Billing and coding for neurology practices pose unique challenges due to the complexity of neurological disorders, intricate documentation requirements, need for regulatory compliance, and the healthcare system itself. In 2024, neurology coding and billing underwent significant changes that will impact how healthcare providers submit claims and receive reimbursement. While a neurology billing company can provide valuable billing and coding support, it is important for neurologists to be aware of the specific challenges their practice may encounter in the area.

Neurology reimbursement challenges include claim denials, payment delays, insurance coverage disputes, and issues related to regulatory compliance. Effectively addressing these challenges necessitates a combination of knowledge, expertise, and advanced technology. Let’s take a deeper into this.

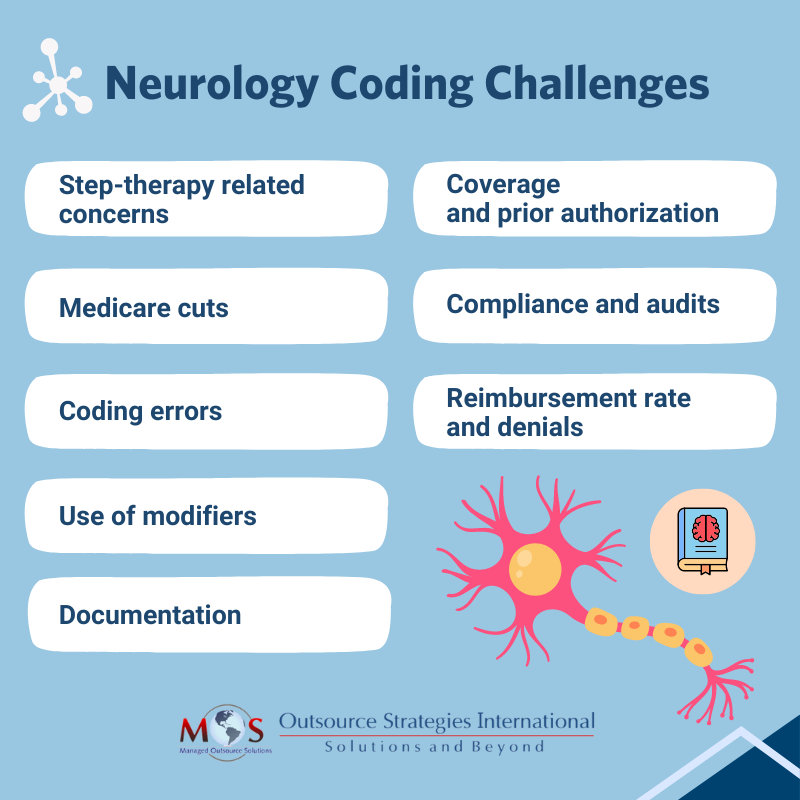

Medical Coding and Billing Challenges in Neurology for 2024

Step-therapy

Step-therapy, also known as “fail first,” is a strategy established by insurance payers that requires patients to seek treatment using a cheaper medication and prove its ineffectiveness before they can be prescribed a better, more expensive medication. The potential harm is that a patient’s medical condition or history is disregarded in this case which leads to delayed treatment. Patients who suffer from neurological conditions such as migraines, Alzheimer’s disease, Parkinson’s disease, ALS and epilepsy are unable to access proper, timely care due to the limitations set by payers.

The Safe Step Act bill requires a group health plan to establish an exception to medication step-therapy protocol in specified cases. A medication step-therapy protocol establishes a specific sequence in which prescription drugs are covered by a group health plan or a health insurance issuer.

Work with our innovative team for your neurology billing and coding services to maximize reimbursement and streamline your practice!

A request for such an exception to the protocol must be granted if

- An otherwise required treatment has been ineffective

- Such treatment is expected to be ineffective and delaying effective treatment would lead to irreversible consequences

- Such treatment will cause or is likely to cause an adverse reaction to the individual,

- Such treatment is expected to prevent the individual from performing daily activities or occupational responsibilities

- The individual is stable based on the prescription drugs already selected

- There are other circumstances as determined by the Employee Benefits Security Administration

The bill requires insurance companies to carry out and make promptly accessible a clear process for a patient to request an exception to the protocol, including required data and criteria for granting an exception. The bill further indicates timelines under which payers must answer to such requests.

“Decreasing barriers is essential in ensuring people with neurologic conditions receiving the appropriate care in a timely manner,” said American Academy of Neurology President Carlayne E. Jackson, MD, FAAN. “Step therapy protocols often cause delays in care and do not consider a person’s unique circumstances and medical history. The Safe Step Act would reform the process of step therapy.”

Neurologists could effectively use step-therapy to grant safer, faster and transparent healthcare access to patients in immediate need of higher medication.

Medicare cuts

On January 1st, the Medicare Physician Fee schedule conversion factor was cut down to nearly 3.4 percent due to budget neutrality requirements. Congress had declared that they would fix this issue and ensure proper reimbursement by January 19 funding deadline, however, no deal was fixed on this day.

“Such cuts make it difficult for neurology practices to stay afloat and provide much needed specialized care to people with neurologic conditions,” said Bruce H. Cohen, MD, FAAN, and Chair of the American Academy of Neurology’s Advocacy Committee. “Addressing these cuts will ensure that neurologists can continue to provide the highest quality neurologic care.” On March 8, Congress tackled the Medicare Physician Fee Schedule (MPFS) cut in a budget packet by providing a partial fix of increasing the conversion factor by 1.68%. In a press release issued by AAN, they stated that “This fix is not retroactive, so it will only apply to services provided from March 9 through December 31, 2024”.

Coding errors

Common medical coding challenges in neurology practices include accurately documenting complex diagnoses, selecting the correct CPT and ICD-10 codes, managing frequent coding updates, and ensuring proper linkage between procedures and medical necessity. Neurological procedures, tests, and treatments often have specific coding requirements, making it essential for coders to have specialized knowledge.

Neurology codes are subject to frequent coding changes, owing to the government amendments, technological advancements and insurance regulations. These days, even though computer assisted coding (CAC) is implemented in place of human coders, it doesn’t make for a large portion of the workforce. Human-made errors such as typos, under coding and expired codes usage could result in claim denials.

As the rules, regulations, and code sets continue to evolve, it is imperative that coders also stay vigilant and adapt to the changes accordingly. The onset of COVID-19 gave rise to long-term challenges in neurological condition billing and introduced new sets of neurology codes as well. Ensure that your medical coders are up to date and educated on the latest working terminologies so that your services are accurately paid for and you can maintain a flourishing practice.

Use of modifiers

In addition to neurology coding accuracy, it is important to know the modifiers to use to clarify the nature of a procedure or service, such as whether it was performed bilaterally or as part of a larger service. Understanding the appropriate use of modifiers is essential for accurate billing and reimbursement and can help prevent denials or delays in payment.

Documentation

Accurate and detailed documentation is crucial for neurology coding. Neurological conditions often require precise descriptions and specific terminology to capture the complexity of the diagnosis and treatment. Insufficient documentation or its lack of specificity can lead to coding errors, claim denials, and reimbursement delays. Providers must pay close attention to neurology documentation requirements, particularly concerning the neurologic examination, to ensure precise coding and billing.

Neurological procedures and tests must meet specific medical necessity criteria to justify reimbursement. Payers often require detailed documentation of the patient’s symptoms, medical history, and the necessity of the procedure or service. Failure to establish medical necessity can result in claim denials and disputes.

Coverage and prior authorization

Some neurological procedures, particularly expensive diagnostic tests and specialized treatments, may require prior authorization from insurance companies. Navigating the prior authorization process, ensuring that all necessary documentation is submitted, and that the procedure is approved for coverage are significant billing challenges.

Compliance and audits

Billing and coding for neurology practices must meet various regulatory and compliance standards, including those set by government agencies and private payers. Non-compliance can lead to penalties, audits, and potential legal issues. It is essential for neurology practices to have robust compliance programs and internal auditing processes.

Reimbursement rate and denials

Neurology services may have varying reimbursement rates and policies across different insurance plans and payers. Coding and billing professionals need to understand the unique reimbursement rules of each payer to optimize reimbursement.

Neurology billing professionals often face claim denials, which can result from coding errors, lack of medical necessity, and other factors. Effective denial management, including timely appeals and communication with payers, is crucial to ensure appropriate reimbursement.

Navigate New Neurology-related Codes

Parkinson’s disease

- 20.A- (Parkinson’s disease without dyskinesia)

- G20.A1 (Parkinson’s disease without dyskinesia, without mention of fluctuations)

- G20.A2 (Parkinson’s disease without dyskinesia, with fluctuations)

- G20.B- (Parkinson’s disease with dyskinesia)

- G20.B1 (Parkinson’s disease with dyskinesia, without mention of fluctuations)

- G20.B2 (Parkinson’s disease with dyskinesia, with fluctuations)/li>

- G20.C (Parkinsonism, unspecified)

Chronic migraine with aura

- G43.E0 (Chronic migraine with aura, not intractable)

- G43.E01 (Chronic migraine with aura, not intractable, with status migrainosus)

- G43.E09 (… without status migrainosus)

- G43.E1 (Chronic migraine with aura, intractable)

- G43.E11 (Chronic migraine with aura, intractable, with status migrainosus)

- G43.E19 (… without status migrainosus)

It’s clear that neurology billing and coding requires specialized knowledge, attention to detail, and ongoing education to navigate the complex reimbursement landscape and ensure accurate coding, timely reimbursement, and compliance with regulatory requirements. That’s why many neurology practices are relying on outsourced medical billing services. Neurology billing companies have specialized knowledge and expertise in the unique coding and billing requirements specific to this specialty. They stay updated with the latest coding guidelines, payer policies, and regulatory changes. With their dedicated support, providers can ensure accurate and compliant billing for neurological procedures and services and stay focused on delivering high-quality patient care.

Physician Payment Challenges in 2024

The physician reimbursement has not kept pace with the practice cost inflation; in fact, they saw a decrease of 29% in payments from 2001 to 2024, as proven in data compiled by AMA. Meanwhile, hospital reimbursement rose over 70% which compelled doctors to abandon independent practice for hospitals. This payment reduction, along with inflation, high burnout rates, difficulty in finding qualified staffs and patient expectation are the financial challenges that physicians face in 2024 and beyond.

While the pressures are worrisome for doctors, there are strategies that you can implement to mitigate the payment-inflation gap:

Evaluation and Management (E/M) – bill the correct level of care

The E/M patient visit is the basis of most physician practices. However, many practitioners are not knowledgeable about selecting the right CPT code for an E/M visit, which leads to loss of revenue. Practices come under scrutiny if their E/M levels are high compared with that of their peers. Another problem is not documenting properly to support the level of care. Higher E/M levels are often the outcome of over-reliance on EHR templates even when the medical necessity might not be there:

- Templates may pre-populate information from previous visits or require physicians to check “all others negative” when completing the review of systems. The EHR will include the information regardless of whether the physician performs the work.

- EHR copy-and-paste functionality is another problem. Instead of confirming whether the information is relevant to the current visit, physicians may overrule the suggested code if they think that it does not accurately report the patient’s presenting problem.

Negotiating contracts

Physicians from all departments, whether employed by hospitals or government or private firms, have the right to negotiate in their employment contracts for securing proper compensation. A fair contract should encompass all considerations including work-life balance, salary, bonuses, time commitment and other additional incentives. Physicians are advised to engage a contract lawyer or legal counsel while negotiating to review and clarify the terms, offer insights into standard industrial practices, recognize any potential pitfalls and ensure your rights are protected throughout the negotiating process.

Navigating the complexities of neurology procedure coding requires a deep understanding of specialized codes, evolving documentation requirements, and payer-specific guidelines to ensure accurate billing and timely reimbursement. In these times of heightened payer scrutiny and risks of denials, physician practices would do well to partner with a medical billing and coding company that has a team of experienced AAPC-certified coders. While choosing a medical billing company, physicians must make sure that the firm is experienced and is aware of various applicable Federal programs and coding standards. This will ensure accurate assignment of codes and checks to ensure that documentation meets regulatory requirements. These experts are also well versed in Medicare and private payer policies. Reputable medical billing companies stay updated on all new resources appearing from time to time, and are therefore equipped to meet even the most challenging billing and coding requirements.