Aging accounts receivable (AR) is one of the most common revenue challenges dental practices face. When unpaid patient balances and overdue insurance claims start piling up, cash flow slows, operational stress rises, and profitability takes a hit. If your practice isn’t tracking how long it takes to get paid for services (average AR days), you’re ignoring an important chance to strengthen your financial health. The good news is that implementing the right strategies can significantly reduce aging AR in dental practices and improve financial health. In this post, we’ll discuss how to identify the causes of overdue balances, streamline collections, prevent AR from aging in the first place, and improve dental revenue cycle management.

What is Aging AR?

Aging AR in dentistry refers to unpaid balances owed to the dental practice from patients and insurance companies. Accounts receivable is typically categorized by time periods, for e.g., 30, 60, and 90 days). Tracking aging A/R is crucial for understanding the financial health of a practice and identifying potential issues that could affect cash flow.

According to DentistryIQ, the industry average for AR Days in dental practices is around 45 days. They explain that most insurance companies typically pay claims in about 30 days, and the 45-day average includes a roughly 15-day buffer for claim processing delays. If a practice’s AR days consistently exceeds 45 days, it’s likely experiencing delayed reimbursements or internal process inefficiencies.

Here’s a healthy AR collection example for dental practices:

If your average monthly charges are $90,000 and your practice has a total AR balance of $75,000, your AR days calculation would be:

Average Daily Charges: $90,000 ÷ 30 = $3,000

AR Days: $75,000 ÷ $3,000 = 25 days

This means it’s taking your practice about 25 days, on average, to collect payments after services are provided. As this is well ahead of the 30–45 day industry benchmark, it indicates strong claim submission, follow-up, and patient payment processes.

On the other hand, if it takes 60 days to collect in the same example, this is a red flag. It could mean slow claim processing, poor follow-up on unpaid claims, or delays in collecting patient portions.

Impact of High Aging A/R

High aging A/R affects dental billing efficiency, cash flow, profitability, and daily operations:

- Cash flow strain: Delayed payments make it harder for the practice to cover overhead expenses, pay staff, and invest in essential equipment or technology upgrades.

- Higher administrative costs: Managing accounts receivable consumes time and resources, driving up costs. Staff must spend more hours on claims tracking, patient reminders, follow-up calls, and reconciliation — pulling them away from other critical tasks.

- Costly collections: Increased AR days may force dental practices to use collection agencies or legal action, with associated fees cutting into revenue. This can affect patient relationships.

- Greater non-payment risk: The older the receivable, the higher the chance of non-payment, often leading to bad debt write-offs.

Implementing dental accounts receivable management best practices can significantly reduce payment delays, improve cash flow, and enhance the overall financial health of your practice.

How to Manage Aging Accounts Receivable in Dental Offices

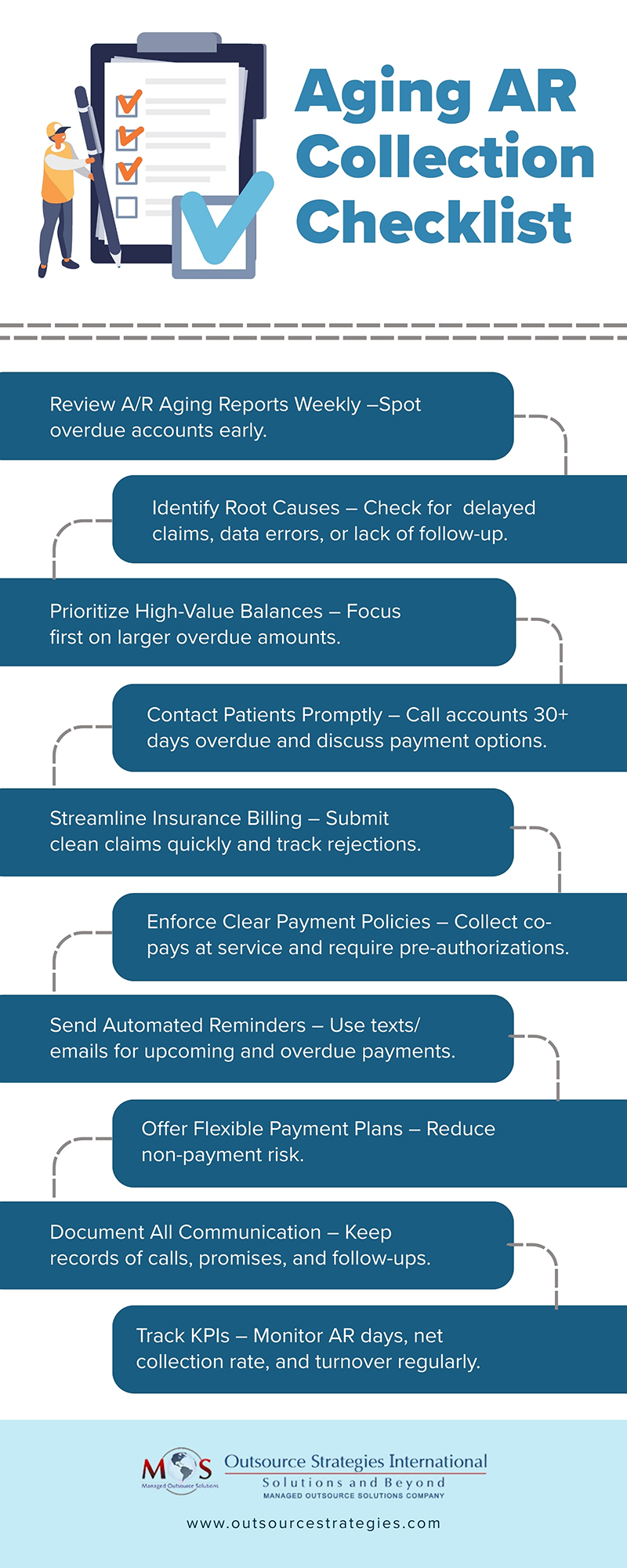

Reducing average AR days requires a focused approach that actively engages patients and insurance providers to resolve outstanding balances and boost collection rates. Implementing the following dental AR strategies is the way forward:

-

- Identify Root Causes: Understanding why receivables are aging is the first step toward fixing the problem. Common causes include:

- Delayed insurance claim submissions that slow down reimbursements.

- Dental billing errors such as inaccurate patient information or incomplete documentation and coding mistakes, leading to denials.

- Lack of consistent patient payment policies, resulting in unpredictable collections.

- Insufficient follow-up on unpaid claims, leading to balances growing older.

- Identify Root Causes: Understanding why receivables are aging is the first step toward fixing the problem. Common causes include:

Once the causes are clear, you can set up policies and practices to correct them.

-

- Implement Clear Financial Policies

If collecting fees is taking too long or becoming increasingly difficult, the American Dental Association (ADA) recommends reviewing your internal policies and the written payment information provided to patients. Your financial policy should clearly detail the procedures staff must follow when pursuing overdue payments for completed treatments, including recording any payment commitments made by patients. Strong, transparent patient payment policies set the tone for timely payments.

Provide upfront cost estimates and explain payment expectations before treatment. Obtain pre-authorizations for procedures with higher patient responsibility to avoid risk of nonpayment. Collecting co-pays at the time of service is the best way to deal with future collection issues. When patients have dental benefits and assign them to your practice, collect their portion of the payment at the time of service. If a balance remains after receiving insurance payments, send a clear, prompt statement outlining the amount due. For patients who frequently carry balances, consider obtaining authorization to charge their credit card for any remaining costs once third-party payments are processed.

-

- Streamline Insurance Billing

Efficient insurance billing is essential to reducing AR days. Submit claims promptly with correct coding and complete documentation. Delaying claim submissions can cause your AR balance to grow, as most insurance carriers enforce strict submission deadlines, typically just days or weeks after treatment. Missing these windows can result in routine claim denials, making payment recovery more difficult and time-consuming. Use electronic claim submissions to minimize mailing delays, Track claims closely and follow up on rejections or delays immediately.

-

- Improve Patient Communication

Many patients lack a clear understanding of the dental insurance billing process and their financial responsibilities when receiving services. Clear and proactive communication reduces misunderstandings and speeds up collections. Provide easy-to-read billing statements and regular payment reminders. Offer flexible payment plans or financing for larger balances.

Front desk training for collections is key to handling payment conversations effectively and courteously. Accounts more than 30 days overdue require prompt attention. The ADA advises having the office manager or another trained staff member contact the patient by phone to request payment. Be proactive by explaining your payment plan options during the call, and schedule a follow-up conversation within five days of the due date to encourage resolution.

-

- Use A/R Aging Reports Effectively

Aging reports are a valuable tool for spotting issues before they escalate. Review reports weekly to catch problem accounts early. Focus on high-value overdue balances for follow-up. Track A/R days as a core performance metric to track progress.

-

- Leverage Technology and Automation

Leveraging technology and automation can significantly improve the efficiency and effectiveness of your AR management. Dental practice management software enables real-time tracking of outstanding balances, helping staff prioritize follow-ups and reduce AR days. Automated payment reminders sent via text or email keep patients informed and encourage timely payments without adding to administrative workload. Integrated online payment portals make it easier for patients to pay their bills anytime, from anywhere, while reducing processing delays. Using technology to streamline these tasks can minimize manual tasks, improve cash flow, and maintain a healthier revenue cycle.

-

- Monitor and Improve

Monitoring and adjusting your processes is essential for keeping AR under control. Regularly track key performance indicators (KPIs) such as net collection rate and A/R turnover to evaluate the effectiveness of your billing and collection efforts. Use this information to identify recurring problems like frequent claim denials, delayed payments, or high patient balances. This will allow you to make adjustments to your workflows to address them. Continuous monitoring ensures your strategies remain effective and helps maintain your practice’s financial health.

Outsourcing RCM: The Smart Way to Streamline Your Cash Flow

Partnering with a dental billing company is ideal if you have persistent A/R issues.

Dental billing specialists reduce aging AR in dental practices by combining expertise, technology, and proactive follow-up strategies. They ensure claims are submitted promptly and accurately, minimizing delays and rejections. If denials do occur, they handle appeals efficiently to secure payment. They also track A/R aging reports closely, prioritizing high-value or long-overdue accounts for immediate action. By communicating with patients about balances, setting up payment plans, and sending timely reminders, they help practices collect patient portions faster. They are well-informed about insurance policies and payer deadlines, which prevents missed submission windows, reducing the risk of write-offs. Dedicated billing experts ensure timely follow-ups with insurers, address denials efficiently, and ensure appeals are submitted with complete documentation. With dedicated dental RCM services, practices can improve cash flow, lower administrative burdens, and maintain a healthier revenue cycle.

Get paid faster with our accurate, hassle-free dental billing services