Submitting accurate and timely claims is only half the story. Collecting debts due from insurers and patients is what actually matters for successful dental revenue cycle management. Maintaining a strong collection rate ensures steady cash flow and keeps the practice operating smoothly. However, reports indicate that, on average, 18% of dental practices’ accounts receivable is over 90 days past due.

Dental collection gaps are caused by delays in patient payments, insurance denials, or poor follow-up, significantly impacting cash flow and patient care. Data and reports play a key role in identifying these gaps. Several types of reports can be used to understand collection gaps or accounts receivable (AR) by analyzing various stages of the revenue cycle, from initial patient billing to final payment. By regularly reviewing and analyzing these reports, practices can address the root causes of under-collection and implement effective dental accounts receivable revenue recovery strategies to minimize payment delays and stabilize cash flow.

Optimize your collections with expert Dental RCM Services

Essential Reports to Track Collection Gaps

Accurate financial reporting for dental practices provides insights into revenue trends, payment collections, and overhead costs, helping providers make informed business decisions

By reviewing key performance indicators (KPIs), providers can spot revenue losses from denied claims, billing issues, and unpaid patient balances. Using these insights in the revenue cycle helps practices improve finances, lower costs, and provide a better patient experience. Here are the best reports for tracking AR:

- Accounts Receivable (A/R) aging report

This report is the most direct tool for identifying collection gaps. It organizes outstanding claims and patient balances into time-based buckets (e.g., 0–30 days, 31–60 days, 90+ days).

What to look for:

- Increasing balances in older buckets: A rising percentage of receivables in the 90+ day column is a significant red flag, indicating systemic issues with the collection process.

- Large balances from specific payers: Consistently large balances from a single insurer may indicate contract issues, slow processing, or a high denial rate with that specific payer.

- High volume of small balances: A large number of small, uncollected balances in older buckets can point to inefficiencies in patient billing and follow-up processes

- Denial management reports

These reports track the rate, reasons, and trends of denied claims, which are a major source of revenue leakage. This report helps you track your overall denial rate and categorize denials by reason, such as:

- Authorization gaps: The patient’s insurance requires pre-authorization, but it was not obtained.

- Eligibility issues: The patient’s insurance was inactive on the date of service.

- Coding errors: The claim was submitted with an incorrect or incomplete medical code.

What to look for:

- High initial denial rate: A high percentage of claims denied upon first submission can indicate a problem with the front-end of the revenue cycle, such as incorrect patient information or prior authorization issues.

- Categorized denial reasons: Break down denials by reason (e.g., coding errors, eligibility issues, medical necessity) to reveal specific areas that need process improvement and staff training.

- Payer-specific denial trends: Some payers may have stricter requirements than others. Tracking denials by payer can help practices create targeted strategies to meet unique compliance expectations

- Payer performance reports

These reports allow you to compare the financial performance of different insurance companies.

What to look for:

- Denial rate by payer: This metric highlights which payers are denying claims most frequently. A high rate may require closer examination of that payer’s policies or an appeal process.

- Net collection rate by payer: This calculates the percentage of collectable revenue that was actually collected. A low rate for a specific payer suggests that a significant amount of revenue is being lost.

- Days in A/R by payer: This shows how long it takes, on average, for a payer to remit payment. Extended payment times for specific payers can strain cash flow.

- Patient collections metrics report

This report focuses specifically on money owed by patients.

What to look for:

- Patient balance after insurance (PBAI) ratio: This metric reveals how much of the practice’s revenue depends on direct patient payments. A high or increasing ratio means a greater need for effective patient collection strategies.

- Patient contact rate: A low contact rate indicates gaps in patient billing efficiency– the practice is not successfully reaching patients to notify them of their financial responsibility.

- Payment plan enrolment rates: A low number of patients on payment plans could indicate that high deductibles are discouraging patients from paying, requiring the practice to offer more flexible options.

Other useful dental billing reports to identify collection gaps are:

- Payment and adjustment report

This report details the payments received and any adjustments made to patient accounts. You can analyze it to ensure insurance payments match contracted rates and identify underpayments or unfulfilled payer obligations.

- Bad debt rate report

This reports enables you monitor how much debt is written off as uncollectible. A rising bad debt rate indicates a breakdown in your patient collections process and identifies the revenue lost

- Financial trend reports

By comparing performance over different periods (e.g., quarterly or annually), you can identify revenue gaps and evaluate the effectiveness of process changes. A declining net collection rate over time can indicate a deteriorating collection process that needs immediate attention. Rising days in AR shows that, on average, it is taking longer for the practice to collect payments, which can point to inefficiencies or new problems. Quarterly revenue reviews can help identify and address revenue gaps and ensure financial sustainability by providing a periodic check on financial health.

How Reports Help Identify Collection Gaps

Payment collection gaps are caused by a mix of operational inefficiencies, administrative complexity, and payer and patient issues. Reports help reveal the status of a dental practice’s collections in several ways:

- Identify aging balances and high-risk accounts: Reports help practices identify overdue balances and accounts that are more likely to become uncollectible.

- Spot patterns in insurance denials and patient non-payments: With regular reporting, practices can see trends in denied claims or missed patient payments before they grow out of control.

- Reveal inefficiencies in payment posting or AR follow-up: Tracking data identifies slow payment posting and missed opportunities in follow-up efforts.

- Provide visibility into staff accountability and front-office workflows: Reports show how effectively staff handle billing, collections, and communication with patients.

With these reports, practices can compare their performance to benchmarks (such as keeping A/R over 90 days below 5%), so they know where they stand. Once practices understand the overall position of their collections, they can take steps to address them.

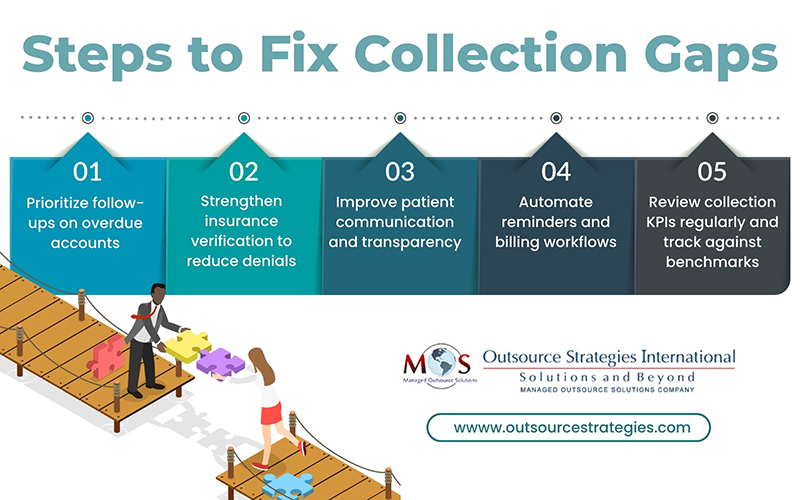

Steps to Fix Collection Gaps

Prioritize follow-ups on overdue accounts: Follow up on overdue accounts with a step-by-step approach—start with automated reminders, then move to personal calls or emails, and finally send formal demand letters if needed. Patients are more likely to pay when they understand what they owe and why. Use automation for reminders and task tracking, and have dedicated staff handle insurance follow-ups.

Ensure robust insurance verification to prevent denials: Verifying insurance eligibility and benefits before an appointment helps prevent claim denials and unexpected charges at the point of service. By confirming coverage details, co-pays, deductibles, and plan limitations in advance, dental practices can reduce billing errors, speed up reimbursements, and build patient trust. This proactive approach also empowers patients to make informed decisions about their care.

Improve patient communication: Before treatment, patients should clearly understand their financial responsibilities, including insurance coverage and out-of-pocket costs. Medical bills with complex codes can confuse patients, but using plain language and clear itemization makes them easier to understand, leading to faster payments and greater satisfaction. Offering flexible payment options—such as online portals, mobile payments, and payment plans—reduces financial stress and encourages timely collections. Well-trained staff who can explain billing, provide cost estimates, and guide patients to resources play a key role in reducing confusion and enhancing the patient experience.

Automate reminders and billing workflows: Leveraging advanced digital tools such as patient portals and mobile apps allows patients to view billing statements, cost estimates, and payment history in real time. These tools increase transparency and give patients greater control over managing their financial obligations. In addition, technologies like Artificial Intelligence (AI) can automate reminders, send personalized notifications, and even predict payment risks, keeping patients engaged and practices better prepared. By combining convenience with proactive communication, dental practices can streamline collections while improving the overall patient experience.

Regularly review collection KPIs and compare against benchmarks: Regularly tracking collection KPIs and comparing them with industry benchmarks helps practices spot weaknesses early, measure progress, and maintain healthy cash flow. This ensures collections stay on target and aligned with best practices.

Outsourcing AR/Payment Collections: A Smarter Way to Boost Cash Flow

Handling payment collections in a dental practice can quickly become overwhelming. The processes involved in following up on overdue patient balances to managing delayed insurance reimbursements takes time and distracts staff from patient care. Outsourced dental billing services help practices overcome these challenges with greater efficiency.

A reliable billing partner brings specialized expertise, advanced technology, and consistent follow-up to ensure payments are collected on time. This reduces outstanding balances, improves cash flow, and minimizes costly write-offs. By outsourcing, practices also lower administrative overhead, avoid staffing shortages, and gain access to clear performance reports that highlight collection trends and areas for improvement.

Simplify billing and improve cash flow with our trusted dental billing solutions.