For dental professionals, obtaining optimal reimbursement for services rendered requires using appropriate Current Dental Terminology (CDT) codes on claims. CDT codes in dentistry allow dentists to clearly and consistently record every procedure performed, ensuring precise patient records and accurate reporting of services to third-party payers. Following established dental billing and coding standards ensures accurate claims and effective dental revenue cycle management. Proper use of CDT codes helps dental offices track services, minimize denials and improve care while ensuring compliance with insurance and regulatory requirements.

The post aims to help dental professionals and practice managers understand what CDT codes are, why they matter, and how to use them effectively. By learning the importance of accurate coding, you can streamline billing, improve cash flow, stay compliant, and enhance patient transparency. We highlight common challenges and best practices, ensuring your dental practice maximizes efficiency and revenue while providing high-quality care.

Simplify your billing process with professional CDT coding support!

What Are CDT Codes?

CDT codes are alphanumeric codes used to identify dental procedures and treatments, maintained by the American Dental Association (ADA) as part of the official code set under federal HIPAA regulations.

CDT codes begin with the letter ‘D’ and are followed by four numbers. Each code is accompanied by a short description of the procedure, which clarifies what service is being provided. Understanding these components helps dental practices accurately document treatments, submit claims, and avoid errors that could lead to denials or compliance issues.

Importance of CDT Codes in Dental Practices

CDT codes for dental billing standardize dental procedures by providing a universal system of alphanumeric codes to describe each procedure and service. They allow dentists to ensure consistency in documentation and record-keeping, and enable insurance companies to process claims and determine coverage. CDT codes also help patients understand what services they are being billed for, which promotes transparency in treatment costs.

Common CDT Code Categories for Dentists

CDT codes are organized into 12 major categories that cover nearly every aspect of dental care, such as diagnostic, preventative, restorative, surgical, and implant services. Understanding these categories helps dental teams code procedures correctly and streamline insurance claims.

- Diagnostic – D0100-D0999 (D0)

- Preventive – D1000-D1999 (D1)

- Restorative – D2000-D2999 (D2)

- Endodontics – D3000-D3999 (D3)

- Periodontics – D4000-D4999 (D4)

- Prosthodontics, removable – D5000-D5899 (D5)

- Maxillofacial Prosthodontics – D5900-D5999 (D59)

- Implant Services – D6000-D6199 (D6)

- Prosthodontics, fixed – D6200-D6999 (D62)

- Oral & Maxillofacial Surgery – D7000-D7999 (D7)

- Orthodontics – D8000-D8999 (D8)

- Adjunctive General Services – D9000-D9999 (D9)

The ADA updates and revises the CDT code set annually based on new procedures, changes in technology, and patient needs. For dental practice compliance and documentation, providers must stay aware of the current dental terminology codes. However, it’s important to note that coverage for the codes is dependent on the patient’s specific benefit plan.

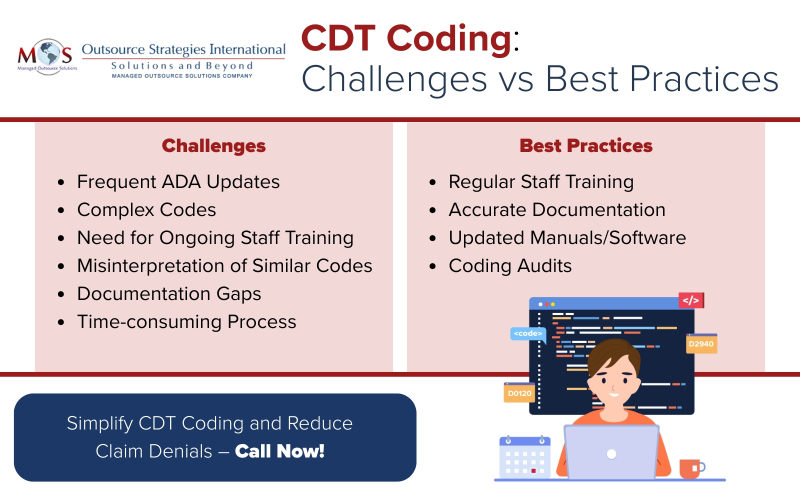

Challenges in Using CDT Codes

While CDT codes are essential for accurate documentation and billing in dentistry, their proper use comes with certain challenges:

- Difficulty keeping up with frequent updates: Keeping up with the ADA code updates can be difficult, especially for busy dental practices. Failure to adopt the latest codes can result in claim rejections or compliance issues.

- Complexity of coding can cause billing errors and claim denial: With hundreds of codes covering everything from preventive to surgical procedures, CDT coding can be complex. Misinterpretation can lead to inaccurate billing and potential revenue loss. Even small mistakes in CDT coding can lead to claim denials, delays in reimbursement, and cost time and effort to rework to correct and resubmit claims.

- Need for regular dental staff training: Without regular training, dental staff may struggle to apply the correct codes. This lack of consistency can create inefficiencies in billing and increase the likelihood of errors.

- Misinterpretation between similar codes: One of the most common challenges in CDT coding is the risk of confusing similar codes. Misinterpretation can lead to incorrect billing, claim denials, or even compliance issues. For example, while both D1110 – Prophylaxis, adult and D4910 – Periodontal maintenance involve cleaning the teeth, D1110 is for patients without periodontal disease, whereas D4910 is for patients who have completed periodontal therapy and require ongoing maintenance. Using the wrong code not only misrepresents the treatment provided but may also result in denied insurance claims and lost revenue.

- Documentation Requirements: Claims must be submitted with proper documentation to support the CDT codes used. If documentation is rushed, it increases the risk of omissions or inaccuracies. Missing details about procedures, materials used, or treatment specifics make precise coding difficult. Moreover, if different providers in a practice describe the same procedure differently, it will lead to coding errors.

- Time-Consuming Process: Coding requires attention to detail, and in a busy practice setting, finding the time to ensure accuracy can be a significant challenge.

Practices that invest in training, updated software, and regular audits are better positioned to overcome these hurdles. Given the complexity and frequent updates of CDT codes, many dental practices outsource their billing and coding tasks to specialized billing company.

Best Practices for Accurate CDT Coding

Accurate and consistent coding of dental procedures ensures that practices capture the full value of the services they provide while giving insurers a clearer understanding of each patient’s needs. Proper use and submission of CDT codes are essential, as dental benefit plans depend on this data to determine coverage, frequency limitations, and associated reimbursement rates.

Here are four CDT codes best practices for dental offices:

Regular Staff Training

Continuous education for is crucial for front office staff, hygienists, and billing teams. Regular training sessions keep teams up to date on the latest CDT code changes and help avoid common mistakes that can lead to claim denials.

Ensure Accurate Documentation

Accurate documentation is crucial for CDT coding because it provides a clear, detailed record of the procedures performed. Proper documentation ensures that codes reflect the exact services delivered, supporting correct insurance claims, minimizing denials, and maximizing practice revenue. It also helps maintain compliance with regulatory requirements and provides a reliable reference for patient care continuity.

Using Updated Coding Manuals/Software

Make sure your practices always uses the latest coding manuals and ensure your practice management software reflects the ADA’s current codes. This helps maintain compliance and improves claim accuracy

Conducting Dental Coding Audits

Routine internal audits of submitted claims can catch errors before they affect reimbursement. Regular reviews also highlight patterns of recurring mistakes, allowing practices to address training or workflow issues proactively.

Partner with an Expert

Partnering with a professional dental billing company is a practical strategy to ensure CDT coding accuracy and ensure smooth revenue cycle management. Billing professionals stay current with the latest ADA updates, minimizing the risk of using outdated or incorrect codes. By handling coding, submission, and follow-up, dental billing services allow practices to focus more on patient care while maintaining healthy cash flow. With the right partner, your dental practices can minimize risk of CDT coding errors and remain profitable, compliant, and patient-focused.

Maximize reimbursement and reduce claim denials with expert dental billing services!