While most physicians are honest, provide high-quality care, bill patients correctly, and submit accurate claims to insurance companies, there are few who exploit the health care system for personal financial gain. Medical billing fraud refers to unethical practices aimed at manipulating or falsifying billing processes within the healthcare system for personal gain or advantage.

Medical billing fraud is a pervasive problem. The Federal Bureau of Investigation estimates that fraudulent billing adds up to 3% to 10% of total health spending, leading to inefficiency, high health care costs, and waste. The financial losses due to health care fraud amount to tens of billions of dollars each year, according to the National Health Care Anti-Fraud Association (NHCAA).

Looking to expand your knowledge?

Check out blog post on Legal and Ethical Considerations in Medical Billing

In addition to affecting the integrity of the health care system as a whole, medical billing fraud can have serious consequences for your practice, including financial losses, legal penalties, and damage to their reputation. For patients, it can lead to false diagnoses, treatment, and medical history, putting them at significant risk of injury or even death. Healthcare providers can avoid such risks by partnering with an experienced medical billing company. This is because professional medical billers manually review the claims to ensure there is no duplicate billing, upcoding, and such other issues that could all amount to fraud.

Medical fraud is a federal crime with stiff penalties. Medical billing fraud prevention is essential for patient safety, safeguarding the integrity of the billing process, and reducing financial losses for both insurers and healthcare organizations. This article takes a look at the common types of healthcare billing fraud, effective detection strategies, and anti-fraud measures in medical finance.

Ensure accuracy, trust, and transparency with reliable medical billing services!

Understanding Fraud in Healthcare Billing

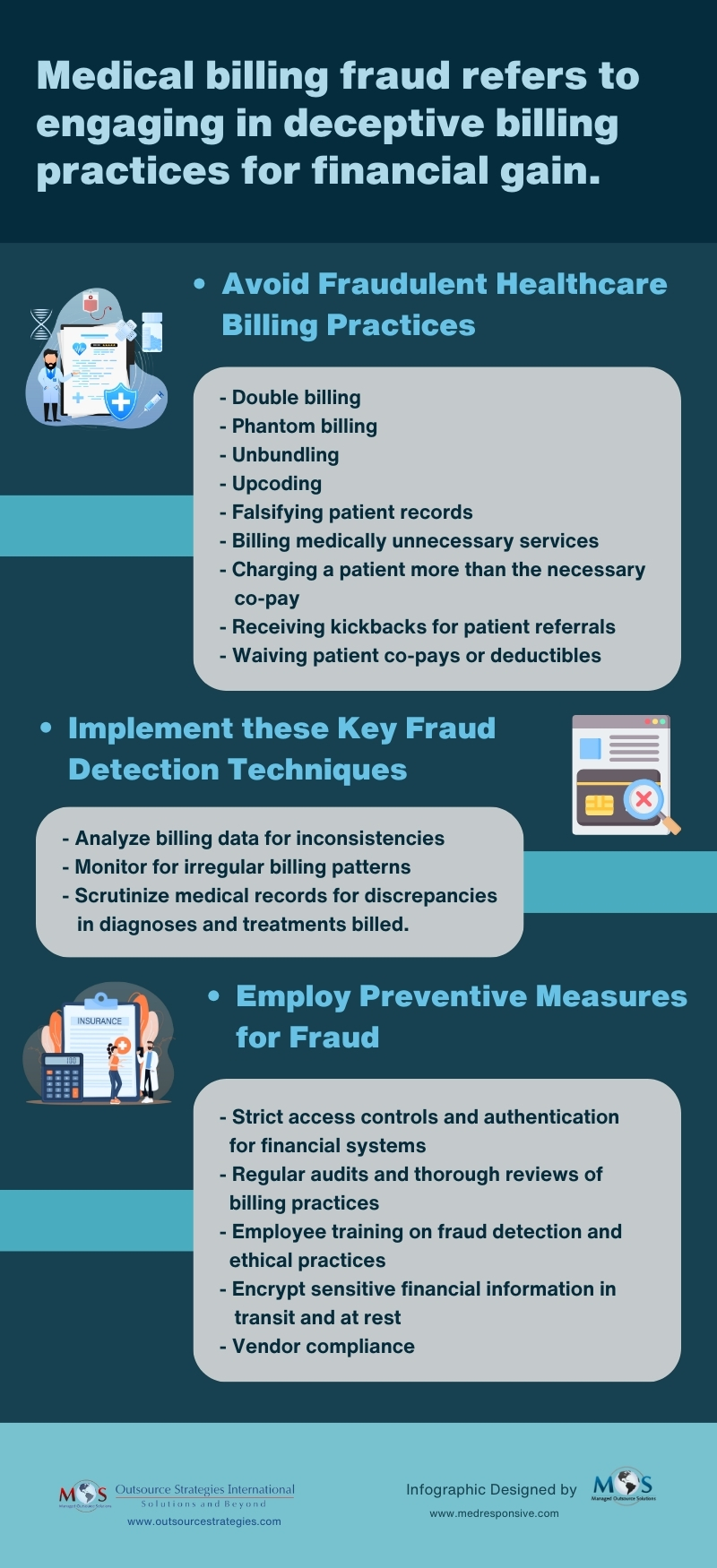

Medical billing fraud can be caused by an error or done intentionally. To avoid medical billing fraud, physicians need to know what constitutes fraud, waste and abuse in the health care system. Let’s take a look at four common types of fraudulent billing in healthcare:

Double billing

This involves submitting multiple claims for the same service. Double billing in medical billing occurs when a healthcare provider bills a patient or their insurance company twice for the same service or procedure. For example, if a patient receives a particular treatment during a single visit, and the provider charges for it twice, submitting two separate claims for that same treatment, this constitutes double billing.

Phantom billing

This type of fraudulent billing deceives the payer by charging for services that were not rendered. Phantom billing occurs when the provider submits claims for tests, treatments, or appointments that never took place or weren’t necessary for the patient’s care.

Unbundling

Unbundling is when a provider separates billable codes for individual components of a procedure. For example, when performing a routine surgical procedure, a provider engaging in unbundling might enter separate codes for incision and suturing, rather than using the standard billing code. This significantly increases a provider’s reimbursement. Law firm Price Armstrong reported on Duke University’s unbundling cardiac and anesthesia services, which are typically billed together. The Department of Justice found that Duke was applying a modifier to the codes so they could unbundle anesthesia services in a cardiac procedure. Duke University paid a $1,000,000 settlement in 2014.

Upcoding

This involves submitting codes for more expensive service than the patient received in order to get higher reimbursement. For instance, a provider billing for 30 or 60 minute face-to-face sessions with patients when, in reality, he only met with patients for 15 minutes each to do medication checks is an example of upcoding (AMA).

Other type of fraudulent medical billing includes:

- Performing medically unnecessary services solely for obtaining insurance payments.

- Misrepresenting non-covered treatments as medically necessary covered treatments for generating insurance payments.

- Altering a patient’s diagnosis and medical records to support unnecessary tests, surgeries, or procedures.

- Charging a patient more than the necessary co-pay for services that were already prepaid or covered in full by the benefit plan.

- Receiving kickbacks for patient referrals.

- Waiving patient co-pays or deductibles and over-billing the insurance carrier.

Medical billing fraud is serious crime that has far-reaching financial and ethical implications for patients, insurance companies, and healthcare providers. For patients, it can result in financial burdens and unnecessary treatments, eroding trust in the medical system. Insurance companies face inflated costs, ultimately affecting premiums and coverage. Healthcare providers that commit fraud risk tarnishing their reputation and credibility, undermining the fundamental trust between them and their patients. Stringent medical billing fraud prevention measures are necessary to safeguard the integrity of the healthcare system for all involved parties.

How Can You Detect Medical Billing Fraud?

Detecting fraud in requires a keen eye for irregularities in billing patterns, documentation, and coding practices. Today, advanced technology such as AI and data analytics play a significant role in identifying outliers or questionable billing practices. AI algorithms can analyze vast amounts of healthcare data, and identify patterns and anomalies indicative of fraudulent billing practices. Data analytic tools can detect instances of duplicate billing, upcoding, unbundling of services, or billing for medically unnecessary procedures. Providers associating with a professional medical billing and coding company can avoid any concerns of medical billing fraud. They can easily identify issues such as consistent high-level coding, phantom billing and so on that could trigger an audit. Trained medical billers will make sure that the codes assigned are based on the actual documentation provided and not coded higher to maximize reimbursement.

Partner with OSI

Outsource your medical billing to our expert team and focus on patient care!

Here are some effective ways to detect and prevent fraud in your medical practice:

- Review billing data: Check for inconsistencies like duplicate billing or unnecessary procedures.

- Use advanced monitoring tools: Employ software for risk detection, including outlier identification and trend analysis.

- Cross-check medical records: Scrutinize records for discrepancies between diagnoses and billed treatments.

- Secure financial systems: Implement strict access controls, multi-factor authentication, and encryption for sensitive data.

- Regular audits and training: Conduct routine audits and educate employees on fraud detection and ethical practices.

- Encrypt sensitive information: Ensure encryption for data in transit and at rest, especially when outsourcing medical billing.

- Vendor compliance: Vet vendors handling financial transactions and ensure anti-fraud compliance in contracts. Make sure the company you partner with is HIPAA compliant.

When it comes to enforcing anti-fraud measures in medical finance, a proactive, multi-layered approach is essential. Combining technology, employee training, compliance, and continuous monitoring is key to detecting and combating fraud, and safeguarding the integrity of your billing process.