Periodontal disease is a serious gum infection caused by bacteria. It often starts as gingivitis, a mild inflammation of the gums, and can progress to periodontitis if left untreated. Periodontal care can range from routine treatment to treating advanced gum disease. Dental insurance typically covers treatments like scaling and root planing, and medical insurance may cover treatment if the gum disease is linked to another medical condition.

Periodontal treatments – ranging from scaling and root planing to surgical interventions—are often medically necessary but can also be costly. However, because insurance coverage for periodontal care varies widely across plans, comprehensive dental insurance verification is essential before treatment begins for smooth periodontal treatment billing, reducing the risk of denials.

Periodontal Care: What Dental Insurance Typically Covers

Most dental plans provide periodontist insurance coverage for preventive, basic, and major procedures, though the extent of coverage varies by insurance plan and type as well as severity of the gum disease.

- Preventive care: Most dental insurance plans cover routine dental exams and cleanings at or near 100%.

- Basic procedures: Most insurance plans cover 50–80% of scaling and root planning or deep cleaning, after the deductible is met.

- Major procedures: insurance plans generally cover 50–70% of the cost of surgical procedures such as gum grafting, flap surgery, and bone regeneration.

Periodontal maintenance, which is done after the initial treatment, is often covered at 50–80%, but only if deemed medically necessary.

If the patient’s gum disease is linked to a health condition like diabetes or heart disease, it may qualify for coverage by their medical insurance.

Challenges of Periodontal Treatment Billing and the Importance of Dental Insurance Verification

Billing for periodontal treatment can be complex due to the variety of procedures involved, from scaling and root planing to periodontal surgery. Apart from claim denials, incorrect coding, delayed reimbursements, variations in gum disease insurance coverage is a key reason why comprehensive insurance verification is critical in periodontal care. The American Dental Association emphasizes, “It is essential for dentists and their teams to fully read and understand each payer’s processing policies”.

For example, variations in scaling and root planing (SRP) insurance reimbursement are significant, arising from different payer criteria, coverage limits, and the importance of correct CDT coding. Insurers have their own criteria for defining necessary treatment, which can differ from standard clinical guidelines, and benefit designs can vary even for the same insurer. Each insurance company has its own criteria for what constitutes “medical necessity” for SRP. To ensure accurate claim submission it’s essential to verify the patient’s coverage for SRP before treatment and understand any specific limitations or co-pays.

How Insurance Verification prevents Claim Denials for Gum Disease Treatment

Thorough verification helps dental practices:

- Confirm Coverage and Eligibility – Many plans have specific limitations on periodontal procedures, frequency of treatment, or waiting periods. Checking benefits upfront prevents claim denials and unexpected out-of-pocket costs for patients.

- Identify Preauthorization Requirements – Insurers often require prior authorization for periodontal surgery or advanced procedures. Verifying these requirements in advance ensures smoother approvals and timely reimbursement.

- Clarify Patient Financial Responsibility – Patients are more likely to proceed with recommended treatment when they understand their exact coverage, co-pays, deductibles, and potential out-of-pocket expenses.

- Reduce Billing Delays and Denials – By confirming codes, frequency limits, and plan exclusions, practices avoid rejected claims and the revenue loss associated with rework or appeals.

- Enhance Patient Trust and Satisfaction – Transparent communication about benefits builds confidence in the practice and improves treatment acceptance rates.

For claim accuracy, practices must review patients’ policy’s limitations, waiting periods, and exclusions as well as ensure thorough diagnostic documentation like periodontal charting and X-rays. Practices that are struggling to find time to do this in-house can consider outsourcing dental insurance verification.

Comprehensive Dental Insurance Verification with Expert Support

Partnering with a reliable, HIPAA-compliant dental billing company is one of the most effective ways to ensure accurate insurance verification and clean claim submission. These companies employ experienced specialists who manage the entire process with precision using the latest technologies. With in-depth knowledge of insurance requirement and payer coverage guidelines, dental benefit verification experts confirm the following critical details before treatment:

- Type of plan and coverage specifics

- Co-pay, co-insurance, and deductible amounts

- Referrals and pre-authorization requirements

- Patient policy status and effective dates

- Plan exclusions and limitations

- Out-of-network benefits

- Claims mailing address, and more

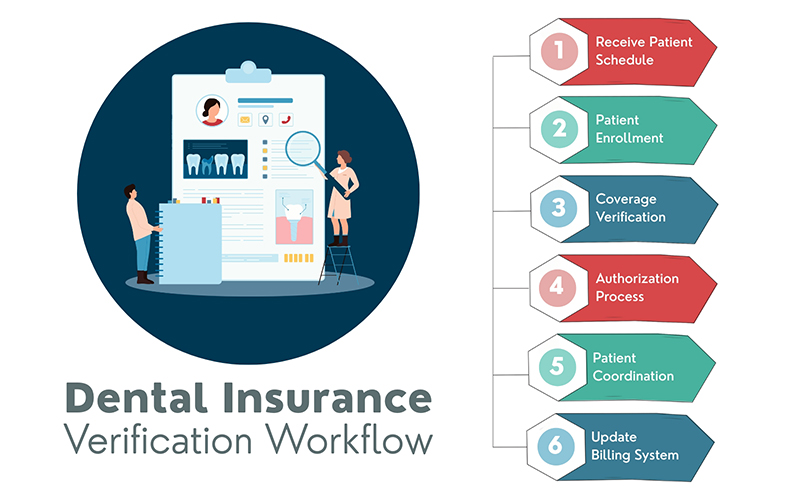

Experts implement a well-structured benefits verification cycle that typically includes:

- Receiving patient schedules from hospitals or practices via FTP, fax, or email.

- Patient enrollment by entering or updating demographic information and securing prior authorizations for office visits.

- Verifying coverage across all primary and secondary payers.

- Obtaining treatment authorizations from the appropriate sources.

- Coordinating with patients to gather additional information if needed.

- Updating the billing system with verified eligibility and benefits details.

This comprehensive approach not only reduces claim denials and maximizes periodontal care reimbursement, but also improves patient satisfaction by ensuring cost transparency before treatment begins.

Learn how comprehensive insurance verification can streamline your practice and improve patient care.