As a dentist you may sometimes be required by patients or insurance companies to perform medical-dental cross coding. This involves submitting dental procedures to a patient’s medical plan rather than their dental insurance, when the dental work is considered medically necessary. Some dental procedures have a medical component and insurance companies require the dentist to file the patient’s medical claim first. An experienced dental billing company can ensure that this is done correctly so that you receive appropriate reimbursement for your dental services.

Many people don’t have dental insurance and may forgo expensive dental treatment because they cannot pay for it. Dental care can be costly even for those who are covered with plans with annual maximums, co-pays, and procedure exclusions, resulting in high out-of-pocket costs.

This post discusses which dental procedures can be billed to medical insurance, their CDT codes, and tips for dental-medical cross coding.

Boost your practice revenue with our comprehensive dental billing services!

Medically Necessary Dental Procedures that can be Billed to Medical Insurance

Many common dental procedures that meet medical necessity considerations can be billed to medical insurance. A procedure is deemed medically necessary when it complies with recognized medical standards, and is appropriate and necessary for diagnosis or treatment, prevention of a medical condition, improvement of a condition, or for rehabilitation of lost skills.

A typical example is oral sleep appliances (HCPCS code E0486) for OSA (ICD-10 code G47.33) for patients suffering from Obstructive Sleep Apnea (OSA). Dental practices provide oral sleep appliances and the equipment is covered by a patient’s medical insurance since it is considered medically necessary services/equipment provided in the dental practices setting.

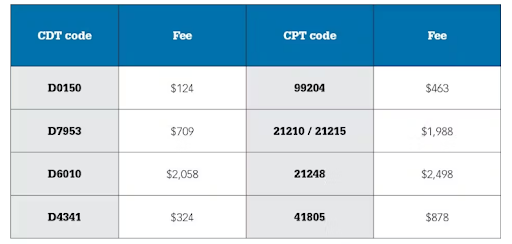

The following table from a recent Dental Economics article shows a sample listing of fees with the CDT to the cross-code of CPT, with higher medical insurance for the same procedures.

Source: Bridging the gap: The Advantages of Medical Billing in Dentistry, Dental Economics February, 2024.

Common dental services that are medically necessary and may be eligible for dental-medical cross coding include:

- Custom sleep appliance fabrication and placement (D9947) and adjustment of custom sleep apnea appliance (D9948)

- Dental repair of teeth due to injury: oral and maxillofacial surgery procedures after traumatic injuries are often covered by medical insurance (D7140, D7210, D7250, and D7280)

- Dental implants, bone grafts, and CT scans (D6010 implants with abutment, D4263 bone graft, and D7953 maxillary / mandible bone grafts)

- Treatment for temporomandibular joint (TMJ) problems (D7880)

- Congenital defects (D7940 osteoplasty – for orthognathic deformities, reconstruction of jaws for correction of congenital, developmental or acquired traumatic or surgical deformity)

- Guided tissue regeneration – resorbable barrier, per site (D4266)

- Lateral sinus augmentation (D7951)

- D7240 (x4) – removal of impacted tooth – completely bony; most or all of crown covered by bone; requires mucoperiosteal flap elevation and bone removal

- D7310 – alveoloplasty in conjunction with extractions – per quadrant, usually in preparation for prosthesis.

- Sedation – D9222 and D9223 identify GA services in dental offices. D9222 covers the first 30 minutes of GA and D9223 is for the subsequent 15 minute intervals)

- D0414- Laboratory processing of microbial specimen to include culture and sensitivity studies, preparation, and transmission of written report.

- D0600- Non ionizing diagnostic procedure capable of quantifying, monitoring, and recording changes in structure and enamel, dentin, and cementum.

- D4346 – Removal of plaque, calculus, and stains from supra- and sub-gingival tooth surfaces when there is generalized moderate or severe gingival inflammation in the absence of periodontitis.

- D9311- Treating dentist consults with a medical health care concerning medical issues that may affect patient’s plan dental treatment; For e.g., as diabetes affects the gums and the gums affect diabetes management, dentists treating a patient with diabetes may want to collaborate with the patient’s primary care physician on issues related to blood sugar control, medications, diet, and exercise. Collaborative medical consultations can greatly improve a patient’s overall health and well-being.

- D9991- Individualized efforts to assist patients to maintain scheduled appointments by solving transportation challenges or other barriers (aimed at Medicaid patients).

- D9992- Assisting in a patient’s decision regarding the coordination of oral health care services across multiple providers, provider types, specialty areas of treatment, health care settings, health care organizations, and payment systems.

- D9993 – Patient-centered, personalized counseling using methods such as motivational interviewing to identify and modify behaviors interfering with positive oral health outcomes.

- D9994- Individual, customized communication of information to assist a patient in making appropriate health decisions designed to improve oral health literacy.

- D6085 – to be used when a period of healing is necessary prior to fabrication and placement of permanent prosthetic. This code may be used when a patient who is healing comes for follow-up.

Other dental procedures that may be billed to medical insurance are:

- Treatment related to inflammation and infection

- Certain periodontal surgery procedures

- Consultation for and excisional biopsy of oral lesions

- Infection that is beyond the tooth apex and not treatable by entry through the tooth

- Pathology that involves soft or hard tissue

- Emergency trauma procedures

- Clearance exams before chemotherapy or surgery

Cross Coding Dental to Medical – Points to Note

Medical billing can help patients have the complex, expensive dental procedures they need. Filing medical claims may be the only way for the patient to receive reimbursement for the procedure if it is performed in a hospital setting, an ambulatory center, or using anesthesia.

Knowledge of CDT, CPT, HCPCS, and ICD-10 coding is crucial for dental and medical cross coding and billing. Dental practitioners need to report the correct codes to properly and fully describe the treatment provided. Partnering with a company that specializes in both medical and dental billing can ensure accurate claim submission. Their staff is trained in both medical and dental coding and knowledgeable about submission and processing guidelines of dental payers vs. medical payers, including commercial and government insurance companies.

Verify patient coverage. Performing dental insurance verification is necessary to determine the type of coverage the patient has. Understanding the specifics of the patient’s insurance policy will help you identify if the procedure in question is covered.

Documentation is vital – when submitting medical claims, dentists and their team should thoroughly document everything to demonstrate medical necessity of the procedure or equipment required for care. Using specific terminology is also crucial. For instance, when a diagnosis of “cracked tooth” is documented, it is often recognized as being due to trauma, establishing that the treatment is 100% medically necessary.