Managing accounts receivable (A/R) in medical billing involves tracking and collecting payments from both insurers and patients for services provided. Effective A/R management is vital for cash flow and financial health. By implementing a consistent and comprehensive accounts receivable tracking strategy, medical practices can reduce days in A/R, minimize denials, optimize revenue, and enhance their overall profitability. However, AR management is one of the most complex and challenging aspects of healthcare revenue cycle management (RCM). Instead of treating A/R as an ad-hoc task, practices need to have a strong weekly A/R management routine to ensure steady cash flow.

Recent surveys highlighted in a Fierce Healthcare report reveal that claim delays and denials are severely disrupting providers’ revenue cycle performance, leading to volatile AR and shrinking cash reserves for health systems. A robust weekly routine ensures that denied claims, pending payments, and patient balances are reviewed promptly—before they become harder to collect.

Partner with our RCM experts to streamline A/R management and boost your practice’s revenue cycle performance.

In this post, we’ll discuss how you can create a weekly A/R management routine for your medical practice.

Why a Weekly A/R Routine Matters

Here are the reasons why managing AR on a weekly basis is important:

- Prevents revenue leakage and long-overdue claims: When A/R follow-up is only handled on an ad-hoc basis (e.g., when time permits), small delays can mount up, leading to big losses. Weekly AR follow-up ensures pending payments are reviewed before they age into harder-to-collect categories — 90+ or 120+ days.

- Improves cash flow stability: Medical practices rely on steady cash flow to cover payroll, rent, supplies, and physician compensation. Weekly A/R reviews keep payer and patient collections on track, allowing practices to predict cash inflows.

- Keeps denials, rejections, and follow-ups under control: Denials are easier to fix when caught early—within days rather than months. Weekly accounts receivable tracking supports faster denial resolution. It helps spot denial trends such as coding mistakes, missing modifiers, and prior authorization issues quickly. Practices can fix the issues and resubmit claims before become they become uncollectible.

- Provides actionable insights: Weekly tracking of claim submission and follow-up provides visibility into financial performance by providing a constant picture of key metrics like average days in A/R, percentage of A/R >90 days, and collection rates. By identifying trends such as payer payment slowdowns and patient balance growth early, practices can make timely adjustments.

- Reduces administrative stress and fosters better staff accountability: Without routine, tasks may get delayed, causing administrative stress. When tasks are handled regularly, it improves workflow. Moreover, a structured routine assigns clear responsibility: who is checking claims, who is following up with insurers, who is contacting patients.

- Enhances patient satisfaction and trust: Weekly routines support more professional, timely engagement with patients about what they owe. Proper communication with patients about balances and billing issues helps avoid surprise collections or aggressive follow-up later.

By building a weekly A/R management routine, practices can ensure a proactive collections process that improves cash flow, reduces denials, and strengthens patient relationships.

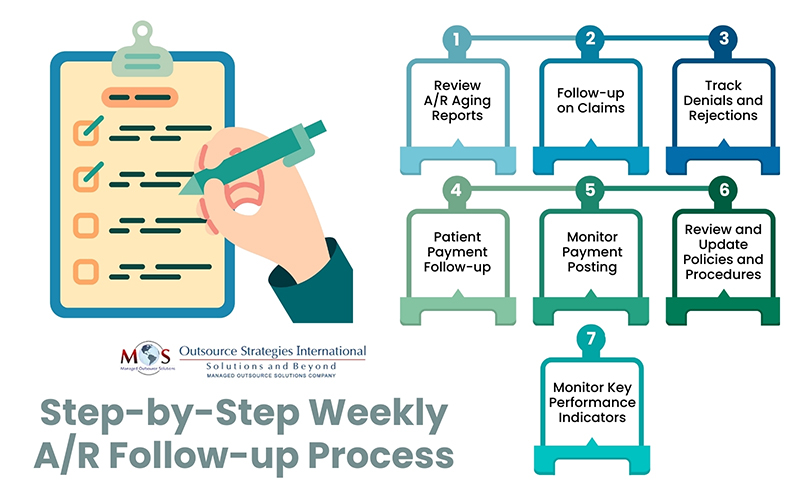

Step-by-Step Weekly A/R Follow-up Process

Here are the key elements to include in a weekly AR management routine:

-

- Review A/R Aging Reports

The first step is to identify claims that are past due and need immediate attention. Then create and analyze A/R aging reports, typically broken down into 30-day increments (e.g., 0-30, 31-60, 61-90, 90+ days). Identify claims based on age, prioritizing oldest claims and larger balances. Categorize claims by payer and patient to streamline follow-up efforts.

-

- Follow-up on Claims

This step involves contacting payers and patients regarding outstanding claims, utilizing phone calls, emails, or online portals. Weekly follow up on claims is crucial to ensure timely payment of claims and address any issues that may be causing delays. The focus should be on verifying claim status, understanding reasons for non-payment, and addressing any errors or missing information. Focus on high-value, older outstanding claims and those approaching critical deadlines. All communication and follow-up actions taken should be carefully documented.

-

- Track Denials and Rejections

Managing denials promptly and accurately is essential to minimizing revenue loss and improve future claim submissions. The process involves reviewing weekly denial reports to identify and document common denial reasons (for e.g., coding and eligibility issues) and trends, take corrective action, and submit appeals when appropriate.

-

- Patient Payment Follow-up

Reach out to those with outstanding balances, offering clear and accurate billing information. To collect patient balances and address outstanding payments, generate statements, send reminders for unpaid balances, make phone calls or initiate soft collections as needed. Identify and focus on accounts with a high risk of becoming uncollectible and implement strategies to recover those funds. Communicate clearly with patients about their financial responsibility and offer flexible payment options. Document all patient communication and payment arrangements.

-

- Monitor Payment Posting

Reviewing payment posting every week is essential to maintaining clean and accurate financial records. Posted payments should be reconciled against Explanation of Benefits (EOBs) and Electronic Remittance Advice (ERA) files to confirm that payers have reimbursed claims correctly. This process also ensures that contractual adjustments are followed correctly and that write-offs are appropriate, preventing revenue leakage. In addition to supporting accurate reporting, careful monitoring also helps practices quickly spot underpayments, posting errors, or payer discrepancies that could negatively impact cash flow.

-

- Review and Update Policies and Procedures

Regularly reviewing and updating A/R policies and procedures is essential to ensure that processes are efficient and compliant. Staff should be properly trained on reviewing A/R procedures based on industry best practices and changes in regulations.

-

- Monitor Key Performance Indicators (KPIs)

Weekly tracking the effectiveness of the A/R management process is crucial to Identify areas for improvement. Monitor KPIs such as A/R days, denial rates, and collection rates, and use the information to adjust A/R management strategies as needed.

By implementing this weekly A/R management routine, medical practices can effectively manage their outstanding receivables, improve cash flow, and ensure financial stability.

Reduce Aging AR with Proactive Revenue Cycle Management Support

Reducing aging A/R with consistent weekly follow-up is much easier when you have the right support. In today’s environment, that support has never been more critical. According to a Guidehouse analysis of an HFMA 2024 survey, hospital and health system leaders cited payer challenges and staffing shortages as top sources of financial stress.

Denials remain one of the biggest hurdles:

- 41% reported claim denial rates above 3.1%

- Nearly 50% reported a net collection yield of 93% or less

- Almost 30% reported final denial rates of 3.1–5%

- More than 10% faced denial rates above 5%, while less than one-third managed to stay at 0–2%

These numbers highlight a pressing issue: high denial rates are often the result of internal process breakdowns, documentation gaps, and payer delay tactics. Yet the effort required to research, appeal, and manage denials has quickly become unsustainable for practices already hit by staffing shortages. Leading organizations recognize that the optimal final denial rate should be 1% or less—but achieving that benchmark requires both expertise and capacity.

This is why outsourcing medical billing has become the top strategy to bridge resource gaps. In fact, 71% of healthcare leaders report satisfaction with their vendor partners. By partnering with specialized billing teams, your practice can establish a proactive weekly A/R management routine designed to monitor claims, reconcile payments, and resolve denials quickly. The result is faster reimbursement, healthier cash flow, and sustainable financial stability – giving physicians and healthcare providers the freedom to focus on growth, resilience, and patient care instead of chasing payments.

Outsource your medical billing today and ensure faster reimbursements with fewer denials.