In the healthcare sector, where patient care intersects with financial stability, the significance of insurance verification services cannot be overstated. Can you imagine this: being a healthcare provider, you deliver exceptional service, only to encounter denied claims due to inaccurate insurance details. The remedy to this concern is to accurately verify a patient’s active coverage with the insurance company and check the eligibility of his or her insurance claims. Successful billing depends on reliable insurance verification services. Gathering information such as insurance identification, policy number, coverage period, co-payment requirements, deductibles, and preauthorization is crucial to prevent claim denials.

Get the fastest, most accurate insurance verification services ideally customized for you.

Speak to our experts at (800) 670-2809!

Successful medical insurance eligibility checks rely on key components such as – collecting thorough patient information, timely communication with insurance providers, and accurate documentation of coverage details. Integration of technology, staff training, and adherence to compliance standards contribute to efficient and error-free processes. Clear communication with patients and continuous evaluation ensure the ongoing success of medical insurance eligibility checks.

The process involves confirming the patient’s eligibility for specific medical services. It helps in shaping the entire treatment journey.

Want to stay informed?

Check out our post on: Key Components of Effective Insurance Verification

8 Reasons to Verify Patient Insurance

- Ensure error-free billing

- Secure preauthorization for treatments

- Establish patient eligibility

- Get precise out-of-pocket expense estimates

- Streamline reimbursement

- Ensure adherence to healthcare regulations

- Provide positive patient experiences

- Minimize claim denials

Why Is Insurance Verification Important?

Here comes the power of proactive verification – a silent guardian angel for your practice.

Ensuring accurate insurance verification in healthcare helps providers to have accurate and up-to-date information about a patient’s insurance coverage before delivering services. It helps –

- Prevent billing errors: Avoid costly mistakes and billing errors by ensuring accurate and up-to-date insurance information before providing healthcare services.

- Safeguard revenue streams: Protect your financial stability by minimizing claim denials, ensuring a steady and reliable flow of revenue for your healthcare organization.

- Enhance operational efficiency: Streamline administrative processes and reduce workload by proactively verifying insurance details, allowing for more effective resource allocation.

- Build trust and transparency: Foster a relationship of trust with patients by providing clear and transparent information about their insurance coverage, minimizing surprises and disputes.

- Save time and resources: Invest your time wisely by confirming insurance details upfront, reducing the need for follow-ups and administrative overhead.

- Ensure patient-focused care: Prioritize patient care by eliminating potential disruptions caused by inaccurate insurance information, creating a seamless and patient-focused healthcare experience.

Accurate Patient Eligibility Verification Enhances Patient Satisfaction

Proper patient eligibility verification can not only help avoid claim denials or resubmission, but also elevate the patient experience, and increase the patient satisfaction levels. Patients are more likely to make timely payments if they understand costs up-front. With increased cost transparency, patients are also more likely to trust the organization for care if they know that the practice is not going to surprise them with a heavy medical bill.

Got questions about the importance of insurance verification?

Our expert team is here to support.

Health Insurance Verification Process

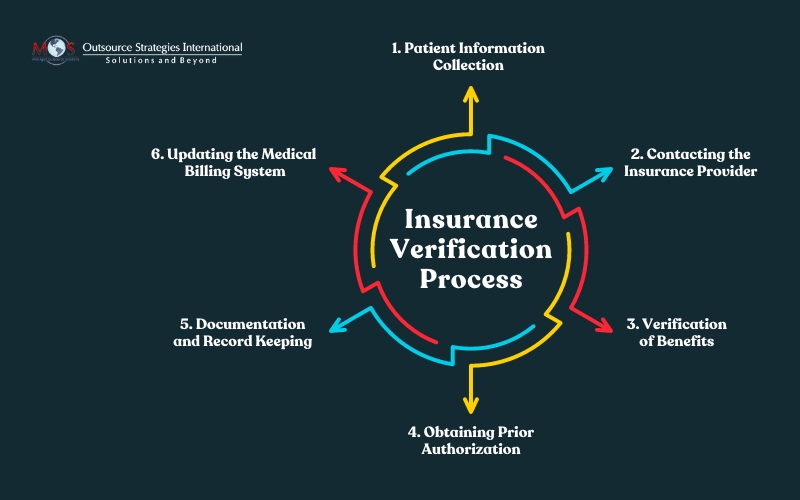

Here’s an overview of the insurance verification process, which is a critical step in the healthcare journey that ensures accurate and up-to-date information about a patient’s insurance coverage.

This process involves several key steps:

- Patient information collection: We gather comprehensive details about the patient, including their personal information, insurance ID, policy number, group ID, and other relevant demographic data.

- Contacting the insurance provider: We reach out to the patient’s insurance company to verify the current status of their coverage. This step involves confirming the policy’s active status, coverage type, effective dates, and any associated co-pays or deductibles.

- Verification of benefits: Our team assesses the extent of coverage by verifying the benefits associated with the insurance plan. This includes understanding the services covered, limitations, and any pre-authorization requirements for specific medical procedures.

- Documentation and record keeping: We record the verified insurance information accurately and maintain detailed documentation. This step is crucial for future reference, billing, and audit purposes.

- Updating the medical billing system: We ensure that your medical billing system is promptly updated with the verified insurance information for accurate and efficient billing processes.

This process ensures that healthcare providers have accurate and up-to-date information about a patient’s insurance status, coverage details, and any associated financial responsibilities.

Why Outsource Patient Eligibility Verification?

Providers can get rid of verification administration hassles by outsourcing the process to experienced hands. Keep your wallet and your staff happier professional insurance verification services.

To take the stress out of managing these tasks, it is better to outsource insurance verification to an experienced service provider.

Key benefits of outsourcing insurance verification include the following.

- Access to expertise: Specialized billing professionals will have in-depth knowledge and experience in navigating the complexities of insurance plans, policies, and procedures. Professional services ensure accurate and efficient processing of claims.

- Enhanced accuracy: Professional outsourcing ensures well-organized verification processes, minimizing errors and inaccuracies in insurance information.

- Increased efficiency: Outsourcing streamlines insurance verification, accelerating the overall process and reducing delays in reimbursement.

- Cost savings: Efficient outsourcing leads to cost-effectiveness by eliminating the need for extensive in-house resources and training.

- Focus on patient care: Healthcare providers can dedicate more time to patient care, leaving the intricate details of insurance verification to specialized experts.

- Scalability: Outsourcing offers flexibility, allowing healthcare organizations to scale up or down based on their current needs without additional hiring or training efforts.

- Improved revenue flow: Streamlined verification contributes to more efficient revenue cycle management, optimizing cash flow for healthcare organizations.

- Compliance assurance: Outsourcing partners stay abreast of evolving healthcare regulations, ensuring compliance and minimizing legal risks.

Technology plays a pivotal role in streamlining insurance verification processes, revolutionizing the efficiency and accuracy of healthcare administration. The integration of technology accelerates the verification process and ensures that healthcare providers can maintain compliance with evolving industry regulations, ultimately contributing to a seamless and error-free insurance verification workflow. Insurance authorization and verification services that are technology-driven can lead to a smoother, faster, and more secure experience for everyone involved.

Our patient eligibility verification services bring ease, accuracy, and speed to your revenue cycle.

Ready for a smoother ride?