Effective revenue cycle management (RCM) is essential for the financial health of any dental practice. At the core of that process lies a strategic approach to managing pending payments – segmenting A/R by payer type. A practice’s “payer mix”—the percentage of revenue from each payer type—directly impacts its financial health and cash flow. Different dental insurance payer categories have distinct reimbursement rules and payment turnaround times. Knowledge about the payer mix is critical to understand days in accounts receivable (A/R). By grouping outstanding invoices according to who is financially responsible—whether it’s a commercial insurer like Aetna or Blue Cross Blue Shield, a public program such as Medicare or Medicaid, or the patient themselves—dental practices can gain valuable insights into payment behaviors and manage their collection efforts accordingly.

In a previous post, “Recovering Lost Revenue Through Better AR Strategies, we discussed processes to reduce aging AR, ensure timely collections, and protect your dental practice from significant revenue loss. In this post, we explain why segmenting A/R by payer type is an essential step for optimizing dental revenue cycle management.

Partner with our dental billing company to optimize your A/R management today.

Why Segmenting A/R by Payer Type Matters

Different payer categories pose different challenges. Commercial payers often have higher denial rates and slower turnaround, government payers follow strict schedules, and self-pay patients may struggle with affordability and follow-through. A 2023 Crowe report highlighted that commercial insurers deny claims at 12 times the rate of Medicare, underscoring the impact on cash flow. Segmenting A/R by payer type helps providers spot trends, prioritize follow-ups, and improve collections, boosting overall financial health.

Common Payer Types in Dentistry

The primary types of payers in dentistry are commercial payers (private insurance companies like Aetna or Blue Cross Blue Shield), government/public payers (such as Medicare and Medicaid), and direct patient payments (out-of-pocket costs). Let’s take a look at the impact of payer mix on AR management:

- Commercial/private insurance: This category typically offers the highest reimbursement rates but may involve lengthy contract negotiations and complex claim processes. Among the commercial plans, Preferred Provider Organizations (PPOs) and Dental Health Maintenance Organizations (DHMOs) dominate the dental insurance market.

- Preferred Provider Organization (PPO): These are the most popular commercial plan type. PPO plans have a network of contracted dentists who agree to provide services at a discounted rate. However, patients can see out-of-network dentists and still receive some coverage, though their out-of-pocket costs will be higher.

- Dental Health Maintenance Organization (DHMO): Dentists in this network receive a fixed monthly fee for each enrolled patient, regardless of whether that patient receives services.

AR impact: In-network dentists receive a negotiated, discounted fee, which streamlines the payment process compared to fee-for-service plans. When patients see an out-of-network dentist, the patient may need to submit the claim, and payments may be sent directly to the patient, increasing the risk of collection delays.

AR impact: The monthly capitation ensures that revenue is more predictable. Dentists are often pre-paid for basic services and file “encounter forms” instead of traditional claims, reducing the administrative burden. If patient volume is low, the capitation payment may not fully cover a dentist’s overhead for the month. However, delays from complex claims can still impact the A/R aging report.

- Medicare: While Original Medicare does not cover most dental services, many privately offered Medicare Advantage (Part C) plans include some dental, vision, and hearing coverage. Reimbursement rates are set by the government and are often lower than commercial rates.

- Medicaid: States are required to provide dental benefits to children (under 21), including diagnostic, preventive, and restorative services. However, coverage for adults is optional and often limited to emergency services, though many states are expanding this. Reimbursement varies by age and state.

- Patient Self-Pay: This includes all costs not covered by insurance, such as copayments, deductibles, and non-covered services like cosmetic procedures. It also includes services for uninsured patients.

AR impact: The rules, covered services, and reimbursement rates depend on the individual Medicare Advantage plan, not Original Medicare. Verifying a patient’s Medicare Advantage plan is essential to understand their specific dental benefits. Clean claims typically have a reliable, shorter reimbursement cycle, but a large Medicare population can lower overall revenue compared to a mix of commercial plans.

AR impact: Medicaid reimbursement rates are typically much lower than commercial rates, though some studies show prompt payment for managed Medicaid programs.

AR impact: Self-pay accounts are the most challenging to collect, often leading to longer payment cycles and a higher risk of being written off as bad debt. Strategies like collecting copayments upfront, creating clear payment plans, and offering financing options are crucial for managing this AR segment. Practices can manage patient self-pay AR by offering in-house or third-party financing plans to spread out the cost of treatment.

Tracking insurance A/R by payer type in dental practices can help identify payer-specific delays, streamline follow-ups, and improve overall collections efficiency.

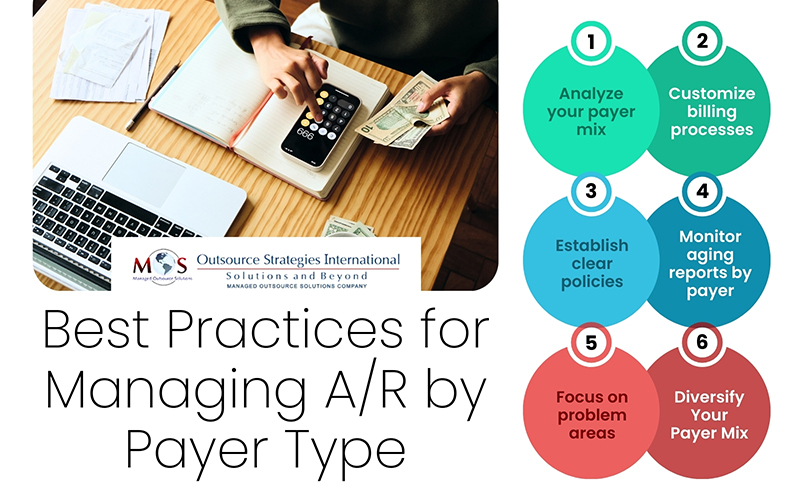

Best Practices for Managing A/R by Payer Type

Effective A/R management requires tailoring strategies to each payer group:

- Analyze your payer mix

Regularly review reports to understand the percentage of your revenue contributed by each payer type. Payer mix analysis helps forecast cash flow and identify areas for improvement.

- Customize billing processes

Each payer has unique rules for claims submission and appeal. Standardizing and automating these workflows based on the payer type can reduce claim denials by payer and speed up payment.

- Establish clear policies

Implement specific credit and collection policies for each payer type. This includes clear billing procedures for different insurance plans and a structured collections strategy for self-pay accounts.

- Monitor aging reports by payer

Segmenting accounts receivable aging reports by payer, is the most helpful tool for managing receivables. It tracks how long money has been owed by each payer category, typically in intervals like 30, 60, 90, and 120+ days.

- Focus on problem areas

The aging report can highlight problematic payers with a slow payment history. By focusing collection efforts on these areas, practices can better manage payment delays. BerryDunn recommends prioritizing the five to ten largest balances and working with staff to resolve them quickly. For credit balances, review the underlying reasons—since regulations often require prompt refunds or claim adjustments. In some cases, credits may stem from misapplied payments, such as posting to the wrong patient account or service date. Establish a routine process for staff to review and clear credit balances to avoid unnecessary collection efforts on accounts that are already settled (www.berrydunn.com).

- Consider a diversified payer mix

Relying too heavily on low-reimbursement government payers can strain your practice financially. Diversifying your patient base and actively managing contracts with commercial payers can improve profitability and stability.

Optimize Collections with Expert Support

Segmenting A/R by payer type is a strategic approach to dental revenue cycle optimization. By understanding payer-specific patterns, providers can prioritize follow-ups, reduce reimbursement delays, and strengthen overall cash flow. Partnering with an experienced dental billing company can make this process more efficient by leveraging advanced analytics, payer insights, and proven denial management strategies. With a structured A/R segmentation approach, practices can improve collections, minimize write-offs, and maintain long-term financial stability.

Strengthen your revenue cycle with expert denial management strategies.