In dental practices, insurance verification sets the stage for efficient revenue cycle management. According to a Dentistry IQ article, dental insurance checks make up approximately 50% of practice income. However, verifying dental insurance is a labor-intensive and time-consuming task, and when not handled efficiently, can lead to delayed or denied payments. Outsourcing dental insurance verification is an ideal way to improve accuracy and compliance in insurance eligibility checks and claims submissions. A reliable dental insurance verification company will clarify patient coverage and benefits before dental services are provided, enhancing transparency and the patient experience.

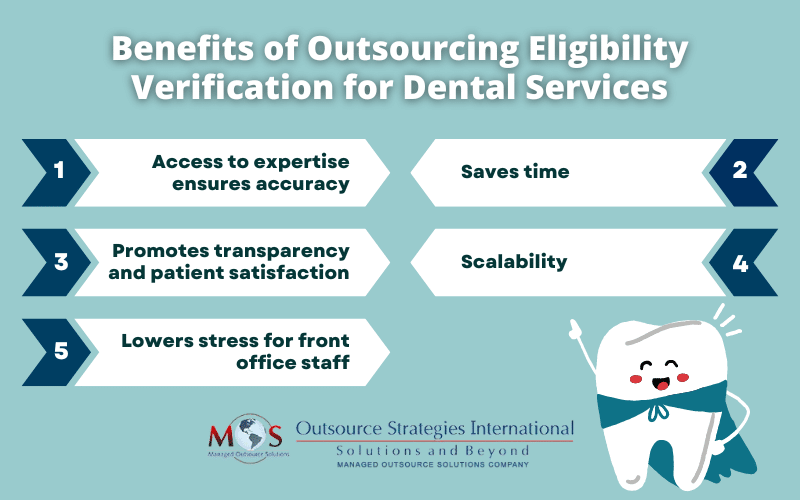

Five Benefits of Outsourcing Patient Eligibility Verification for Dental Services

Let’s take a look at five benefits of outsourcing patient eligibility verification for dental services:

- Access to expertise ensures accuracy: Accuracy is paramount when it comes to insurance eligibility verification. Getting an accurate breakdown of benefits including effective date, plan maximum, co-pay, coverage period, deductibles, in-network and out-of-network benefits, and other information such as maximum limitations, Insurance providers update their plans frequently and not checking the details can lead to mistakes in claim submission and consequently, denials. A large number of claims have been found to be denied for data related errors. Outsourcing companies have a dedicated and knowledgeable team on the job, which ensures that claims go out accurately and practices get paid in a timely manner, which will reduce the length of the medical billing cycle.

- Saves time: Navigating the complexities of dental insurance can take time. Dental insurance plans vary widely in terms of coverage terms, exclusions, deductibles, and authorization requirements. Since dental insurance policies and coverage details often change on an annual basis, constant tracking is necessary to keep up with these updates. Coverage and benefits must be verified not just at the initial patient visit, but also before every procedure to ensure changes have not occurred. Your staff also has to spend additional time clarifying the data provided by patients.Outsourcing eligibility verification reduces the administrative overhead and staff time spent on insurance-related tasks. It frees them up focus on core clinical and patient care activities.

- Promotes transparency and patient satisfaction: The insurance industry has evolved to place greater financial responsibility on patients. Patients want to know the cost of the services being provided before they are billed for them. Both the dentist and the patient should know how the plan will cover a planned procedure. Coverages may differ such as 100%, 80%, or 50% depending on the type of procedure being done. There may be limitations on the number of times a dental insurance plan will pay for a certain treatment. For instance, the plan might cover only two cleanings a year. If the patient has completed these two cleanings and comes in for another, you must inform the patient that their insurance plan will not cover it. If insurance verification is not done correctly, patients might end up with surprise credits or balances.Outsourcing insurance eligibility verification ensures the process is handled correctly. Experts will provide you with the correct information on plan benefits in a timely manner so that you can discuss the coverage details with the patients. This promotes healthcare cost transparency, prevents surprise billing, and improves patient satisfaction.

- Scalability: Outsourcing has a definite advantage when it comes to business scalability. An experienced dental insurance verification service provider will be well-positioned to scale to meet your growing patient volume by hiring additional staff, without any additional costs for your practice. With in-house insurance verification, you would have to hire more staff to handle high volume work, which will increase the amount you spend on salaries and benefits.

- Lowered stress for front office staff: When you outsource time-consuming insurance-related work to an external provider, it frees up front office staff from tedious processes of checking patient insurance details, entering the data if the medical record, claim submissions, and follow-ups. By easing a major source of daily stress and frustration, it makes your staff more relaxed and happier.

Specialized outsourcing companies have the expertise, technology, and dedicated resources to handle dental eligibility verification with speed and precision. Live calls are their forte. In addition to using web portals, their specialists call up the insurance companies. This ensures detailed, up-to-date information about a patient’s current insurance status, coverage details, and any limitations or preapproval requirements. This is also crucial to confirm coverage for complex procedures. With a capable service provider, your practice will be assured of accurate information at the start of the claims process, resulting in fewer claim denials due to eligibility issues, positively impacting your revenue cycle.

Save time and prioritize patient care with our expert dental insurance verification services!