A well-managed claim lifecycle is critical for the financial health of a dental practice. Handling the dental claim process effectively ensures timely reimbursements, fewer denials, and a smoother experience for both patients and providers. The complete lifecycle of a dental claim involves several key stages, from the patient visit to final payment or denial. These stages include dental eligibility verification and pre-authorization, claim submission, adjudication, payment posting, denial management and appeals, and patient billing and collections. Practices are increasingly relying on outsourced dental billing services for efficient revenue cycle management (RCM).

This post walks you through the complete dental claim lifecycle, including best practices to help optimize every step.

Struggling with claim denials or slow payments?

Our dental RCM experts can streamline your billing process.

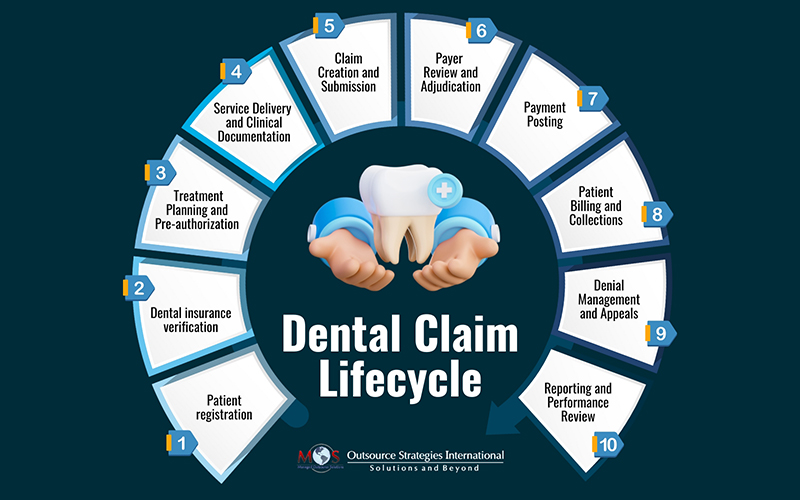

Essential Stages in the Dental Claim Lifecycle

The lifecycle of a dental claim or dental billing process begins from the moment treatment is rendered to a patient and continues until the final payment is made and reconciled.

Here’s an overview of the step-by-step process of dental claim submission:

- Pre-treatment Processes

- Patient registration: The dental office collects up-to-date patient information, including name, date of birth, insurance details, and medical history. Collecting these details ensures proper patient care and accurate and efficient billing processes, reducing discrepancies and potential revenue loss.

- Dental insurance verification: Before any treatment is provided, the dental office confirms the patient’s insurance eligibility and checks benefit coverage, policy exclusions, frequency limitations, and waiting periods. Failing to verify coverage beforehand can lead to claim denials or unexpected out-of-pocket costs for the patient.

- Treatment Planning and Pre-authorization

Once coverage is confirmed, the provider develops a treatment plan. Pre-authorizations or pre-treatment estimates are usually required for complex or expensive procedures like crowns, implants, or orthodontics. The dentist submits a prior authorization request to the insurance company to confirm coverage before treatment begins. This provides a clearer idea of what’s covered and what the patient has to pay, promoting transparency and trust.

- Service Delivery and Clinical Documentation

The patient receives the necessary dental care. The dentist creates thorough records of the services provided. This includes:

- Recording clinical notes, diagnoses, and treatment details

- Using the correct CDT codes for procedures

- Supporting materials such as X-rays, images, or periodontal charting

Submitting proper documentation is essential for the payer to approve claims, especially for services that require justification of medical necessity.

- Claim Creation and Submission

After services are rendered and recorded, the dental claim is created.

- Claim generation: The claim form is created, either electronically or on paper using the ADA Dental Claim Form, including all necessary patient, provider, and procedure information.

- Claim scrubbing: The claim is reviewed for accuracy and completeness to avoid rejections. A clean claim includes correct patient and provider details, accurate CDT codes and fees, and necessary attachments and narratives.

- Claim submission: The claim is submitted to the patient’s dental insurance company.

Submitting claims electronically helps minimize processing time and errors. Mailed claims should be clearly organized and easy to read.

- Payer Review and Adjudication

-

- Claim review: After the insurance company receives the claim, they perform a review to check for basic errors or missing information. The focus is on ensuring that:

- The procedure is covered by the patient’s plan

- The assigned codes and documentation support the services billed

- The claim meets payer requirements and coding guidelines

- Claim review: After the insurance company receives the claim, they perform a review to check for basic errors or missing information. The focus is on ensuring that:

Insurance companies utilize automated systems to verify coverage, policy limitations, and consistency between the diagnosis and the treatment provided. If the automated review finds any issues, a claims adjuster or medical professional manually reviews the claim. The dental office may be asked for additional documentation or clarification if needed.

-

- Payment determination: Based on the review, the payer either approves, partially approves, denies, or requests more information.

- Paid: The claim is approved and the insurance company will reimburse the dental practice or patient.

- Reduced: The claim is partially paid, typically due to limitations or adjustments to the fees.

- Denied: Incorrect coding, lack of supporting documentation, or the service not being covered under the patient’s plan are the common reasons for dental claim denial.

- Payment determination: Based on the review, the payer either approves, partially approves, denies, or requests more information.

An EOB (Explanation of Benefits) or ERA (Electronic Remittance Advice) is issued to the dental practice, detailing how the claim was processed, including the amount paid, what the patient owes, and any reasons for denial or reduction.

- Payment Posting

The dental office receives and records the payment from the insurance company, updating the patient’s account balance accordingly. This step includes:

- Applying insurance payments

- Noting any write-offs, adjustments, or underpayments

- Identifying unpaid line items for follow-up

Timely and accurate payment posting helps maintain clean accounts receivable (A/R) and prepares the practice for billing the patient.

- Patient Billing and Collections

The dental office bills the patient for any remaining balance or their portion of the cost after the insurance payment. If a patient’s balance is not paid, the dental office initiates collection procedures to recover the outstanding amount. This step involves:

- Sending clear, itemized statements

- Offering multiple payment options

- Following up consistently but politely

Offering payment plans or third-party financing has been shown to improve collections and patient satisfaction.

- Denial Management and Appeals

Knowing how to handle dental claim appeals and denials is crucial for RCM success. If a claim is denied, the dental office needs to analyze the reason, correct any errors, gather any missing documentation and resubmit it. The practice should appeal the denial with the insurance company or resubmit the corrected claim within the payer’s timeline. Proactive denial management is crucial to build a positive revenue cycle and reduce long-term financial loss.

- Reporting and Performance Review

The final step is monitoring and evaluating the claim process. Practices should regularly review metrics such as:

- First-pass resolution rate

- Denial rates

- Average time to payment

- A/R aging

Analyzing this data helps identify workflow bottlenecks, improve claim accuracy, and ensure your revenue cycle remains healthy.

By understanding the complete dental claim lifecycle, dental practices can streamline their processes, minimize errors and denials, and improve their financial health and the patient experience. This is where outsourcing proves useful.

Ensuring Efficient Dental Claim Processing Through Outsourced RCM

Outsourcing dental revenue cycle management can significantly enhance the dental claim processing workflow, resulting in faster reimbursements and improved cash flow. Experienced RCM providers have an in-depth knowledge of payer requirements, coding standards, and submission protocols, reducing errors and claim denials. By streamlining tasks such as claim creation, submission, follow-up, and payment posting, outsourcing to experts ensures that each step in the dental revenue cycle is handled efficiently. Dedicated teams also promptly handle dental claim appeals and denials, helping practices recover revenue more quickly. This speeds up reimbursement timelines, allows dental professionals and their staff to focus more on patient care and less on administrative burdens.

Partner with us for faster dental reimbursements and improved cash flow