Outstanding patient balances are an unavoidable reality in dental care. Dental care was a source of healthcare debt for 36% of adults, according to the Commonwealth Fund’s Biennial Health Insurance Survey (Becker’s Dental, 2024). Dental care was a source of healthcare debt for 36% of adults, noted the report.

One of the biggest drivers of outstanding patient balances is delayed insurance claim processing. When insurers take weeks or months to process claims, the patient’s financial responsibility remains uncertain. This delay prevents timely billing and patients are often left with larger-than-expected balances long after treatment. A dental billing company can play a key role in helping practices manage dental outstanding balances by streamlining follow-ups, offering payment solutions, and reducing collection delays.

Why Timely Follow-Up on Dental Balances Matters

Managing the collection process in dentistry is a delicate but essential part of running a successful practice. Dental practices need consistent cash flow to cover operational expenses such as staff salaries, equipment, and more.

If unpaid dental patient balances build up, it increases the risk of nonpayment and impacts the revenue cycle. Reports show that dentists lose nearly 9% of their revenue to uncollected patient bills. Outstanding accounts receivable not only strain cash flow but also affect your ability to retain staff, invest in growth, and attract new patients.

Timely follow-up is essential. Following up too early may irritate patients, while waiting too long can increase the risk of nonpayment and affect your cash flow. So, for dental offices, the challenge lies in knowing when and how to follow up on patient balances without damaging relationships or disrupting trust.

Follow-up on unpaid dental bills at the right intervals ensures:

- Clear communication with patients about their financial responsibility

- Reduced overdue dental accounts that could otherwise escalate to collections

- Better accounts receivable (AR) management

By developing a structured follow-up schedule, your practice can maintain healthy cash flow while keeping patient satisfaction intact.

How Often Should Dentists Send Patient Balance Reminders?

Developing a structured follow-up schedule helps prevent small balances from turning into uncollectible bad debt. This process should begin as soon as insurance has paid its portion and the patient’s out-of-pocket responsibility is clear.

Here’s a suggested timeline for following up on outstanding dental payments:

- Initial statement (immediately after insurance payment): Send the patient their first statement as soon as the insurance company has sent an Explanation of Benefits (EOB). This makes them more likely to pay.

- Within 7–14 days after claim submission: Once claims are submitted, send patients an informational reminder that outlines the expected insurance portion and their estimated responsibility. This is a courtesy notice that prepares them for upcoming bills.

- At 30 days: If the balance remains, send friendly reminder statements. Keep the tone patient-focused and supportive, emphasizing your willingness to answer questions or assist with payment arrangements. Many practices find that sending polite patient billing reminders at this stage resolves most unpaid balances.

- At 60 days: If payment hasn’t been received, send a second reminder with a firmer tone. This notice should clearly state the outstanding balance and offer payment plan options to make it easier for patients to comply. This step shows patients you are serious while still being accommodating.

- At 90 days: Send a final notice indicating the risk of late fees or referral to collections. Send a final notice that outlines possible late fees or referral to collections. The tone conveying patient financial responsibility should remain professional and compassionate, ensuring patients understand the urgency at this stage.

- Beyond 90 days: If the account remains unpaid, consider outsourcing to a collections agency or involving your billing partner to recover the balance. Make sure patients are informed in advance that this is part of your policy.

Before patients leave, practices should:

- Provide a cost estimate and inform them of their expected insurance coverage

- Provide a clear statement of any portion not covered by insurance

- Encourage same-day payments for co-pays

- Offer flexible payment options

Best Practices for Insurance Claims Follow-up and Unpaid Accounts

A healthy dental practice generally maintains these benchmarks:

- Total AR: Not more than one month of average net production.

- AR over 60 days: No more than 10% of the total AR.

- AR over 90 days: Less than 3–5% of the total AR.

Timely follow-up with insurance companies is crucial for a healthy AR. Most offices use an insurance aging report to manage this process. Here are some best practices for claims submission and follow-up:

- Daily claim submission: Submit all claims within 24–48 hours of a completed procedure to get the reimbursement process started immediately.

- Weekly aging report review (claims >30 days): Claims that remain unpaid after 30 days should be the first priority for follow-up. For each outstanding claim, contact the insurance company to find out why it has not been paid. Maintain records of all communications in your practice management software.

- Appeal or resubmit: Once the reason for delay or denial is identified, promptly resubmit the claim with the corrected information or file an appeal with supporting documents.

Dental billing best practices for unpaid accounts:- Provide estimates: Provide treatment cost estimates upfront to minimize surprises.

- Automate reminders: Use dental practice management software to schedule balance notifications.

- Ensure a compassionate approach: Patient billing discussions can be sensitive—clear, empathetic communication builds trust.

- Offer payment options: Patients are more likely to pay when flexible payment plans are available.

- Maintain records: Keep records of all reminders, notices, and conversations for clarity.

- Automate reminders: Schedule statements and reminders at consistent intervals using your practice management software.

Knowing when to follow up on dental outstanding balances is as important as the care you provide. By developing a structured timeline, your practice can maintain healthy cash flow, reduce overdue accounts, and preserve strong patient relationships.

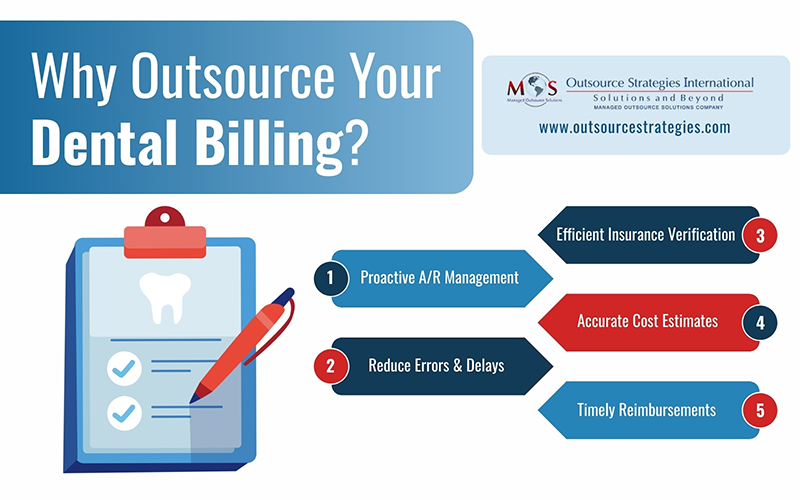

Outsourcing dental billing services is an effective way to address these balances with proactive handling of A/R, including claim submission, denial management, patient billing, and follow-ups, reducing errors and improving revenue cycle management. These services also often include dental insurance verification to confirm eligibility, benefits, deductibles, and co-pays before treatment. This process prevents unpaid claims, delays, and misunderstandings by providing accurate cost estimates to patients and ensuring your office receives timely reimbursement.

Recover lost revenue with proven dental billing services designed for your practice.