Proper accounts receivable (AR) management is essential for maintaining cash flow and ensuring efficient dental revenue cycle management. However, reports from industry analysts and dental billing experts suggest that average dental A/R levels have been on the rise, resulting in wasted resources, lost revenue, and strained cash flow. Growing patient financial responsibility, increasing complexities in insurance claims, and inefficient practice management are the key reasons for revenue leakage. Knowing when to outsource A/R follow-up can make the difference between struggling with delayed collections and achieving a smooth, efficient revenue cycle.

What is the Goal of A/R Management?

Managing A/R is one of the most critical aspects of RCM. The goal of effective receivables management is to streamline billing, payments, and collections to ensure steady cash flow, keep denial rates under control, reduce bad debt, and maintain financial stability. This requires timely follow-up on outstanding claims.

Strong receivables management involves setting clear standards and practices that ensure efficient billing and timely payments from insurers and patients. With the right processes in place, practices can improve cash flow, avoid late payments, and maintain financial stability.

However, with their growing workload, payer complexities, and rising operational costs, many dental office struggle to balance A/R follow-up. When in-house teams are unable to keep up, reducing denied claims through outsourced A/R follow-up can be a smart solution.

Take your Dental A/R Management to the Next Level!

Outsourcing vs In-house Dental A/R Follow-Up

Managing dental AR in-house comes with a unique set of challenges. Front-office teams are often strained, juggling patient scheduling, insurance verification, billing, and collections, which leaves limited time for regular A/R follow-up. Complex insurance requirements, frequent claim denials, and delays in reimbursement further complicate the process, leading to rising aging balances. Without dedicated staff and advanced tools to track and resolve outstanding claims, many practices struggle to maintain cash flow, meet collection benchmarks, and prevent revenue leakage. Over time, this not only impacts profitability but also puts additional strain on staff and the overall patient experience.

Outsourcing dental A/R follow-up helps practices overcome these challenges by ensuring access to specialized teams focused solely on managing collections. Experienced outsourcing partners understand payer requirements, denial patterns, and follow-up strategies that drive faster reimbursements and reduce aging balances. They also leverage advanced technology and analytics to track performance metrics, identify trends, and resolve outstanding claims more efficiently than a busy front-office team can manage. By outsourcing, dental practices can improve cash flow, recover more revenue, and free up in-house staff to focus on patient care and delivering a better overall experience.

Below are the signs that indicate it may be the right time to partner with a specialized revenue cycle outsourcing service.

When Dental Practices Should Outsource A/R Management

Here are the signs that it’s time to consider outsourcing A/R follow-up:

When In-House Resources are Strained

Is your billing staff spending more time chasing unpaid claims than supporting patients or handling core billing tasks? High claim volumes, staffing shortages, or seasonal spikes can quickly overwhelm in-house teams, reducing efficiency. Outsourcing provides access to a dedicated workforce that focuses exclusively on receivables management.

When Aging A/R Is Growing

The widely accepted benchmark is to keep A/R within 30 days. If your dental practice carries a high A/R balance—particularly with accounts overdue beyond 90 days—it becomes increasingly difficult to recover payments and maintain effective collections. A backlog of unresolved claims translates to lost revenue opportunities. Outsourced A/R specialists prioritize aging claims, contact payers, and speed up collections to reduce outstanding balances.

When Denial Management Requires Expertise

Claim denials usually occur due to mistakes in benefits verification, coding errors, missing documentation, or payer-specific rules. If your practice is experiencing frequent denials and your staff struggles to appeal claims effectively, it can disrupt revenue recovery. Outsourcing can provide access to experts who understand payer nuances and can implement proven denial management strategies to recover revenue faster.

When Cash Flow Becomes Inconsistent

Is your practice finding it difficult to cover operating expenses, pay staff, or invest in growth due to delayed payments? If cash flow is inconsistent despite steady patient volumes, outsourcing A/R follow-up can help stabilize collections and improve financial stability.

When Patient Billing and Collections Fall Short

Inefficient patient billing processes—such as unclear statements, delayed invoicing, or lack of flexible payment options—can quickly increase outstanding receivables. As patients take on more financial responsibility due to high-deductible plans, practices that fail to follow up consistently risk growing bad debt and cash flow delays. Outsourcing A/R follow-up ensures structured communication, timely reminders, and better recovery of patient balances, improving both revenue and patient satisfaction.

When Technology Limitations Slow Down Collections

Efficient revenue recovery requires advanced tools, automation, and analytics to track metrics such as A/R days, denial trends, and collection efficiency. If your practice lacks access to such technology, outsourcing helps you leverage modern RCM systems without large upfront investments.

When Your Practice Is Expanding

Expanding services or opening new locations often requires hiring and training additional staff, which can be costly and time-consuming. Outsourcing ensures that your A/R processes function smoothly, without straining your resources as your practice grows. It eliminates the need to recruit and retain specialized staff.

When Complexity of Payer Rules Increase

If your in-house teams find it challenging to keep up with evolving payer requirements, prior authorization rules, and compliance updates, outsourcing can provide the solution. Reliable RCM companies have dedicated teams who stay up to date with payer regulations, reducing compliance risks and improving claim resolution rates.

When Overhead is Rising

Maintaining an in-house billing team involves fixed costs such as salaries, benefits, and training. If your practice overhead is rising without a proportionate increase in collections, outsourcing can provide financial flexibility. Leading dental RCM services offer various pricing packages such as full-time equivalent, fixed cost pricing, and per transaction to meet client needs.

When Patient Experience Is Affected

Patients expect quick answers about their bills. If your staff is tied up with follow-ups, it may lead to delays in resolving patient inquiries and dissatisfaction. Outsourcing allows your front office to focus on patient communication while back-office specialists handle collections.

When Performance Benchmarks Are Missed

Days in A/R and collection rates are key indicators of financial health, with high A/R over 90 days pointing to issues with revenue cycle management. Industry benchmarks suggest a target of less than 15-20% for accounts receivable (A/R) over 90 days and a net collection rate of 95% or higher. If your practice consistently falls short of these targets, outsourcing can provide the dedicated attention needed to meet or exceed performance standards.

Enhance Collections and Improve Workflow with Expert Support

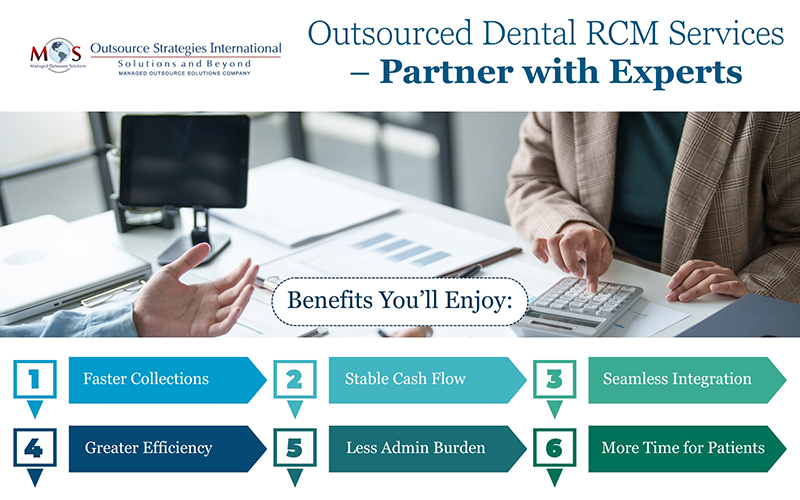

Knowing when to outsource A/R follow-up starts with recognizing these signs early. Outsourced dental RCM services ensure greater efficiency, faster collections, and more stable cash flow. With seamless integration into your practice systems, dedicated teams streamline workflows, reduce administrative burden, and boost overall productivity. By implementing proactive steps to strengthen your revenue cycle, experts ensure you have more time to focus on patient care.

Streamline Collections and Reduce Overdue Accounts.