- What is Medical Billing?

- Who Needs Medical Billing Services?

- Key Components of Medical Billing Services

- Industries Served

- In-House vs Outsourced Billing

- In-House Billing vs Outsourced Billing: Comparing the Key Aspects

- Benefits of Outsourcing Medical Billing Services

- How to Choose a Medical Billing Company

- FAQs

In today’s dynamic healthcare setting, accurate and efficient medical billing is essential to keep practices running smoothly and ensure providers get paid for their services. Understanding the process and intricacies of medical billing is crucial to reduce claim denials, improve cash flow, and maintain compliance. As it is a complex process with many steps, physician practices and other healthcare entities rely on a specialized medical billing company to optimize revenue performance.

This comprehensive guide covers comprehensive services offered by medical billing companies, including a comparison of in-house vs outsourced billing, to help you understand the process and manage it more effectively.

What is Medical Billing?

Medical billing is the process of generating healthcare claims to submit to insurance companies for the purpose of obtaining payment for medical services rendered by healthcare professionals and organizations. It involves translating healthcare services into medical codes on billing claims to ensure that providers are reimbursed correctly for services rendered to patients.

Key responsibilities in medical billing include:

- Submitting accurate claims to insurance companies

- Generating itemized patient bills

- Following up to ensure timely payment

- Coordinating communication among medical coders, healthcare providers, insurance companies, and patients

- Maintaining and updating patient billing records

- Assisting with payment planning and financial arrangements

Medical billing is a subset of revenue cycle management (RCM). RCM covers the entire financial lifecycle of a patient account — from appointment scheduling and insurance verification to billing, payment posting, and collections. Medical billing typically refers to the claim preparation, submission, and follow-up portion of the revenue cycle, though the services that outsourcing companies provide include insurance verification and analytics.

Who Needs Medical Billing Services?

All individuals and other entities that provide medical care, treatment, or related services need medical billing services. These providers include a wide range of professionals and organizations, such as physicians, nurses, hospitals, clinics, and specialized facilities.

Healthcare Providers Served by Medical Billing Companies

-

- Individual Practitioners

- Physicians: Doctors of medicine (MDs) and doctors of osteopathic medicine (DOs) who diagnose and treat illnesses.

- Nurses: Registered nurses (RNs), advanced practice nurses (NPs, CNSs, CNMs, CRNAs), who provide a wide range of care, including primary care and specialized services.

- Allied Health Professionals: Individuals like physical therapists, pharmacists, and other specialists who contribute to patient care.

- Other: Practitioners like dentists, chiropractors, and mental health professionals.

- Organizations and Facilities

- Individual Practitioners

-

- Hospitals: Provide comprehensive medical, surgical, and emergency care.

- Clinics: Offer various outpatient services, including primary care, specialist consultations, and diagnostic testing.

- Home Health Agencies: Provide skilled nursing and therapy services in the patient’s home.

- Nursing Homes: Offer long-term care and rehabilitation services.

- Specialized Facilities: Include dialysis centers, rehabilitation centers, and hospice care providers.

- Other Entities

- Laboratories: Conduct diagnostic testing.

- Medical Supply Companies: Provide necessary medical equipment and supplies.

- Primary Care Providers (PCPs), Specialties and Others

- Primary Care Providers (PCPs): Doctors of medicine (MDs) and doctors of osteopathic medicine (DOs) specializing in family practice, internal medicine, or pediatrics, as well as nurse practitioners (NPs) and physician assistants (PAs) who can serve as PCPs.

- Specialists: Physicians with advanced training in specific areas of medicine, such as cardiology, oncology, neurology, dermatology, pediatrics, and other specialties.

- Advanced Practice Providers (APPs): NPs, CNSs, CNMs, and CRNAs who have advanced training and expanded scope of practice.

- Allied Health Professionals: Individuals like physical therapists, occupational therapists, and speech-language pathologists.

While not direct providers of care, health insurance companies benefit from medical billing services through cleaner claims, accurate coding, and streamlined communication, reducing processing delays and ensuring faster, more efficient reimbursement cycles.

Learn how our end-to-end billing services can improve your revenue cycle.

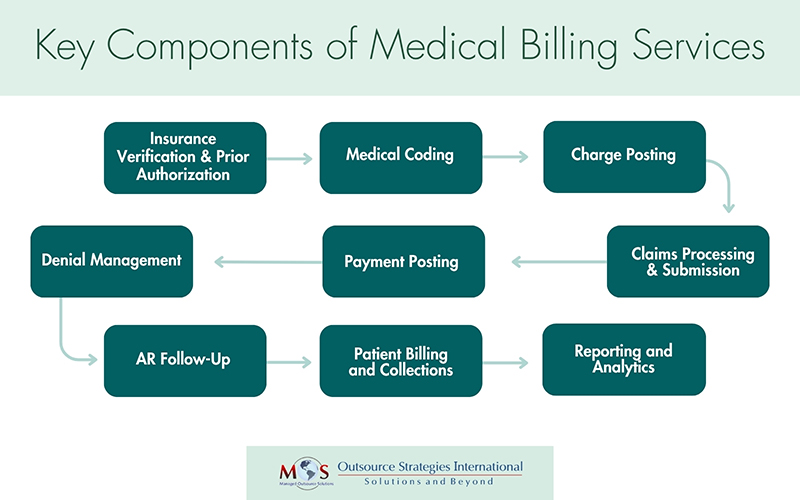

Key Components of Medical Billing Services

Medical billing services include several key components that work together to ensure accurate claim submission, timely reimbursements, and efficient revenue cycle management.

Insurance Eligibility Verification and Prior Authorization

One of the essential services offered by a medical billing company is insurance eligibility verification. This process ensures that a patient’s insurance coverage, policy status, and benefits are confirmed before any medical service is provided. Verifying eligibility upfront helps determine whether the patient’s plan is active and whether the proposed treatments are covered—reducing the risk of surprise out-of-pocket costs and denied claims. They also help providers obtain prior authorizations for procedures, treatments and DME which require prior approval from insurers.

By leveraging real-time eligibility (RTE) tools, billing companies validate insurance details during patient scheduling or check-in. This proactive step allows practices to address coverage issues early, streamline the billing cycle, minimize claim rejections, and accelerate reimbursements—ultimately improving cash flow and operational efficiency.

Coding

Medical coding is the process of converting every aspect of a patient’s care—diagnoses, procedures, and services—into standardized alphanumeric codes. These codes form the backbone of medical billing and reimbursement. Medical billing companies rely on certified and experienced medical coders who collaborate with healthcare providers to ensure accurate, specific, and compliant coding.

Skilled medical coders:

- Carefully review clinical documentation and translate diagnoses, procedures, and services into appropriate codes using CPT®, ICD-10-CM, and HCPCS Level II classification systems.

- Assign the most precise and specific codes to accurately reflect the patient’s encounter and support clean claims submission.

- Apply modifiers as needed to capture special circumstances or conditions that impact the nature of the services provided.

- Assist in preparing complete and accurate claims, helping providers receive proper reimbursement.

- Stay current with code updates, payer-specific rules, and regulatory changes to ensure compliance and reduce audit risk.

Accurate medical coding services not only ensure correct reimbursement but also minimize claim denials, reduce delays, and support the overall integrity of the revenue cycle.

Charge Posting

Charge posting, also known as charge entry, is a vital step in medical billing and the RCM process. It involves translating medical services provided to patients into billable charges and meticulously recording them in the billing system. The key steps in charge posting are:

- Charge entry – inputting medical codes and associated fees into the medical billing system.

- Ensuring that all billable services are captured and charged for.

- Ensuring that all information, codes, and charges are accurate and comply with established coding guidelines and payer requirements.

Efficient charge capture streamlines the medical billing process and supports timely reimbursement, resulting in a more consistent and reliable cash flow.

Claims Processing and Submission

One of the core functions of medical billing is the accurate preparation and timely submission of insurance claims. After services are coded, the billing team compiles the necessary patient, provider, and service information to create a clean claim. This claim is then submitted electronically or manually to the appropriate insurance payer. Billing services ensure that each claim meets payer-specific guidelines and includes all required documentation.

Claims scrubbing is performed before claims are submitted to payers. The process involves reviewing claims to identify and correct any errors, inaccuracies, or inconsistencies that could lead to claim denials, rejections, or payment delays.

Payment Posting

Payment posting is a vital step in the medical billing process that involves meticulously recording and reconciling payments received from patients, insurance companies, and other payers.

Payment posting involves receiving payments from various sources, reviewing and verifying details against EOBs or ERAs, accurately recording payments to patient accounts, identifying and addressing any discrepancies, and reconciling records with bank deposits and remittance advice to ensure accuracy. Today, medical billing services leverage automated solutions that streamline the process, reduce errors, and improve efficiency.

Denial Management

A claim denial occurs when a health insurance payer refuses to reimburse a healthcare provider for services rendered to a patient based on the terms of the patient’s benefits. Common causes of claim denials include incomplete or incorrect information, coding errors, lack of prior authorization, duplicate billing, medical necessity issues, timely filing limits, Coordination of Benefits (COB), and out of network services.

A key aspect of medical billing, denial management focuses specifically on identifying, analyzing, and resolving denied claims. It involves understanding the reason for the denial, correcting errors, appealing if necessary, and resubmitting the claim.

By implementing robust denial management strategies, a medical billing company can help healthcare providers maintain a steady cash flow and protect their financial stability.

check out our post on Mastering Medical Billing: Common Errors and Preventive Strategies.

AR Follow-Up

Accounts Receivable (AR) follow-up is the systematic process of diligently tracking and resolving outstanding claims and unpaid balances with insurance companies and patients. This crucial RCM step ensures that healthcare providers receive timely reimbursement for their services. AR follow-up in medical billing includes

- Following up on unpaid or underpaid claims (even if not denied)

- Tracking claim status across aging buckets (e.g., 30/60/90+ days)

- Working with payers to resolve delays, partial payments, or lack of response

- Ensuring timely reimbursement for all outstanding accounts—not just denied ones

AR follow-up teams in medical billing companies handle denied claims as part of their broader responsibility to manage and collect all outstanding balances.

Patient Billing and Collections

Patient billing and collections involve generating and managing invoices for medical services and ensuring timely payment from patients. This process begins with the creation of accurate, itemized bills that include details such as services rendered, dates of service, applicable charges, and medical codes. Claims are first submitted to the patient’s insurance provider for reimbursement. Once insurance payments are processed, any remaining patient responsibility—such as co-pays, deductibles, or non-covered services—is clearly outlined in a patient statement and sent promptly.

An efficient billing process also includes proactive communication about costs, payment options, and timelines. By setting clear expectations and offering support, effective medical billing services not only improve collections but also help build transparency and trust between providers and their patients.

Analytics and Reporting

Data-driven insights play a key role in improving the financial health of healthcare practices. By tracking key performance indicators (KPIs) to identify trends and areas for improvement and providing regular reports on these matters, medical billing companies enable healthcare providers to make informed decisions that drive financial performance and strengthen compliance.

A billing service provides healthcare organizations access to advanced tools and expert analysis. These services help uncover inefficiencies, reduce claim denials, ensure compliance, and speed up reimbursements. With the support of revenue cycle analytics, providers can maintain a strong financial foundation as they focus on patient care.

Industries Served

| Cardiology | Neurology | Physical Medicine & Rehab |

| Chiropractic | Neurosurgery | Physical Therapy |

| Family Practice | Occupational Therapy | Radiology |

| Gastroenterology | Orthopedics | Rheumatology |

| General Surgery | Pain Management | Vascular |

In-House vs Outsourced Billing

One of the most debated questions is whether physicians should outsource medical billing to a specialized company or handle the process in-house.

Outsourcing billing involves contracting a third party to handle and process all medical coding and billing tasks. It means having a medical billing company take responsibility for the healthcare organization’s administrative functions from billing and coding to claim submission, payment collections and denial management.

Each option has its pros and cons—while in-house billing offers more direct control, it often comes with higher operational costs and resource demands. Outsourced billing, on the other hand, provides access to expert teams, advanced technology, and streamlined processes, often at a lower cost. The table below compares the two approaches across key areas to help you determine which is best suited for your practice.

In-House Billing vs Outsourced Billing: Comparing the Key Aspects

| In-House Billing | Outsourced Billing |

|---|---|

| High overhead costs (salaries, software, training, benefits | Predictable costs; often lower overall expenses |

| Requires hiring, training, and managing billing staff | Handled by experienced billing specialists |

| Depends on internal staff’s knowledge | Ensures access to certified coders and billing experts across specialties |

| Practice must invest in software, updates, and security | Vendors have advanced tools and integrated systems |

| Internal team must stay updated on industry and regulatory changes | Outsourcing companies stay current with HIPAA and payer rules |

| May require hiring more staff during growth or busy seasons | Easily scalable to match your practice’s changing needs |

| Denial management is often overlooked | Dedicated team focused on reducing denials and speeding reimbursements |

| Depends on internal reporting capabilities | Regular, detailed reports and performance analytics |

| Full control over day-to-day billing operations | Shared control; regular communication needed for transparency |

The table indicates that outsourced billing offers distinct advantages compared to in-house. Therefore, it’s no surprise that the market for medical billing services is experiencing significant growth. The global medical billing outsourcing market size was estimated at USD 12.2 billion in 2022 and is projected to reach USD 30.2 billion by 2030, growing at a CAGR of 12.26% from 2023 to 2030, according to Grand View Research. Emerging trends—driven by rising bad debts, advances in technology, increasing billing complexities, and evolving regulatory guidelines—are making healthcare claim outsourcing more impactful than ever.

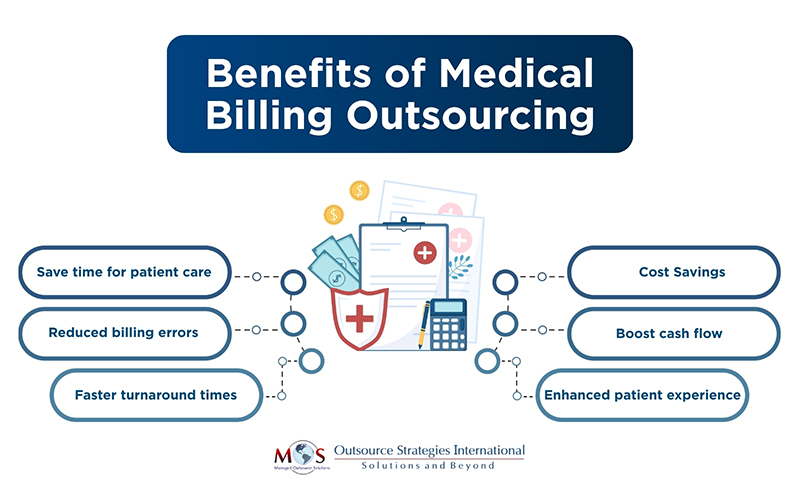

Benefits of Outsourcing Medical Billing Services

Outsourcing medical billing offers numerous benefits for healthcare providers, including cost savings, increased revenue, improved cash flow, and enhanced patient care. By delegating billing tasks to a specialized company, practices can reduce administrative burden, minimize errors, and focus on their core goal of patient care.

However, success with outsourcing depends on choosing the right billing partner.

How to Choose a Medical Billing Company

Choosing the right medical billing company is a critical decision that can significantly impact your practice’s financial health and operational efficiency. With constantly evolving regulations, payer requirements, and coding updates, outsourcing your billing to a reliable partner can help reduce administrative burdens, avoid mistakes, minimize claim denials, and improve cash flow. To ensure long-term success, it’s important to understand the essential qualities to look for when selecting a medical billing company that aligns with your practice’s needs and goals.

- Proven Experience

Experience matters when it comes to navigating the complex world of healthcare billing. A seasoned billing company brings in-depth knowledge of coding, payer-specific rules, compliance requirements, and claims submission processes. They’ve likely encountered—and resolved—a wide range of billing scenarios. Look for a company with specialty-specific expertise to match your practice’s needs.

- End-to-End Revenue Cycle Management (RCM) Services

Opt for a provider that offers comprehensive RCM solutions, including:

- Credentialing

- Patient registration and eligibility verification

- Medical coding

- Charge entry

- Claims submission

- Payment posting and reconciliation

- A/R follow-up and denial management

- Patient billing and collections

Having a single team manage the full revenue cycle improves accuracy, accountability, and cash flow.

- Certified Coding Expertise

Errors in coding are a leading cause of claim denials. Choose a company with AAPC-certified coders proficient in ICD-10, CPT, and HCPCS Level II coding. Skilled coders ensure precise code assignment, proper documentation review, and effective communication with providers to maximize reimbursement.

- Seamless System Integration

Your billing partner should be able to integrate with your existing Practice Management System (PMS) or Electronic Health Record (EHR). Proficiency in using automation tools and advanced billing software reduces manual errors and improves efficiency.

- Regulatory Compliance

Ensure the company strictly adheres to HIPAA, Anti-Kickback Statute, and other regulatory standards. They must have secure systems and processes in place to protect patient data (PHI), and maintain compliance in all billing activities.

- Clear and Timely Reporting

Regular, easy-to-understand reports are vital to monitor your practice’s financial health. Your billing partner should provide transparent reporting on claims status, collections, denials, and other key performance indicators, which will enable you to make informed, data-driven decisions.

- Scalability and Flexibility

Choose a billing company that can scale services as your practice grows or evolves. Whether you’re a solo provider or a multi-specialty group, the company should offer customizable solutions without compromising service quality.

- Reliable Customer Support

The company should provide responsive customer service when issues arise. Look for a company with a dedicated support team, clear communication channels, and prompt response times to ensure your concerns are addressed quickly.

- Transparent Pricing

Understand the company’s pricing structure upfront. Whether they charge a flat fee, percentage of collections, or a hybrid model, make sure there are no hidden fees. The right partner should help you reduce operational costs—potentially saving 30–40% in overhead.

- Fair and Clear Contract Terms

Review the contract thoroughly before signing. Key elements to evaluate include:

- Contract duration

- Termination clauses

- Confidentiality agreements

- Service-level guarantees

A well-structured contract ensures clarity and supports a healthy long-term partnership.

A medical billing company offers a wide range of services designed to streamline the revenue cycle, reduce administrative burdens, and improve cash flow for healthcare providers. By outsourcing these tasks to an expert, practices can focus more on patient care while ensuring accurate, timely, and compliant billing.

FAQs

- What does a medical billing company do?

A medical billing company handles the process of submitting and following up on claims with health insurance companies to ensure healthcare providers are reimbursed for their services. This includes coding, claim submission, payment posting, denial management, and more.

- What types of services are typically included?

Common services include:

- Insurance verification and prior authorization

- Medical coding

- Charge entry

- Claims submission

- Payment posting

- Denial management

- Accounts receivable (A/R) follow-up

- Patient billing and customer service

- Reporting and analytics

- Do medical billing companies offer services for all specialties?

Yes, many billing companies provide specialty-specific billing services, such as for cardiology, dermatology, radiology, orthopedics, internal medicine, and more.

- Can they help with insurance eligibility and pre-authorization?

Absolutely. Most billing companies assist with checking patients’ insurance eligibility and securing necessary prior authorizations to avoid claim denials.

- How does outsourcing billing improve revenue?

Outsourcing improves accuracy, reduces billing errors, speeds up reimbursements, and ensures consistent follow-up on denied or unpaid claims, ultimately boosting cash flow and revenue.

- Is my patient data secure with a billing company?

Reputable medical billing companies follow HIPAA regulations and use secure systems to protect patient information and maintain confidentiality.

- Can I still track my billing performance if I outsource?

Yes. Most companies provide regular reports and dashboards so you can monitor claims status, collections, and other key metrics in real time.

- Do they handle patient billing and payment collections?

Many medical billing companies offer patient billing services, including sending statements, answering billing questions, and assisting with payment plans or collections.

- What’s the difference between in-house and outsourced billing?

In-house billing is managed by your staff, while outsourced billing is handled by a third-party company. Outsourcing can reduce overhead, improve efficiency, and provide access to experienced billing professionals.

- How do I choose the right medical billing company for my practice?

Look for a company with experience in your specialty, strong client references, transparent pricing, robust technology, and a commitment to compliance and data security.

Improve your billing process and boost revenue!

Partner with our medical billing company.