per year, or bitewing X-rays once every 12 months. Frequency limitations vary among dental plans based on the type of procedure, plan level, and insurer policies. If the patient has already used their benefits elsewhere or earlier in the year, additional services may be denied.

- Annual Maximums

Dental insurance often comes with an annual dollar limit. An annual maximum is the total amount a dental insurance plan will pay for covered services within a benefit period—typically 12 months—and generally ranges from $1,000 to $2,000. Some plans may offer a higher maximum. Common dental procedures that apply toward this annual limit include cavity fillings, root canals, crowns, extractions, and various oral surgeries. Once this cap is reached, the patient is responsible for the full cost of any remaining care. If not identified early, this can lead to unexpected out-of-pocket expenses and delayed care.

- Missing Tooth Clauses

Many plans include a “missing tooth clause that allows the insurer to deny coverage for tooth replacement procedures—such as bridges, dentures, or implants—if the tooth was lost, extracted, or removed before the patient’s coverage began. This clause may also apply to a congenitally missing tooth. In this situation, the patient has to pay entirely out of pocket for the tooth replacement. Patients may be unprepared for the full cost.

- Non-Covered or Elective Procedures

Elective dental procedures are non-urgent, cosmetic or restorative treatments chosen by the patient for improved aesthetics or function, not to address an immediate or serious dental problem. These procedures enhance a patient’s smile, fix minor cosmetic flaws, or improve bite alignment without being immediately necessary for overall oral health. These procedures are not covered at all. In some cases, newer or alternative treatments may not be included in a patient’s plan.

- Coordination of Benefits (COB) Issues

Coordination of Benefits (COB) issues in dental arise when a patient has multiple dental insurance coverage (e.g., through a spouse or a secondary policy). This process ensures accurate reimbursement and prevents overpayment, as one plan pays the primary portion and the other pays the remaining eligible amount.

Understanding and applying COB rules can be complex, especially for dental offices. Confusion over which plan is primary can delay claims and reimbursement. Improper COB handling often results in claim denials or long processing times. Effective handling of COB prevents overpayments and ensures patients receive the appropriate coverage.

- Out-of-Network Limitations

Some insurance plans offer lower reimbursement or no coverage at all for out-of-network providers. Patients might be unaware that their chosen dentist is not in-network, leading to coverage denials or higher bills than expected.

Proper Insurance Verification and Clear Communication Are Key

Coverage gaps delay dental treatments, disrupt schedules, damage trust, and impact revenue. The good news is that most of these issues can be identified and managed through proactive dental insurance checks before treatment and transparent communication with patients.

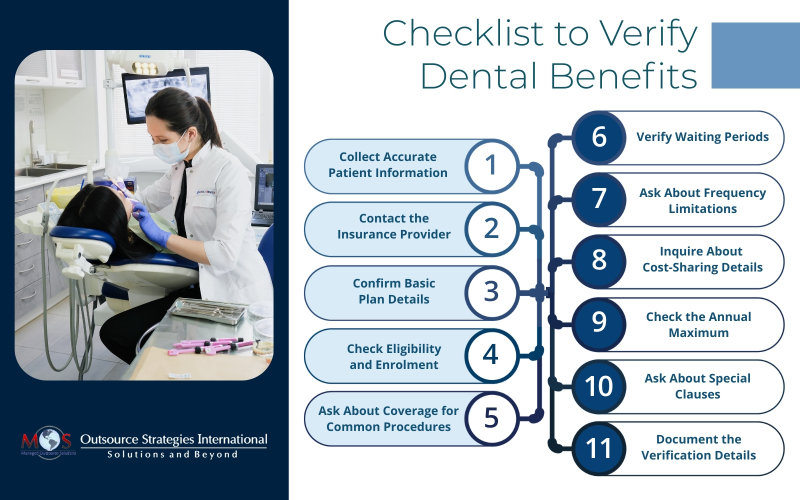

Every practice should implement a checklist to verify dental insurance benefits:

- Collect Accurate Patient Information

- Full name, date of birth

- Insurance provider name

- Member ID or Social Security number

- Employer name (if applicable)

- Group number

- Contact the Insurance Provider

- Call the provider’s customer service number (often found on the insurance card)

- Use the insurance portal (if available) for real-time verification

- Confirm Basic Plan Details

- Coverage type (PPO, HMO, indemnity)

- Effective date of coverage

- Plan year (calendar vs. rolling 12 months)

- In-network vs. out-of-network coverage

- Check Eligibility and Enrolment

- Confirm the patient is currently enrolled and active

- Verify any dependents’ eligibility if applicable

- Ask About Coverage for Common Procedures

- Preventive (exams, cleanings, X-rays)

- Basic (fillings, extractions)

- Major (crowns, bridges, dentures)

- Orthodontics (age limits, lifetime maximums)

- Verify Waiting Periods

- Is there a waiting period for basic or major services?

- How long before coverage kicks in for specific procedures?

- Ask About Frequency Limitations

- Cleanings: How often are they covered?

- X-rays: What’s the interval between covered services?

- Major procedures: How often are replacements covered?

- Inquire About Cost-Sharing Details

- Deductible: Has it been met?

- Coinsurance: What percentage does the plan pay vs. the patient?

- Copays: Are there fixed copays for specific services?

- Check the Annual Maximum

- What is the maximum benefit amount per year?

- How much has already been used (if mid-year)?

- Ask About Special Clauses

- Missing tooth clause

- Replacement clauses (e.g., crowns or dentures)

- Downgrades (e.g., composite fillings covered only at amalgam rate)

- Document the Verification Details

- Date, time, and name of the representative

- Summary of information received

- Save call reference numbers or screenshots from the portal

Given its complexity, it’s best to have experts handle the dental insurance eligibility verification process. By outsourcing insurance verification to trained specialists, dental practices can stay ahead of coverage pitfalls, reduce delays, and provide a smoother, more reliable experience for their patients.

Avoid unexpected billing issues with comprehensive dental insurance checks!